Answered step by step

Verified Expert Solution

Question

1 Approved Answer

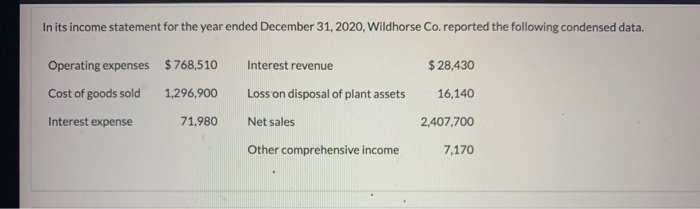

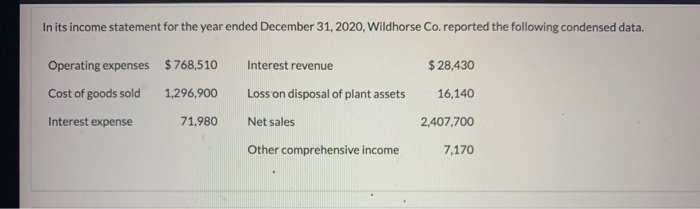

In its income statement for the year ended December 31, 2020, Wildhorse Co. reported the following condensed data. Operating expenses $768,510 Interest revenue $ 28,430

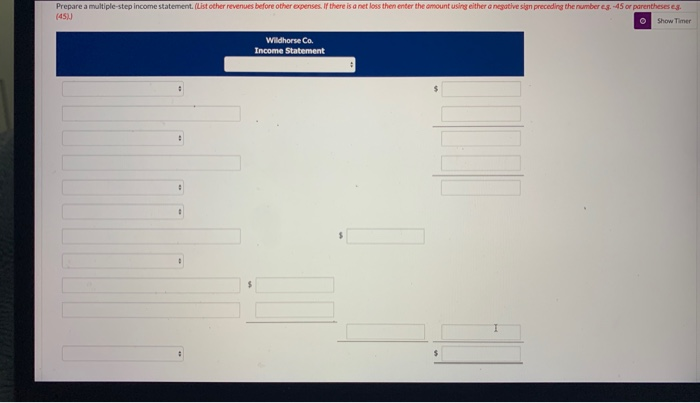

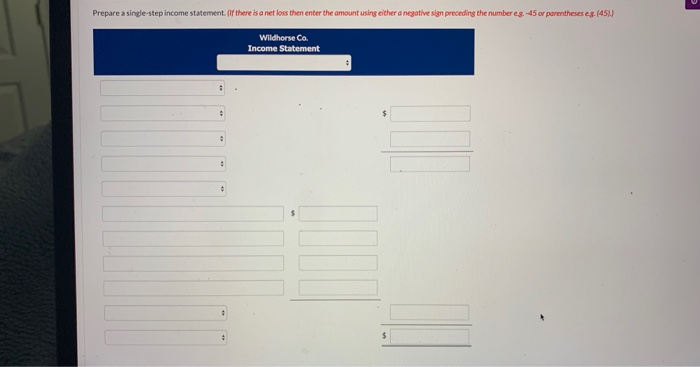

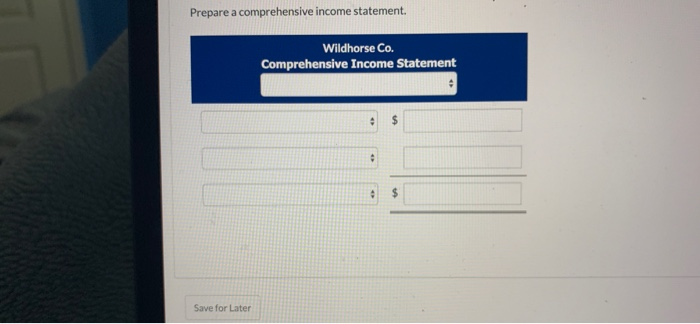

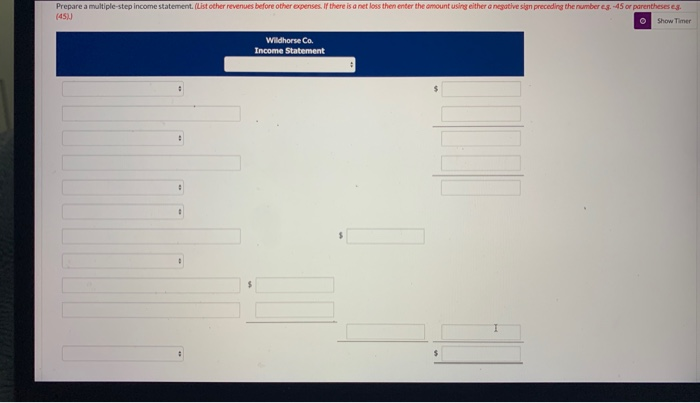

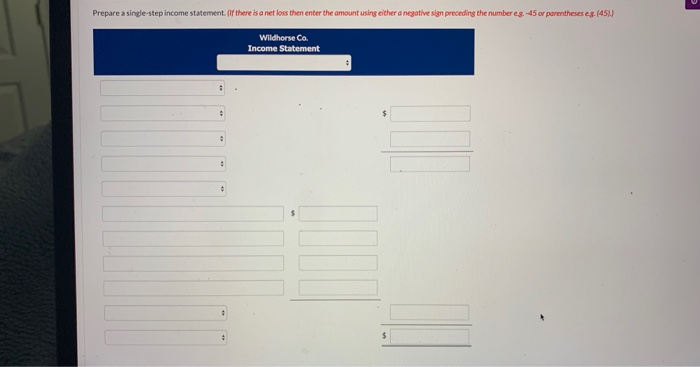

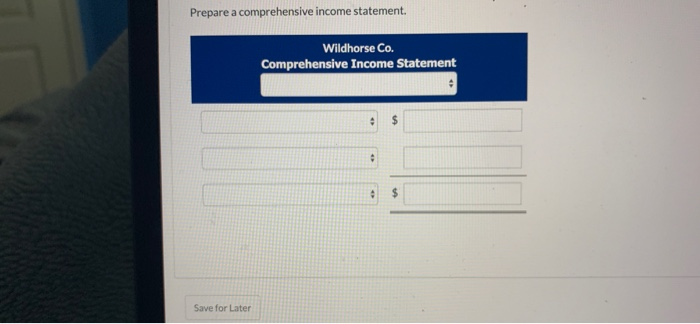

In its income statement for the year ended December 31, 2020, Wildhorse Co. reported the following condensed data. Operating expenses $768,510 Interest revenue $ 28,430 Cost of goods sold 1,296,900 Loss on disposal of plant assets 16,140 Interest expense 71,980 Net sales 2,407,700 Other comprehensive income 7,170 Prepare a multiple-step income statement. (List other revenues before other expenses. If there is a net loss then enter the amount using either a negative sin preceding the number (457) -45 or parentheses Show Timer Wildhorse Co. Income Statement Prepare a single-step income statement. If there is a net loss then enter the amount using either a negative sign preceding the number eg.-45 or parentheses cs. (450 Wildhorse Ca. Income Statement Prepare a comprehensive income statement. Wildhorse Co. Comprehensive Income Statement Save for Later

In its income statement for the year ended December 31, 2020, Wildhorse Co. reported the following condensed data. Operating expenses $768,510 Interest revenue $ 28,430 Cost of goods sold 1,296,900 Loss on disposal of plant assets 16,140 Interest expense 71,980 Net sales 2,407,700 Other comprehensive income 7,170 Prepare a multiple-step income statement. (List other revenues before other expenses. If there is a net loss then enter the amount using either a negative sin preceding the number (457) -45 or parentheses Show Timer Wildhorse Co. Income Statement Prepare a single-step income statement. If there is a net loss then enter the amount using either a negative sign preceding the number eg.-45 or parentheses cs. (450 Wildhorse Ca. Income Statement Prepare a comprehensive income statement. Wildhorse Co. Comprehensive Income Statement Save for Later

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started