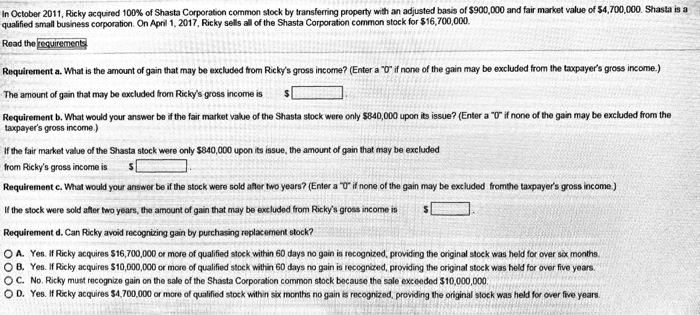

in October 2011, Ricky acq ed 100% of Shasta Corporation co mon stock by transfer ng p perty th an a sted bas s of $900 000 and a qualified small business corporation. On April 1, 2017, Ricky sellsall of the Shasta Corporation common stock for $16,700,000. m ket value of S4 700 000 Shasta is a Requirement a. What is the amount of gain that may be excluded from Ricky's gross income? (Enter a "or if none of the gain may be excluded from the taxpayers gross income.) The amount of gain that may be excluded from Ricky's gross income isS Requirement b. What would your answer be if the fair market vakue of the Shasta stock were only $840,000 upon its issue? (Enter a "0 ifnone of the gain may be excluded from the taxpayer's gross income) If the fair market value of the Shasta stock were only $840,000 upon its issue, the amount of gain that may be excluded from Ricky's gross income is Requirement c. What would your answer be if the stock were sold affer two years? (Enter a "O" if none of the gain may be excluded fromthe taxpayers gross income.) If the stock were sold after two years, te amount of gain that may be excluded from Ricky's gross income is $ Requirement d. Can Ricky avoid recognizing gain by purchasing replacement slock? A. Yes. If Ricky acq res S 16,700,000 or more of qualified stock within 60 days no ga s recognized, provid g the or ginal stock was held for o er six months. B. Yes. If Ricky acquires $10,000,000 or more of qualified stock within 60 days no gain is recognized providing the orignal stock was held for over five years. o c No Ricky must recognize gain on the sale of the Shasta Corporation common stock because the sale exceeded $10,000,000 O D. Yes. IRicky acquires $4,700,000 or more of qualified stock within six months no gain is recognized, providing the original stock was held for over five years in October 2011, Ricky acq ed 100% of Shasta Corporation co mon stock by transfer ng p perty th an a sted bas s of $900 000 and a qualified small business corporation. On April 1, 2017, Ricky sellsall of the Shasta Corporation common stock for $16,700,000. m ket value of S4 700 000 Shasta is a Requirement a. What is the amount of gain that may be excluded from Ricky's gross income? (Enter a "or if none of the gain may be excluded from the taxpayers gross income.) The amount of gain that may be excluded from Ricky's gross income isS Requirement b. What would your answer be if the fair market vakue of the Shasta stock were only $840,000 upon its issue? (Enter a "0 ifnone of the gain may be excluded from the taxpayer's gross income) If the fair market value of the Shasta stock were only $840,000 upon its issue, the amount of gain that may be excluded from Ricky's gross income is Requirement c. What would your answer be if the stock were sold affer two years? (Enter a "O" if none of the gain may be excluded fromthe taxpayers gross income.) If the stock were sold after two years, te amount of gain that may be excluded from Ricky's gross income is $ Requirement d. Can Ricky avoid recognizing gain by purchasing replacement slock? A. Yes. If Ricky acq res S 16,700,000 or more of qualified stock within 60 days no ga s recognized, provid g the or ginal stock was held for o er six months. B. Yes. If Ricky acquires $10,000,000 or more of qualified stock within 60 days no gain is recognized providing the orignal stock was held for over five years. o c No Ricky must recognize gain on the sale of the Shasta Corporation common stock because the sale exceeded $10,000,000 O D. Yes. IRicky acquires $4,700,000 or more of qualified stock within six months no gain is recognized, providing the original stock was held for over five years