Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In June 2023 , Sue exchanges a sport-utility vehicle (adjusted basis of $118,880; fair market value of $148,600 ) for cash of $22,290 and a

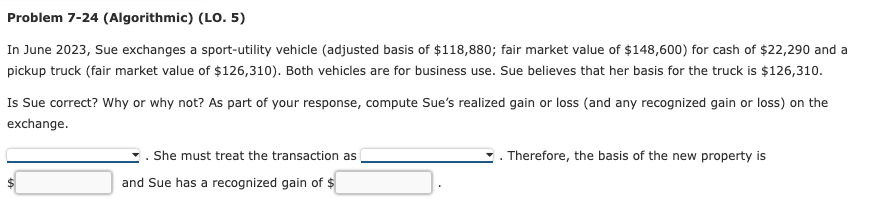

In June 2023 , Sue exchanges a sport-utility vehicle (adjusted basis of $118,880; fair market value of $148,600 ) for cash of $22,290 and a pickup truck (fair market value of $126,310 ). Both vehicles are for business use. Sue believes that her basis for the truck is $126,310. Is Sue correct? Why or why not? As part of your response, compute Sue's realized gain or loss (and any recognized gain or loss) on the exchange. . She must treat the transaction as - Therefore, the basis of the new property is and Sue has a recognized gain of $

In June 2023 , Sue exchanges a sport-utility vehicle (adjusted basis of $118,880; fair market value of $148,600 ) for cash of $22,290 and a pickup truck (fair market value of $126,310 ). Both vehicles are for business use. Sue believes that her basis for the truck is $126,310. Is Sue correct? Why or why not? As part of your response, compute Sue's realized gain or loss (and any recognized gain or loss) on the exchange. . She must treat the transaction as - Therefore, the basis of the new property is and Sue has a recognized gain of $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started