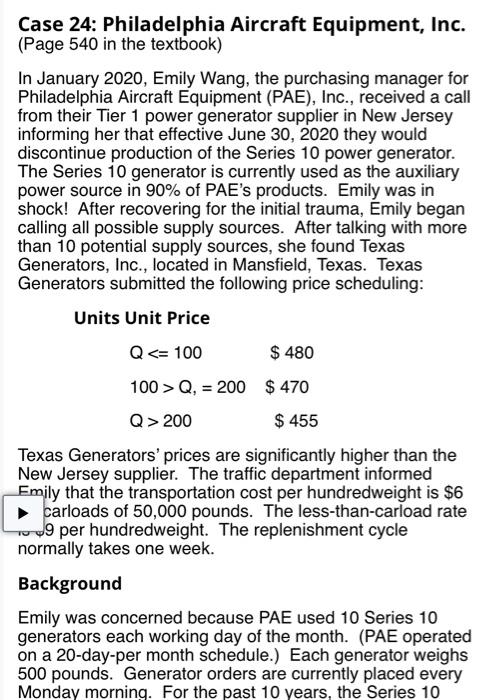

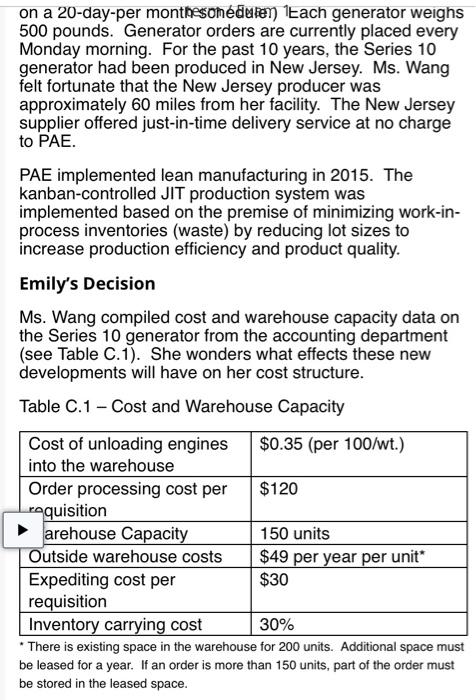

In January 2020, Emily Wang, the purchasing manager for Philadelphia Aircraft Equipment (PAE), Inc., received a call from their Tier 1 power generator supplier in New Jersey informing her that effective June 30, 2020 they would discontinue production of the Series 10 power generator. The Series 10 generator is currently used as the auxiliary power source in 90% of PAEs products. Emily was in shock! After recovering for the initial trauma, Emily began calling all possible supply sources. After talking with more than 10 potential supply sources, she found Texas Generators, Inc., located in Mansfield, Texas. Texas Generators submitted the following price scheduling: Units Unit Price Q Q, = 200 $ 470 Q > 200 $ 455 Texas Generators prices are significantly higher than the New Jersey supplier. The traffic department informed Emily that the transportation cost per hundredweight is $6 for carloads of 50,000 pounds. The less-than-carload rate is $9 per hundredweight. The replenishment cycle normally takes one week. Background Emily was concerned because PAE used 10 Series 10 generators each working day of the month. (PAE operated on a 20-day-per month schedule.) Each generator weighs 500 pounds. Generator orders are currently placed every Monday morning. For the past 10 years, the Series 10 generator had been produced in New Jersey. Ms. Wang felt fortunate that the New Jersey producer was approximately 60 miles from her facility. The New Jersey supplier offered just-in-time delivery service at no charge to PAE. PAE implemented lean manufacturing in 2015. The kanban-controlled JIT production system was implemented based on the premise of minimizing work-in-process inventories (waste) by reducing lot sizes to increase production efficiency and product quality. Emilys Decision Ms. Wang compiled cost and warehouse capacity data on the Series 10 generator from the accounting department (see Table C.1). She wonders what effects these new developments will have on her cost structure. Table C.1 Cost and Warehouse Capacity Cost of unloading engines into the warehouse $0.35 (per 100/wt.) Order processing cost per requisition $120 Warehouse Capacity 150 units Outside warehouse costs $49 per year per unit* Expediting cost per requisition $30 Inventory carrying cost 30% * There is existing space in the warehouse for 200 units. Additional space must be leased for a year. If an order is more than 150 units, part of the order must be stored in the leased space.

- With purchase discounts and different rates, how are costs and EOQ affected?

- How will these changes impact the lean manufacturing philosophy at PAE?

- Determine the cost impact of using Texas supplier. How will the change in supplier for the Series 10 generator affect PAEs sales?

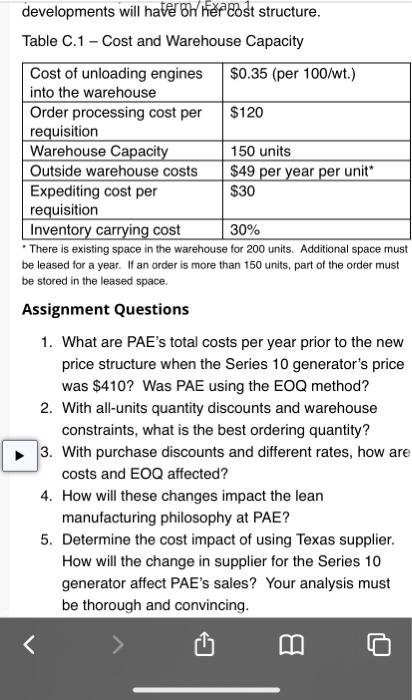

Case 24: Philadelphia Aircraft Equipment, Inc. (Page 540 in the textbook) In January 2020, Emily Wang, the purchasing manager for Philadelphia Aircraft Equipment (PAE), Inc., received a call from their Tier 1 power generator supplier in New Jersey informing her that effective June 30, 2020 they would discontinue production of the Series 10 power generator. The Series 10 generator is currently used as the auxiliary power source in 90% of PAE's products. Emily was in shock! After recovering for the initial trauma, mily began calling all possible supply sources. After talking with more than 10 potential supply sources, she found Texas Generators, Inc., located in Mansfield, Texas. Texas Generators submitted the following price scheduling: Units Unit Price Q Q, = 200 $ 470 Q> 200 $ 455 Texas Generators' prices are significantly higher than the New Jersey supplier. The traffic department informed Emily that the transportation cost per hundredweight is $6 carloads of 50,000 pounds. The less-than-carload rate 9 per hundredweight. The replenishment cycle normally takes one week. Background Emily was concerned because PAE used 10 Series 10 generators each working day of the month. (PAE operated on a 20-day-per month schedule.) Each generator weighs 500 pounds. Generator orders are currently placed every Monday morning. For the past 10 years, the Series 10 on a 20-day-per monthesohedulen Each generator weighs 500 pounds. Generator orders are currently placed every Monday morning. For the past 10 years, the Series 10 generator had been produced in New Jersey. Ms. Wang felt fortunate that the New Jersey producer was approximately 60 miles from her facility. The New Jersey supplier offered just-in-time delivery service at no charge to PAE. PAE implemented lean manufacturing in 2015. The kanban-controlled JIT production system was implemented based on the premise of minimizing work-in- process inventories (waste) by reducing lot sizes to increase production efficiency and product quality. Emily's Decision Ms. Wang compiled cost and warehouse capacity data on the Series 10 generator from the accounting department (see Table C.1). She wonders what effects these new developments will have on her cost structure. Table C.1 - Cost and Warehouse Capacity Cost of unloading engines $0.35 (per 100/wt.) into the warehouse Order processing cost per $120 requisition arehouse Capacity 150 units Outside warehouse costs $49 per year per unit Expediting cost per $30 requisition Inventory carrying cost 30% * There is existing space in the warehouse for 200 units. Additional space must be leased for a year. If an order is more than 150 units, part of the order must be stored in the leased space. developments will haver on vier cost structure. Table C.1 - Cost and Warehouse Capacity Cost of unloading engines $0.35 (per 100/wt.) into the warehouse Order processing cost per $120 requisition Warehouse Capacity 150 units Outside warehouse costs $49 per year per unit Expediting cost per $30 requisition Inventory carrying cost 30% There is existing space in the warehouse for 200 units. Additional space must be leased for a year. If an order is more than 150 units, part of the order must be stored in the leased space. Assignment Questions 1. What are PAE's total costs per year prior to the new price structure when the Series 10 generator's price was $410? Was PAE using the EOQ method? 2. With all-units quantity discounts and warehouse constraints, what is the best ordering quantity ? 3. With purchase discounts and different rates, how are costs and EOQ affected? 4. How will these changes impact the lean manufacturing philosophy at PAE? 5. Determine the cost impact of using Texas supplier. How will the change in supplier for the Series 10 generator affect PAE's sales? Your analysis must be thorough and convincing. Q, = 200 $ 470 Q> 200 $ 455 Texas Generators' prices are significantly higher than the New Jersey supplier. The traffic department informed Emily that the transportation cost per hundredweight is $6 carloads of 50,000 pounds. The less-than-carload rate 9 per hundredweight. The replenishment cycle normally takes one week. Background Emily was concerned because PAE used 10 Series 10 generators each working day of the month. (PAE operated on a 20-day-per month schedule.) Each generator weighs 500 pounds. Generator orders are currently placed every Monday morning. For the past 10 years, the Series 10 on a 20-day-per monthesohedulen Each generator weighs 500 pounds. Generator orders are currently placed every Monday morning. For the past 10 years, the Series 10 generator had been produced in New Jersey. Ms. Wang felt fortunate that the New Jersey producer was approximately 60 miles from her facility. The New Jersey supplier offered just-in-time delivery service at no charge to PAE. PAE implemented lean manufacturing in 2015. The kanban-controlled JIT production system was implemented based on the premise of minimizing work-in- process inventories (waste) by reducing lot sizes to increase production efficiency and product quality. Emily's Decision Ms. Wang compiled cost and warehouse capacity data on the Series 10 generator from the accounting department (see Table C.1). She wonders what effects these new developments will have on her cost structure. Table C.1 - Cost and Warehouse Capacity Cost of unloading engines $0.35 (per 100/wt.) into the warehouse Order processing cost per $120 requisition arehouse Capacity 150 units Outside warehouse costs $49 per year per unit Expediting cost per $30 requisition Inventory carrying cost 30% * There is existing space in the warehouse for 200 units. Additional space must be leased for a year. If an order is more than 150 units, part of the order must be stored in the leased space. developments will haver on vier cost structure. Table C.1 - Cost and Warehouse Capacity Cost of unloading engines $0.35 (per 100/wt.) into the warehouse Order processing cost per $120 requisition Warehouse Capacity 150 units Outside warehouse costs $49 per year per unit Expediting cost per $30 requisition Inventory carrying cost 30% There is existing space in the warehouse for 200 units. Additional space must be leased for a year. If an order is more than 150 units, part of the order must be stored in the leased space. Assignment Questions 1. What are PAE's total costs per year prior to the new price structure when the Series 10 generator's price was $410? Was PAE using the EOQ method? 2. With all-units quantity discounts and warehouse constraints, what is the best ordering quantity ? 3. With purchase discounts and different rates, how are costs and EOQ affected? 4. How will these changes impact the lean manufacturing philosophy at PAE? 5. Determine the cost impact of using Texas supplier. How will the change in supplier for the Series 10 generator affect PAE's sales? Your analysis must be thorough and convincing.