Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In January 2018 a taxpayer who owned a sole proprietorship business, bought a private motor vehicle for $7,000,000. The exchange rate at the time was

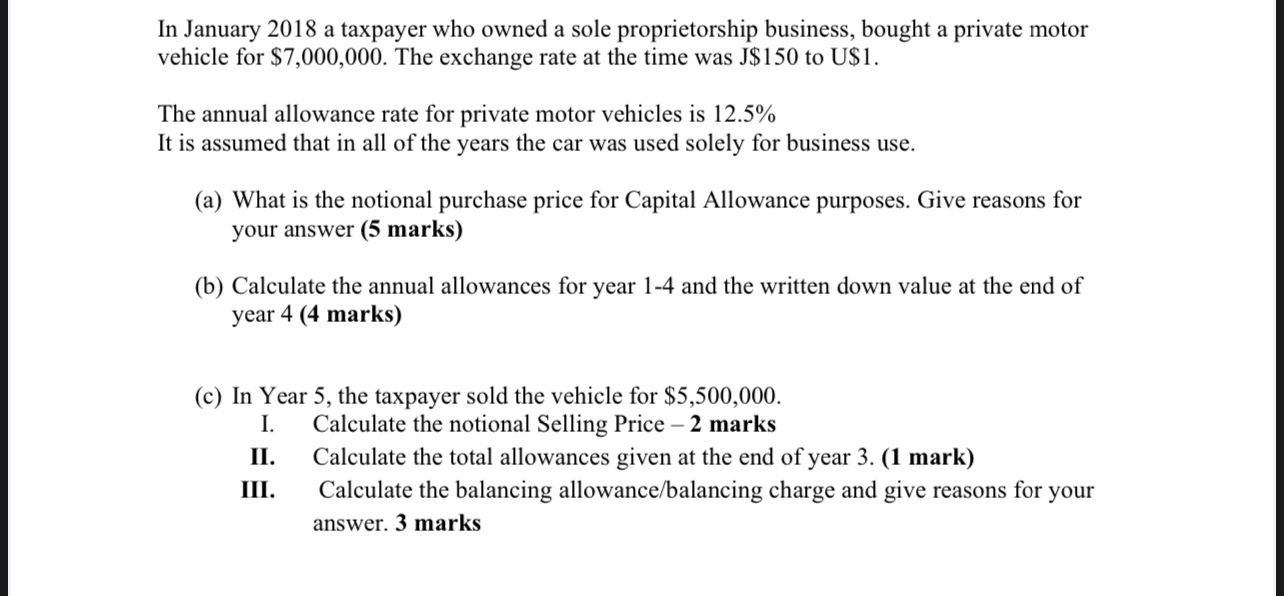

In January 2018 a taxpayer who owned a sole proprietorship business, bought a private motor vehicle for $7,000,000. The exchange rate at the time was J\$150 to U\$1. The annual allowance rate for private motor vehicles is 12.5% It is assumed that in all of the years the car was used solely for business use. (a) What is the notional purchase price for Capital Allowance purposes. Give reasons for your answer (5 marks) (b) Calculate the annual allowances for year 1-4 and the written down value at the end of year 4 (4 marks) (c) In Year 5, the taxpayer sold the vehicle for $5,500,000. I. Calculate the notional Selling Price -2 marks II. Calculate the total allowances given at the end of year 3. (1 mark) III. Calculate the balancing allowance/balancing charge and give reasons for your answer. 3 marks

In January 2018 a taxpayer who owned a sole proprietorship business, bought a private motor vehicle for $7,000,000. The exchange rate at the time was J\$150 to U\$1. The annual allowance rate for private motor vehicles is 12.5% It is assumed that in all of the years the car was used solely for business use. (a) What is the notional purchase price for Capital Allowance purposes. Give reasons for your answer (5 marks) (b) Calculate the annual allowances for year 1-4 and the written down value at the end of year 4 (4 marks) (c) In Year 5, the taxpayer sold the vehicle for $5,500,000. I. Calculate the notional Selling Price -2 marks II. Calculate the total allowances given at the end of year 3. (1 mark) III. Calculate the balancing allowance/balancing charge and give reasons for your answer. 3 marks Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started