Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In November 2 0 2 3 , Kortney ( who is a self - employed management consultant ) travels from Chicago to Barcelona ( Spain

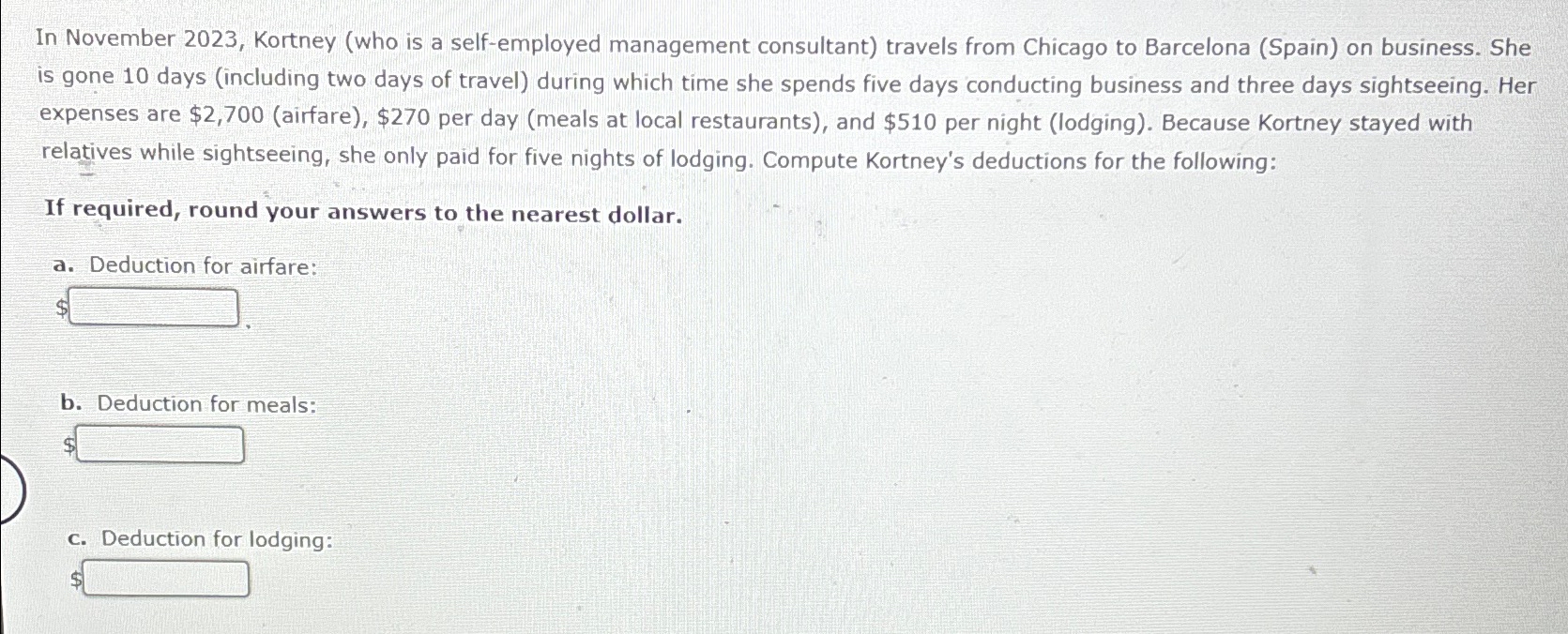

In November Kortney who is a selfemployed management consultant travels from Chicago to Barcelona Spain on business. She is gone days including two days of travel during which time she spends five days conducting business and three days sightseeing. Her expenses are $airfare $ per day meals at local restaurants and $ per night lodging Because Kortney stayed with relatives while sightseeing, she only paid for five nights of lodging. Compute Kortney's deductions for the following:

If required, round your answers to the nearest dollar.

a Deduction for airfare:

b Deduction for meals:

c Deduction for lodging:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started