Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In March, Lee Gall opened a paralegal services company. Please assist her by journalizing the following business transactions: Mar.2 Mar.6 Mar 9 Mar. 13 Mar.

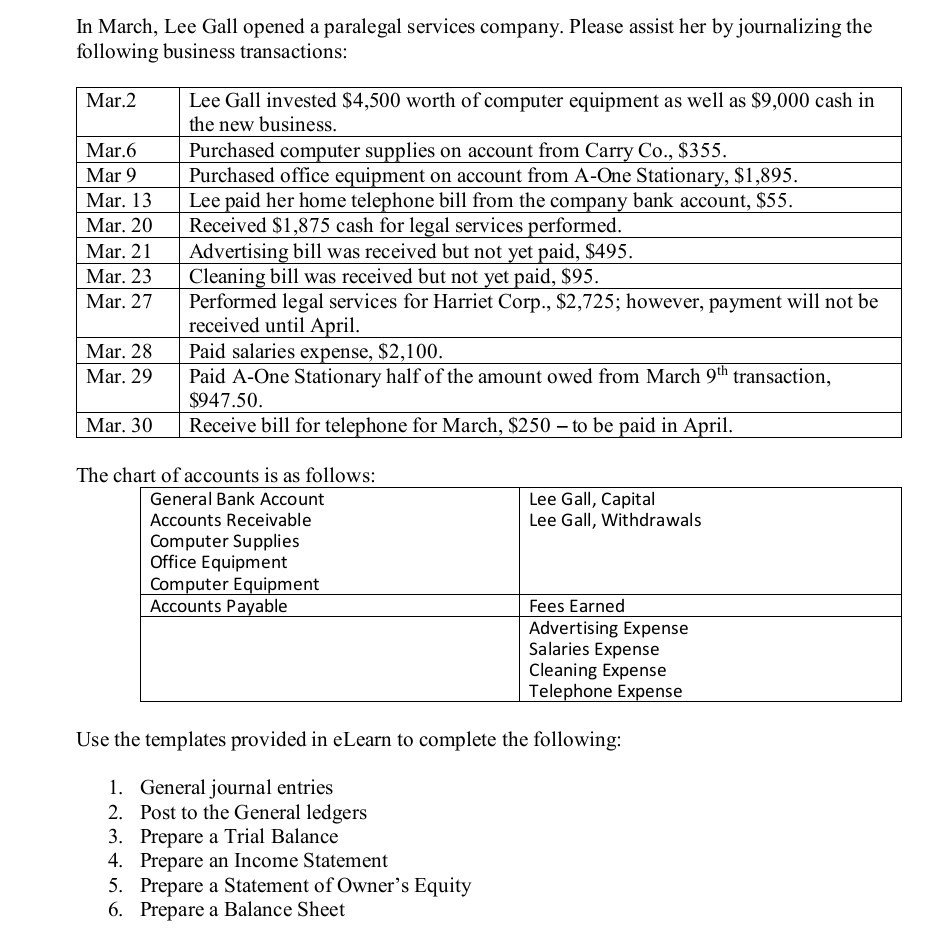

In March, Lee Gall opened a paralegal services company. Please assist her by journalizing the following business transactions: Mar.2 Mar.6 Mar 9 Mar. 13 Mar. 20 Mar. 21 Mar. 23 Mar. 27 Lee Gall invested $4,500 worth of computer equipment as well as $9,000 cash in the new business. Purchased computer supplies on account from Carry Co., $355. Purchased office equipment on account from A-One Stationary, $1,895. Lee paid her home telephone bill from the company bank account, $55. Received $1,875 cash for legal services performed. Advertising bill was received but not yet paid, $495. Cleaning bill was received but not yet paid, $95. Performed legal services for Harriet Corp., $2,725; however, payment will not be received until April. Paid salaries expense, $2,100. Paid A-One Stationary half of the amount owed from March 9th transaction, $947.50. Receive bill for telephone for March, $250 - to be paid in April. Mar. 28 Mar. 29 Mar. 30 Lee Gall, Capital Lee Gall, Withdrawals The chart of accounts is as follows: General Bank Account Accounts Receivable Computer Supplies Office Equipment Computer Equipment Accounts Payable Fees Earned Advertising Expense Salaries Expense Cleaning Expense Telephone Expense Use the templates provided in eLearn to complete the following: 1. General journal entries 2. Post to the General ledgers Prepare a Trial Balance 4. Prepare an Income Statement 5. Prepare a Statement of Owner's Equity 6. Prepare a Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started