Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview please do it in 50 minutes please urgently... I'll give you up thumb definitely All information are given C. e. Problem 2

Old MathJax webview

please do it in 50 minutes please urgently... I'll give you up thumb definitely

All information are given

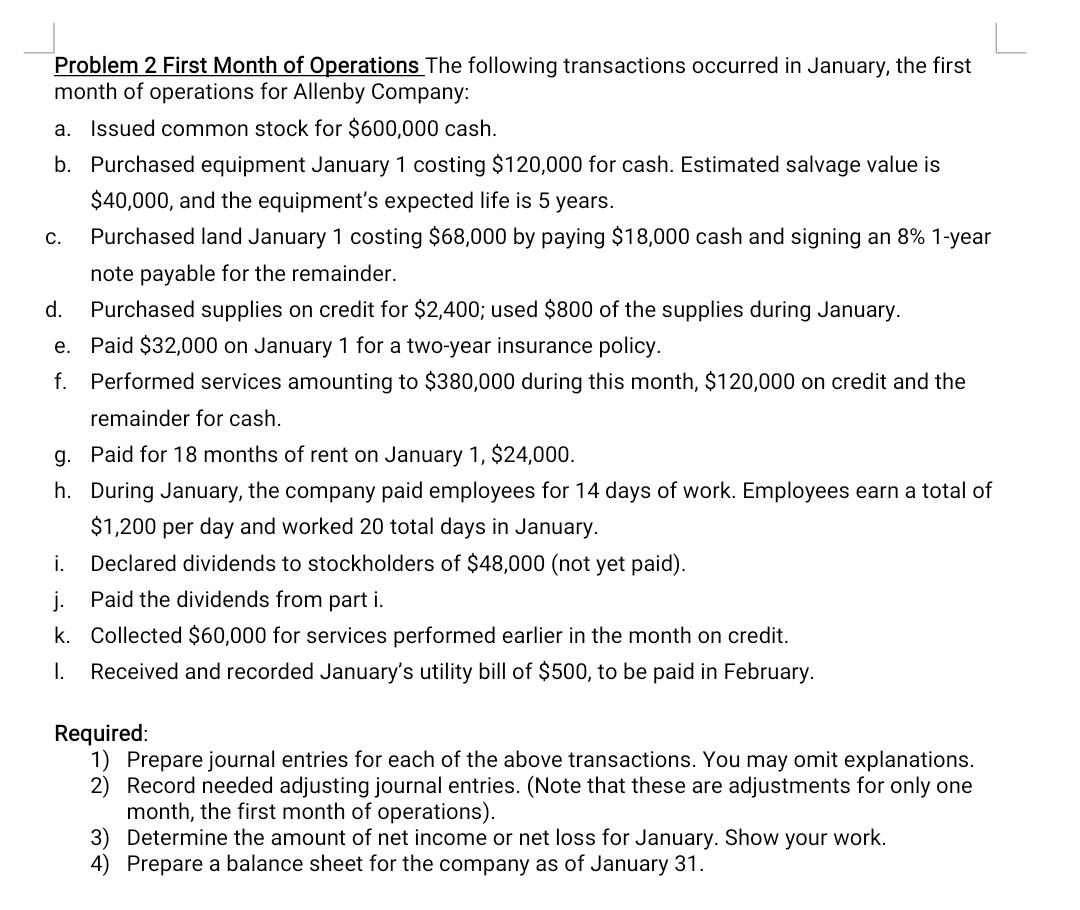

C. e. Problem 2 First Month of Operations The following transactions occurred in January, the first month of operations for Allenby Company: a. Issued common stock for $600,000 cash. b. Purchased equipment January 1 costing $120,000 for cash. Estimated salvage value is $40,000, and the equipment's expected life is 5 years. Purchased land January 1 costing $68,000 by paying $18,000 cash and signing an 8% 1-year note payable for the remainder. d. Purchased supplies on credit for $2,400; used $800 of the supplies during January. Paid $32,000 on January 1 for a two-year insurance policy. f. Performed services amounting to $380,000 during this month, $120,000 on credit and the remainder for cash. g. Paid for 18 months of rent on January 1, $24,000. h. During January, the company paid employees for 14 days of work. Employees earn a total of $1,200 per day and worked 20 total days in January. i. Declared dividends to stockholders of $48,000 (not yet paid). j. Paid the dividends from part i. k. Collected $60,000 for services performed earlier in the month on credit. 1. Received and recorded January's utility bill of $500, to be paid in February. Required: 1) Prepare journal entries for each of the above transactions. You may omit explanations. 2) Record needed adjusting journal entries. (Note that these are adjustments for only one month, the first month of operations). 3) Determine the amount of net income or net loss for January. Show your work. 4) Prepare a balance sheet for the company as of January 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started