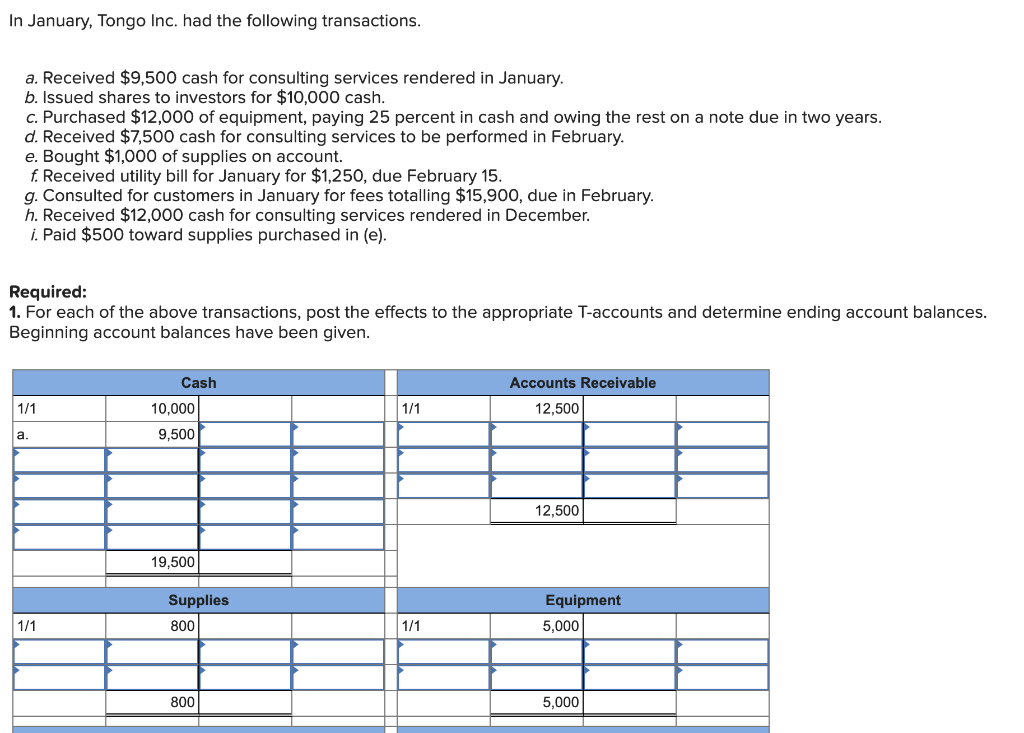

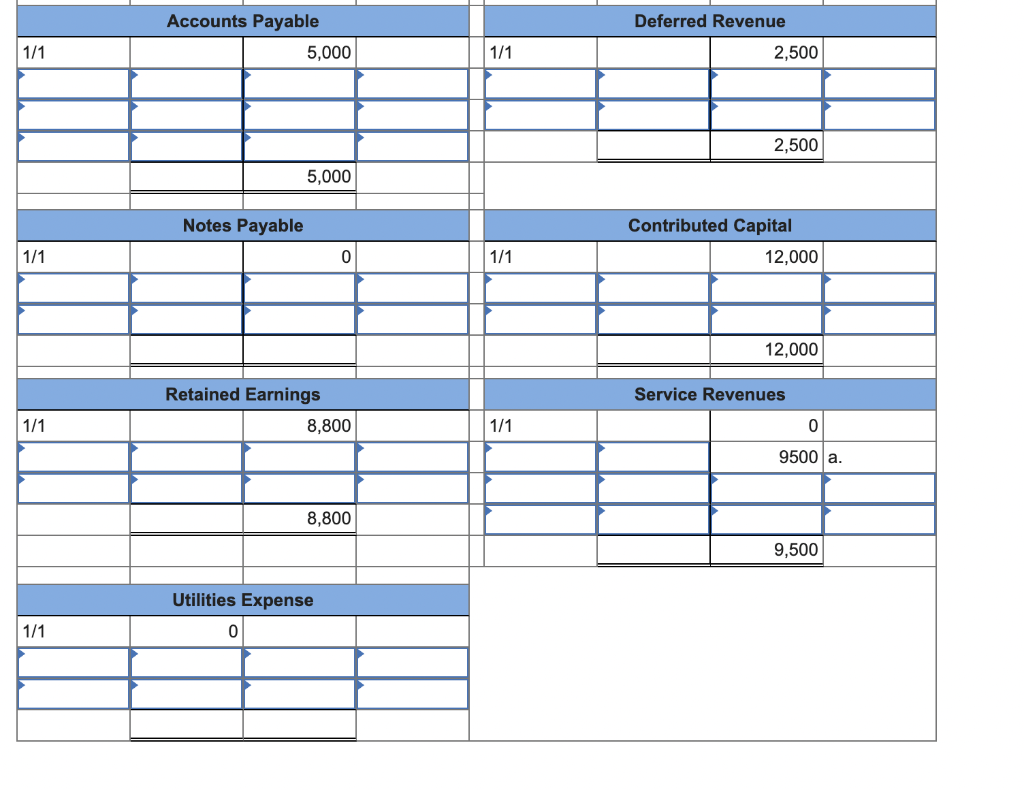

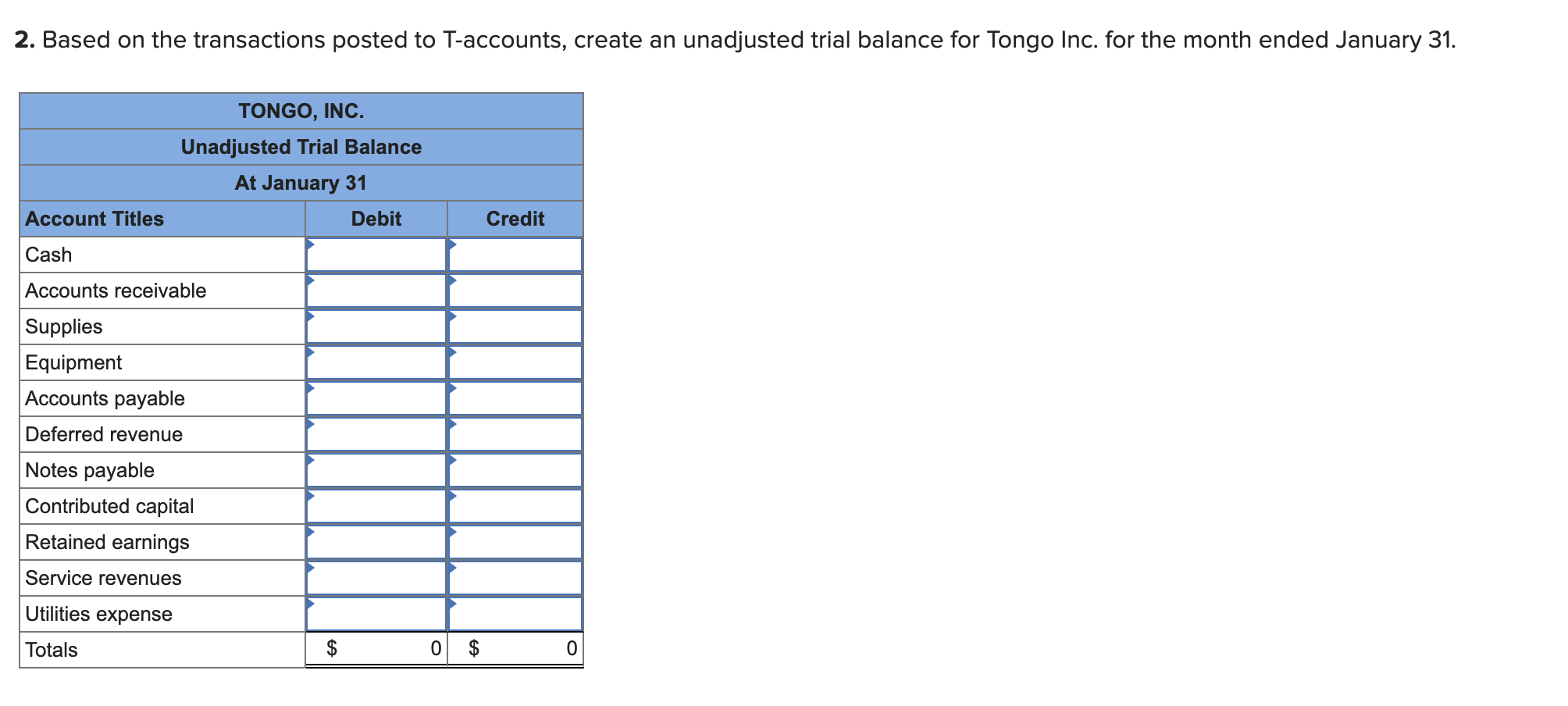

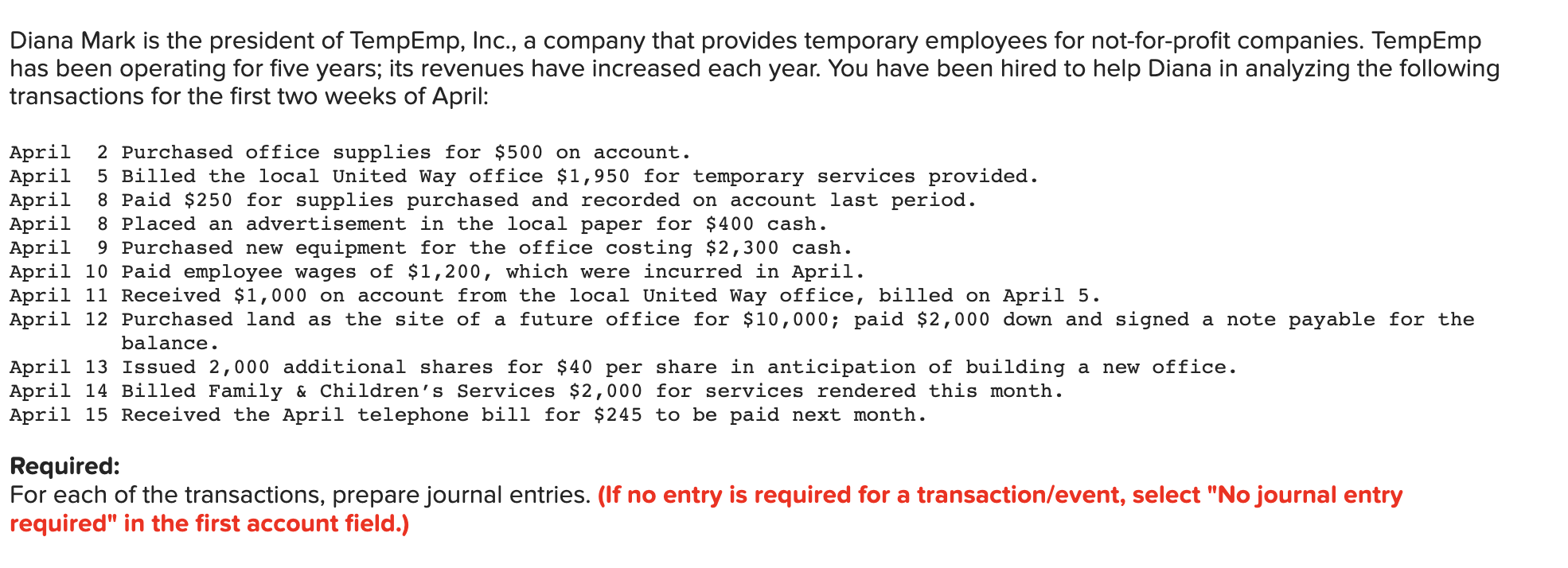

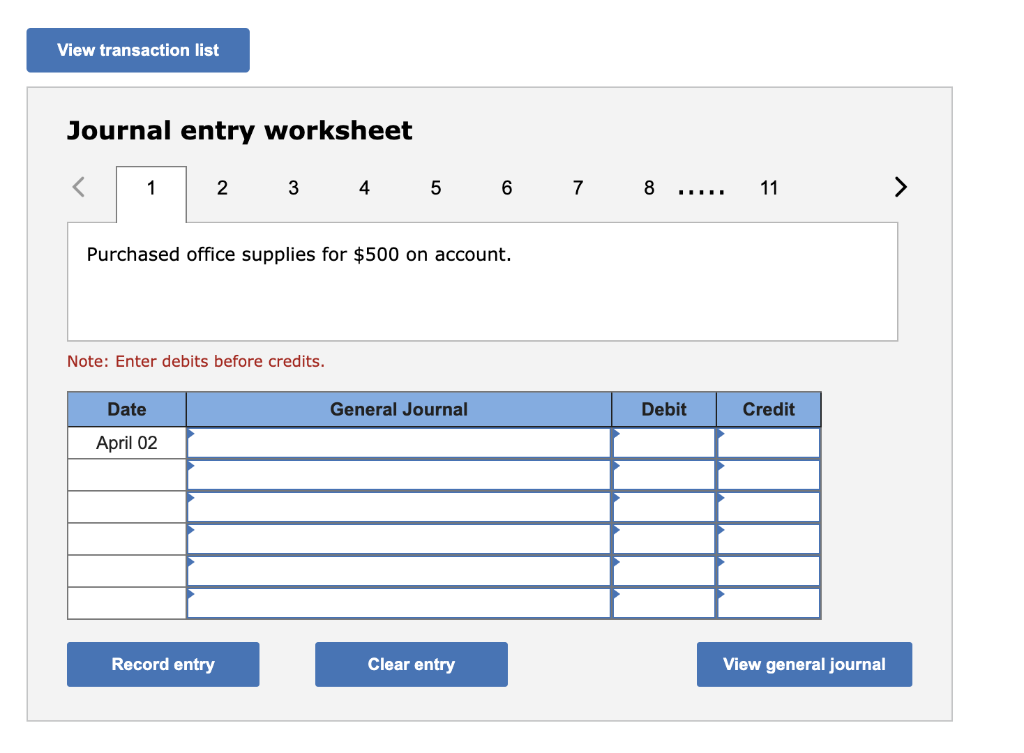

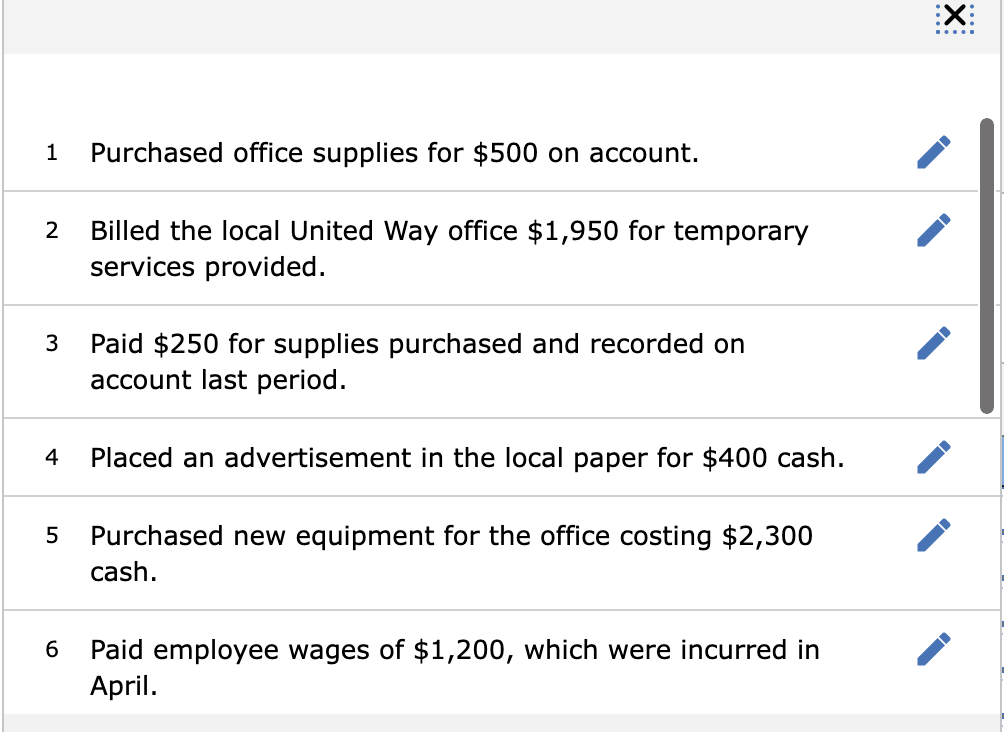

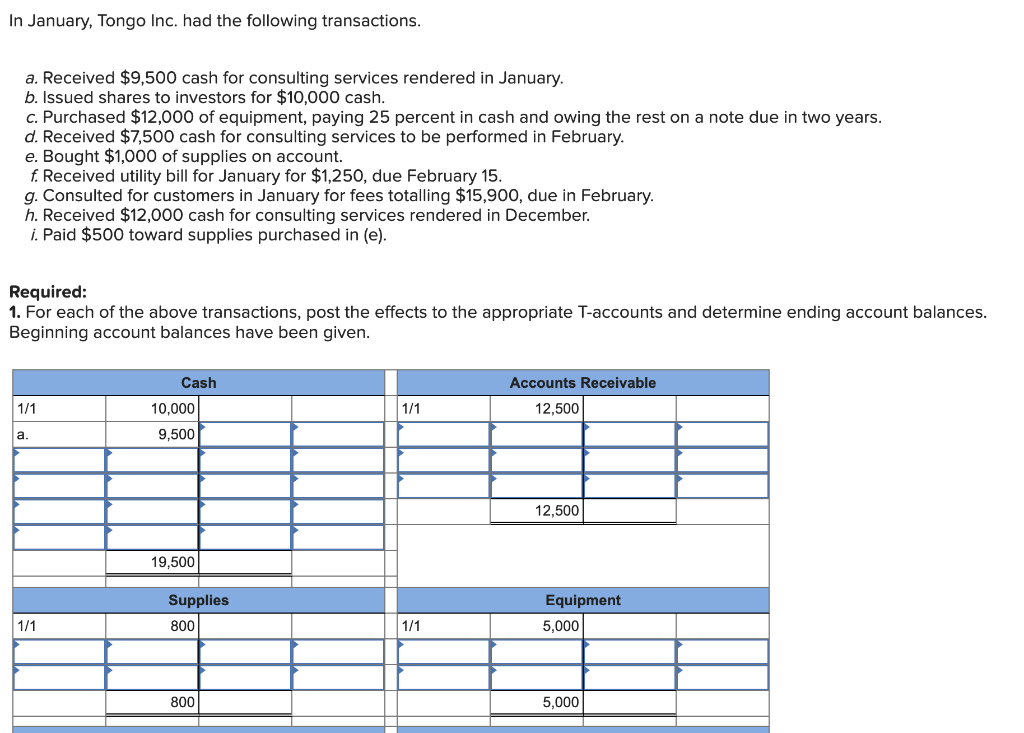

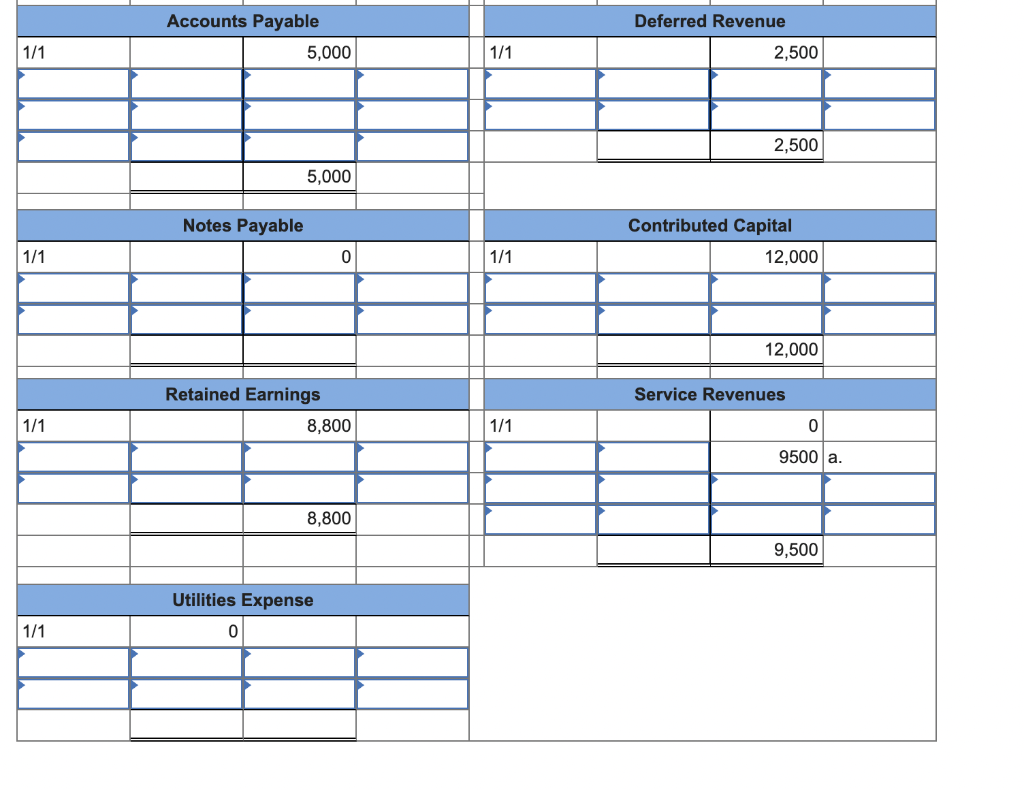

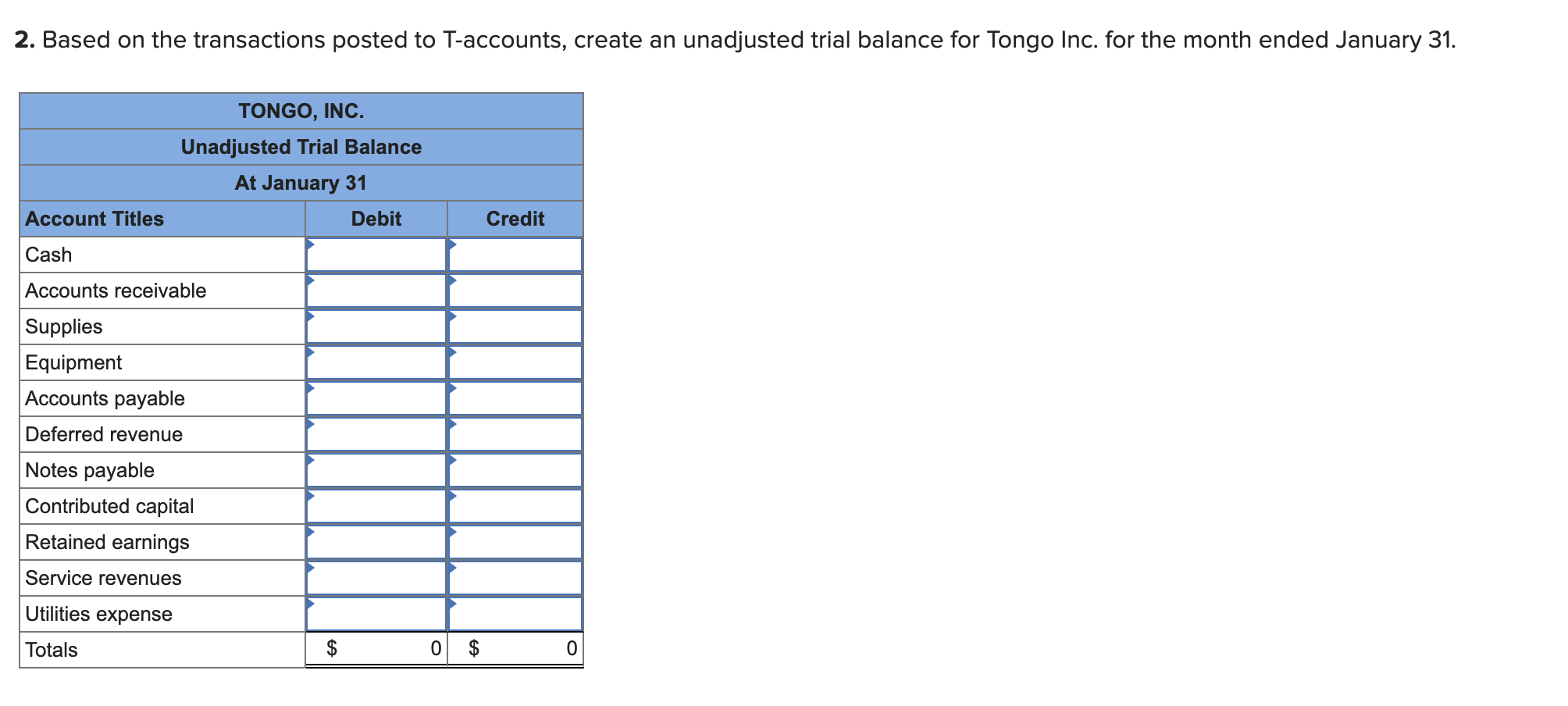

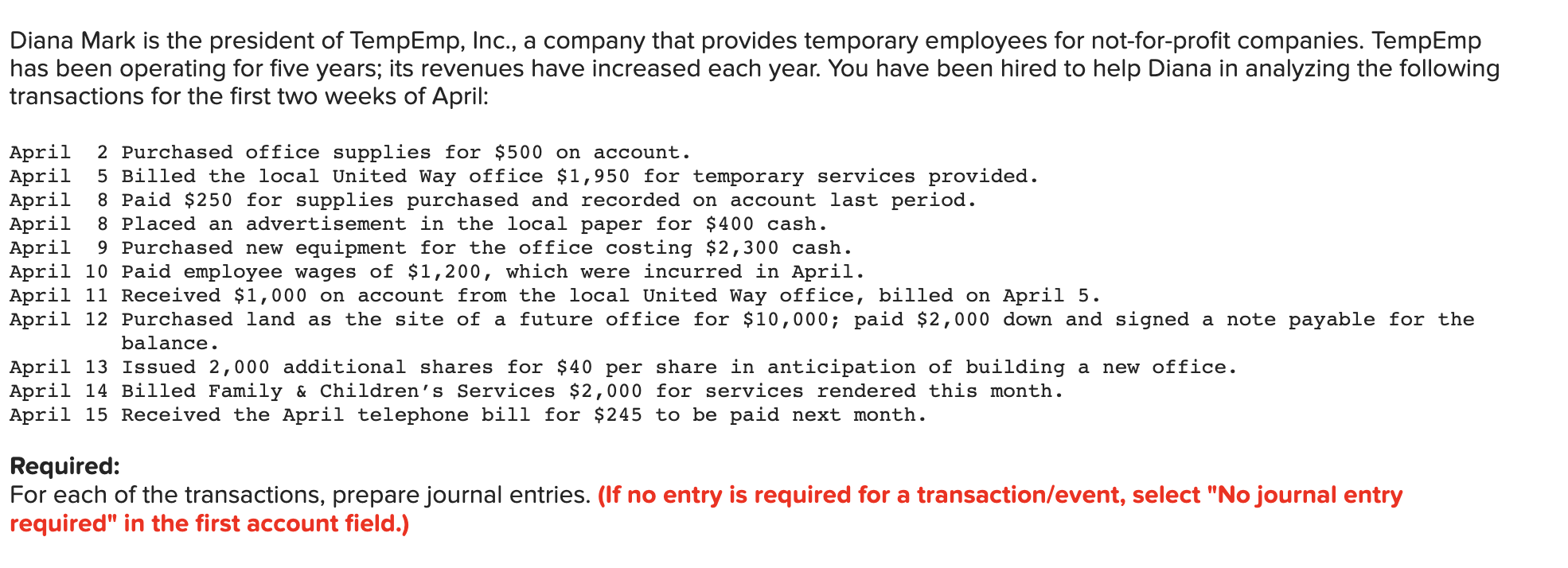

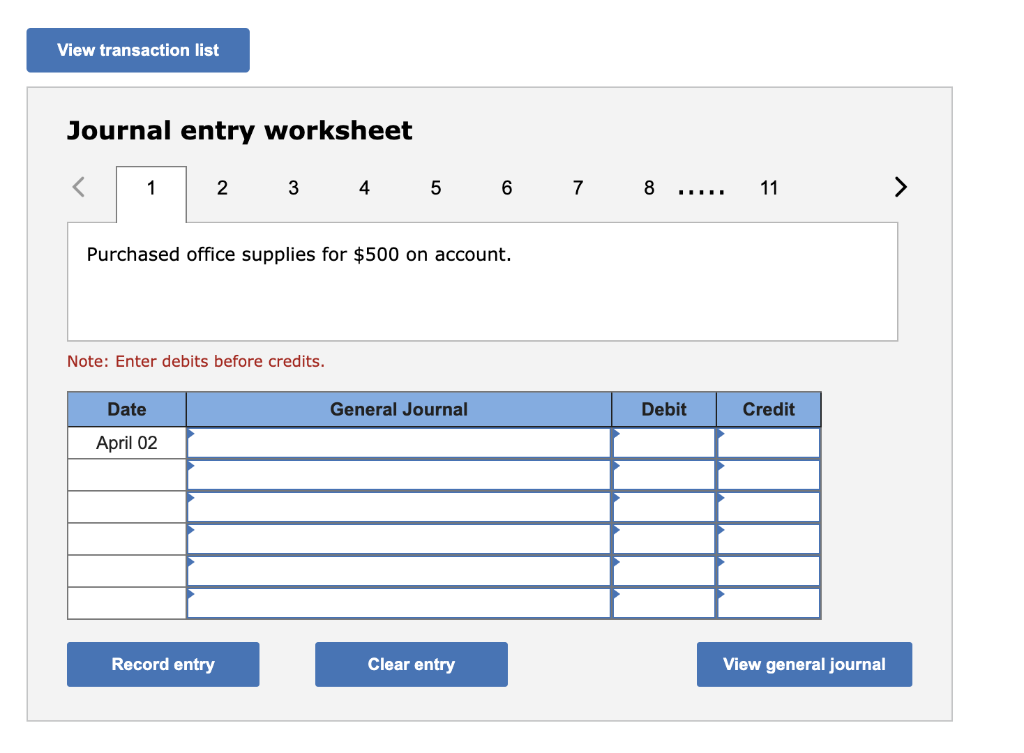

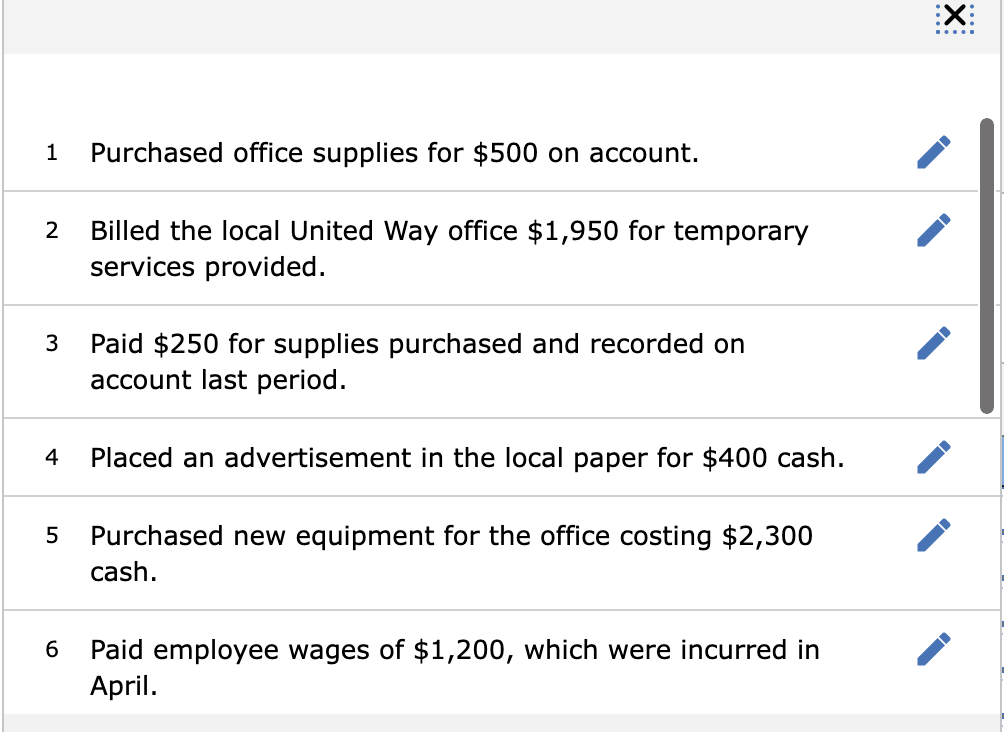

In January, Tongo Inc. had the following transactions. a. Received $9,500 cash for consulting services rendered in January. b. Issued shares to investors for $10,000 cash. c. Purchased $12,000 of equipment, paying 25 percent in cash and owing the rest on a note due in two years. d. Received $7,500 cash for consulting services to be performed in February. e. Bought $1,000 of supplies on account. f. Received utility bill for January for $1,250, due February 15. g. Consulted for customers in January for fees totalling $15,900, due in February. h. Received $12,000 cash for consulting services rendered in December. i. Paid $500 toward supplies purchased in (e). Required: 1. For each of the above transactions, post the effects to the appropriate T-accounts and determine ending account balances. Beginning account balances have been given. 2. Based on the transactions posted to T-accounts, create an unadjusted trial balance for Tongo Inc. for the month ended January 31. Diana Mark is the president of TempEmp, Inc., a company that provides temporary employees for not-for-profit companies. TempEmp has been operating for five years; its revenues have increased each year. You have been hired to help Diana in analyzing the following transactions for the first two weeks of April: April 2 Purchased office supplies for $500 on account. April 5 Billed the local United Way office $1,950 for temporary services provided. April 8 Paid $250 for supplies purchased and recorded on account last period. April 8 Placed an advertisement in the local paper for $400 cash. April 9 Purchased new equipment for the office costing $2,300 cash. April 10 Paid employee wages of $1,200, which were incurred in April. April 11 Received $1,000 on account from the local United Way office, billed on April 5. April 12 Purchased land as the site of a future office for $10,000; paid $2,000 down and signed a note payable for the balance. April 13 Issued 2,000 additional shares for $40 per share in anticipation of building a new office. April 14 Billed Family \& Children's Services $2,000 for services rendered this month. April 15 Received the April telephone bill for $245 to be paid next month. Required: For each of the transactions, prepare journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. 1 Purchased office supplies for $500 on account. 2 Billed the local United Way office $1,950 for temporary services provided. 3 Paid $250 for supplies purchased and recorded on account last period. 4 Placed an advertisement in the local paper for $400 cash. 5 Purchased new equipment for the office costing $2,300 cash. 6 Paid employee wages of $1,200, which were incurred in April