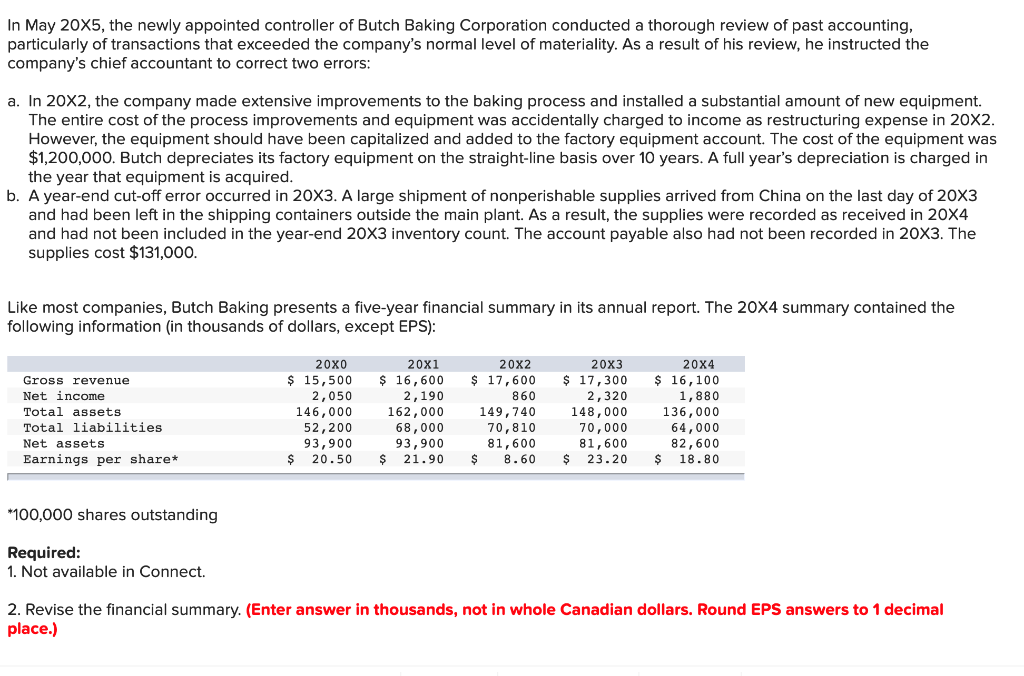

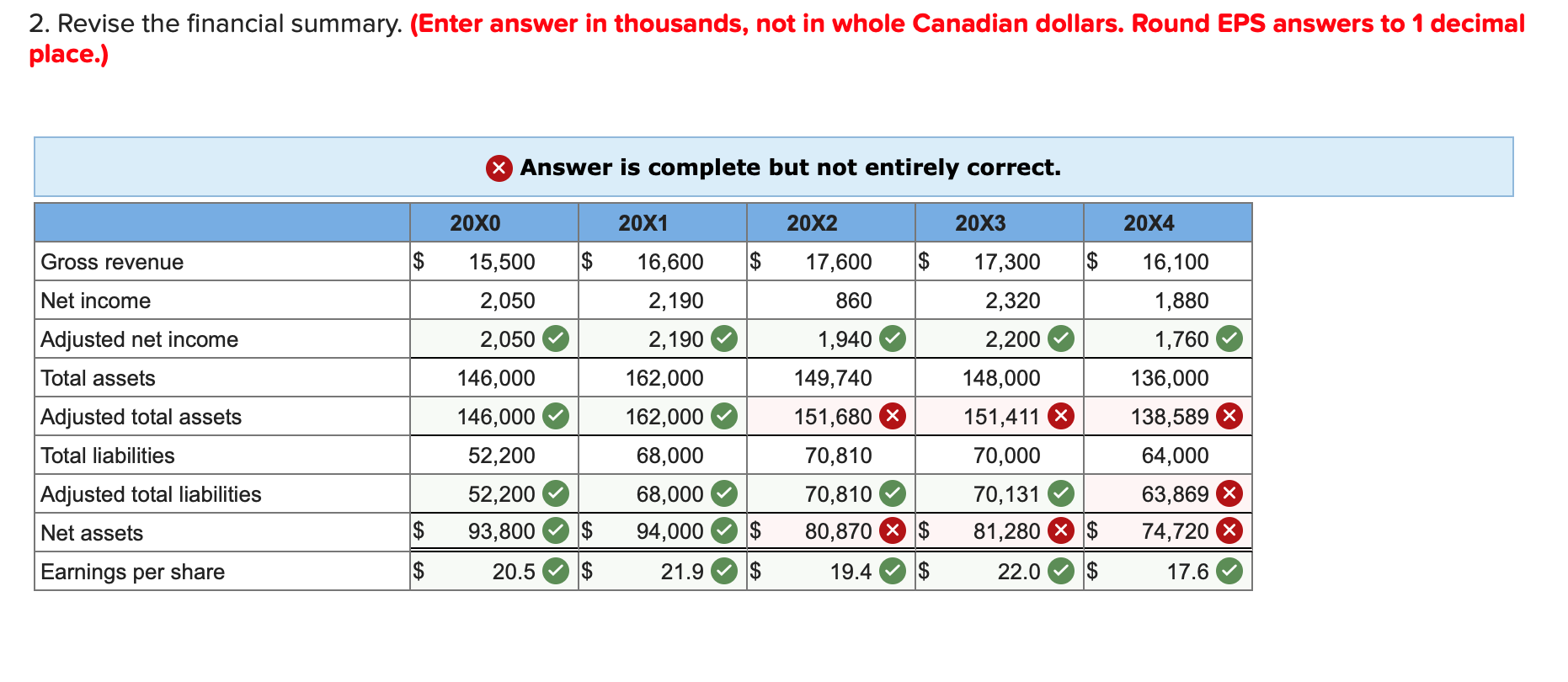

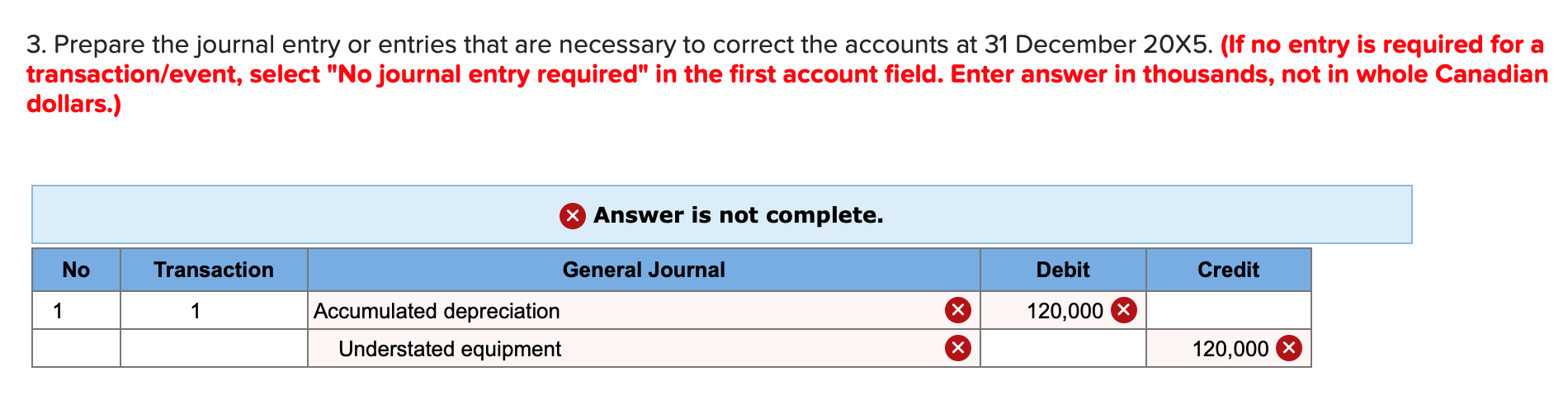

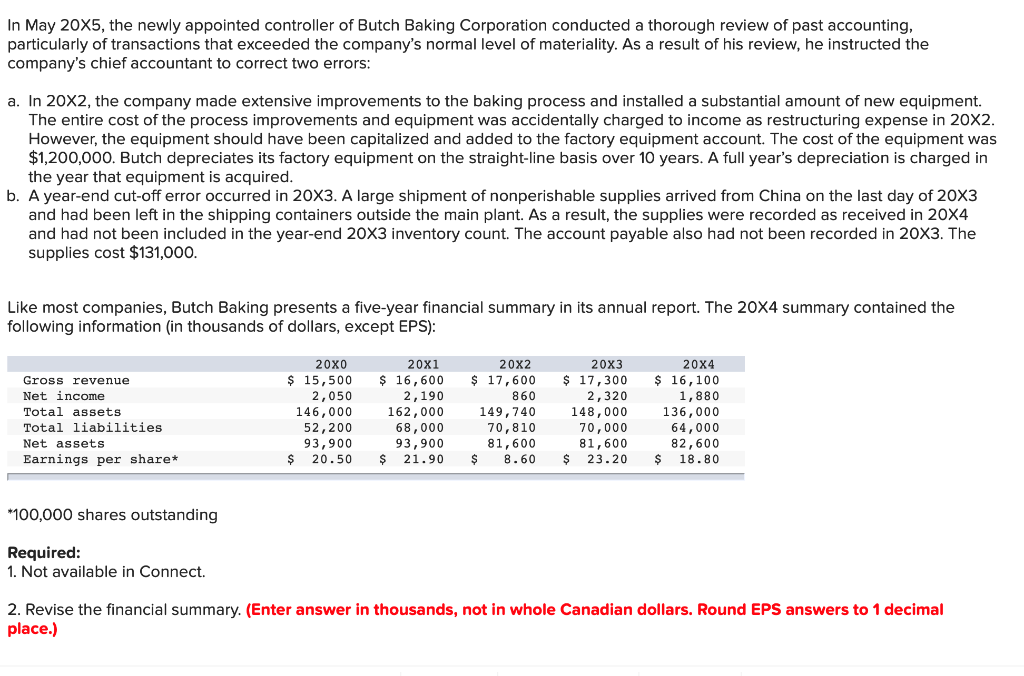

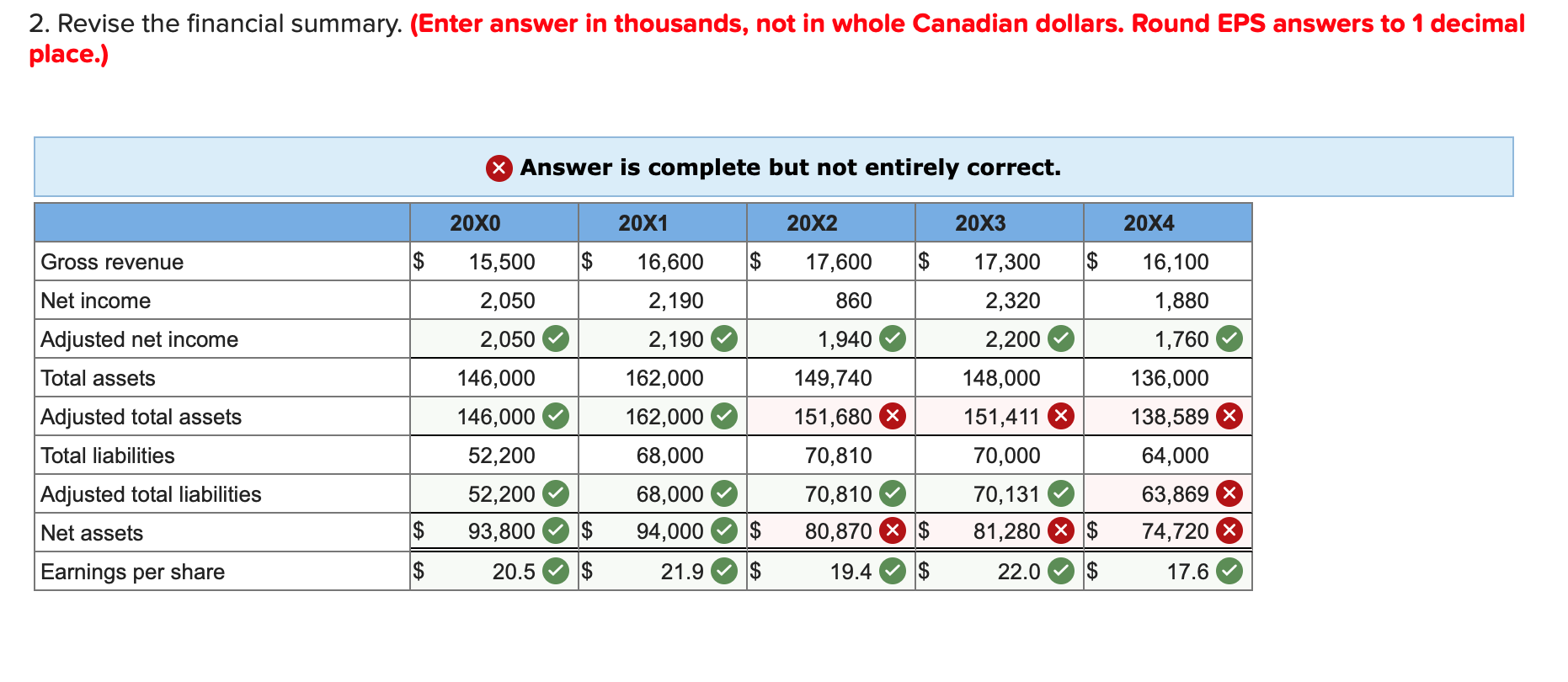

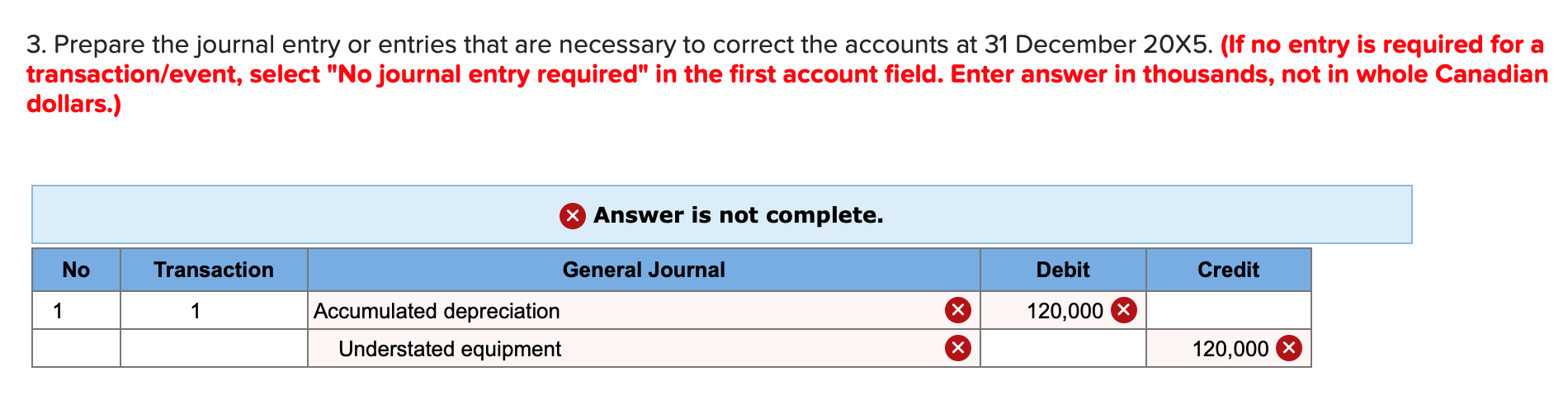

In May 20X5, the newly appointed controller of Butch Baking Corporation conducted a thorough review of past accounting, particularly of transactions that exceeded the company's normal level of materiality. As a result of his review, he instructed the company's chief accountant to correct two errors: a. In 20X2, the company made extensive improvements to the baking process and installed a substantial amount of new equipment. The entire cost of the process improvements and equipment was accidentally charged to income as restructuring expense in 20X2 However, the equipment should have been capitalized and added to the factory equipment account. The cost of the equipment was $1,200,000. Butch depreciates its factory equipment on the straight-line basis over 10 years. A full year's depreciation is charged in the year that equipment is acquired. b. A year-end cut-off error occurred in 20X3. A large shipment of nonperishable supplies arrived from China on the last day of 20X3 and had been left in the shipping containers outside the main plant. As a result, the supplies were recorded as received in 20X4 and had not been included in the year-end 20X3 inventory count. The account payable also had not been recorded in 20X3. The supplies cost $131,000. Like most companies, Butch Baking presents a five-year financial summary in its annual report. The 20X4 summary contained the following information (in thousands of dollars, except EPS): 20X0 20X1 20X2 20X3 20X4 $ 15,500 2,050 146,000 52,200 93,900 20.50 $ 16,600 2,190 $ 17,600 860 $ 17,300 2,320 148,000 70,000 $16,100 1,880 136,000 64,000 Gross revenue Net income 162,000 68,000 93,900 $ 21.90 149,740 70,810 81,600 8.60 Total assets Total liabilities 82,600 $ 18.80 81,600 23.20 Net assets Earnings per share* 100,000 shares outstanding Required: 1. Not available in Connect 2. Revise the financial summary. (Enter answer in thousands, not in whole Canadian dollars. Round EPS answers to 1 decimal place.) 2. Revise the financial summary. (Enter answer in thousands, not in whole Canadian dollars. Round EPS answers to 1 decimal place.) Answer is complete but not entirely correct. 20X0 20X1 20X2 20X3 20X4 $ $ Gross revenue 15,500 17,600 16,600 17,300 16,100 1,880 2,050 Net income 2,190 2,320 860 1,760 Adjusted net income 2,050 1,940 2,190 2,200 Total assets 146,000 162,000 149,740 148,000 136,000 Adjusted total assets 138,589 146,000 162,000 151,680 151,411 68,000 70,000 52,200 70,810 64,000 Total liabilities Adjusted total liabilities 63,869 (X 70,131 52,200 68,000 70,810 $ 80,870 $ 81,280 (X 93,800 94,000 74,720 Net assets $ Earnings per share 22.0 20.5 21.9 19.4 17.6 3. Prepare the journal entry or entries that are necessary to correct the accounts at 31 December 20X5. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter answer in thousands, not in whole Canadian dollars.) Answer is not complete. Credit No Transaction General Journal Debit Accumulated depreciation 1 1 120,000 Understated equipment 120,000