Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In July 2021, Jake bought 20 hectares of land for 204,800. In October 2022, Jake sold four hectares of the land for 64,000 when the

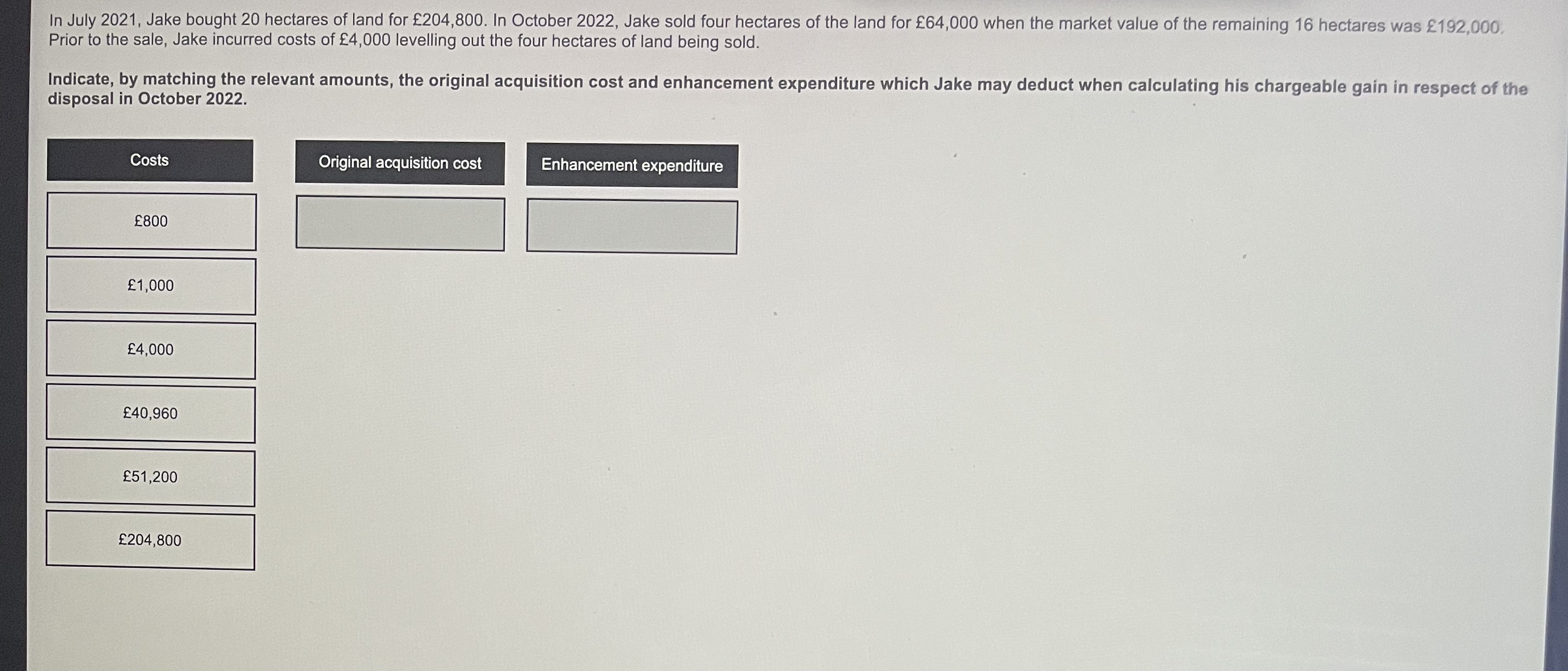

In July 2021, Jake bought 20 hectares of land for 204,800. In October 2022, Jake sold four hectares of the land for 64,000 when the market value of the remaining 16 hectares was 192,000. Prior to the sale, Jake incurred costs of 4,000 levelling out the four hectares of land being sold. Indicate, by matching the relevant amounts, the original acquisition cost and enhancement expenditure which Jake may deduct when calculating his chargeable gain in respect of the disposal in October 2022. In July 2021, Jake bought 20 hectares of land for 204,800. In October 2022, Jake sold four hectares of the land for 64,000 when the market value of the remaining 16 hectares was 192,000. Prior to the sale, Jake incurred costs of 4,000 levelling out the four hectares of land being sold. Indicate, by matching the relevant amounts, the original acquisition cost and enhancement expenditure which Jake may deduct when calculating his chargeable gain in respect of the disposal in October 2022

In July 2021, Jake bought 20 hectares of land for 204,800. In October 2022, Jake sold four hectares of the land for 64,000 when the market value of the remaining 16 hectares was 192,000. Prior to the sale, Jake incurred costs of 4,000 levelling out the four hectares of land being sold. Indicate, by matching the relevant amounts, the original acquisition cost and enhancement expenditure which Jake may deduct when calculating his chargeable gain in respect of the disposal in October 2022. In July 2021, Jake bought 20 hectares of land for 204,800. In October 2022, Jake sold four hectares of the land for 64,000 when the market value of the remaining 16 hectares was 192,000. Prior to the sale, Jake incurred costs of 4,000 levelling out the four hectares of land being sold. Indicate, by matching the relevant amounts, the original acquisition cost and enhancement expenditure which Jake may deduct when calculating his chargeable gain in respect of the disposal in October 2022 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started