Question

In Microsoft Visual Studio (C#): How to Use Benefit Costs Calculation The ABC Internationals benefits package includes: 1. Medical plan: Insurance Company charges monthly premiums

In Microsoft Visual Studio (C#): How to Use Benefit Costs Calculation

The ABC Internationals benefits package includes:

1. Medical plan: Insurance Company charges monthly premiums based on the following rules:

Individual (no dependent): $6000 per year

Less than 3 dependents: $7200 per year

At least 3 dependents: $9000 per year

2. Group Life Insurance: ABC International pays entirely for group life insurance. The annual fee is $2.5 per $1000 of coverage. The benefit for employees varies. An exempt (not eligible for overtime pay) employees benefit is two times his or her salary; a nonexempt (eligible for overtime pay) employees benefit is one and one-half times his or her annual salary. For example, if an exempt employees annual salary is $50,000, then the insurance coverage is $100,000; the premium paid by the company is: $250 (2*salary/1000*2.5).

3. 401K Retirement Plan: Employees may participate in the 401K plan. For those participating employees, the company will pay 5% of their salary to the plan.

4. Workers Compensation: The workers compensation premium is based on a fee of $7.5 per $1000 of annual salary(Salary/1000*7.5).

5. FICA Taxes (Social Security): The Social Security (FICA) tax contains two parts. The Social Security (Old Age, Survivors, and Disability Insurance) FICA tax is based on the first $87,900 paid at the rate of 6.2% with a maximum amount withheld of $5450. The Medicare (Medical Hospital Insurance) FICA tax is based on all earnings paid, at the rate of 1.45%. There is no limit on the Medicare FICA gross.

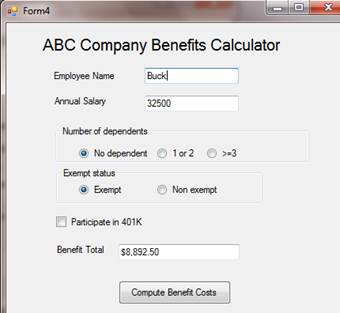

Create a form similar to the form below and compute and display the total benefit cost of an employee with a textbox.

Use the following data to test your program: Employee name: Buck; annual salary: 32500; no dependent, an exempt exployee; not participate in 401K.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started