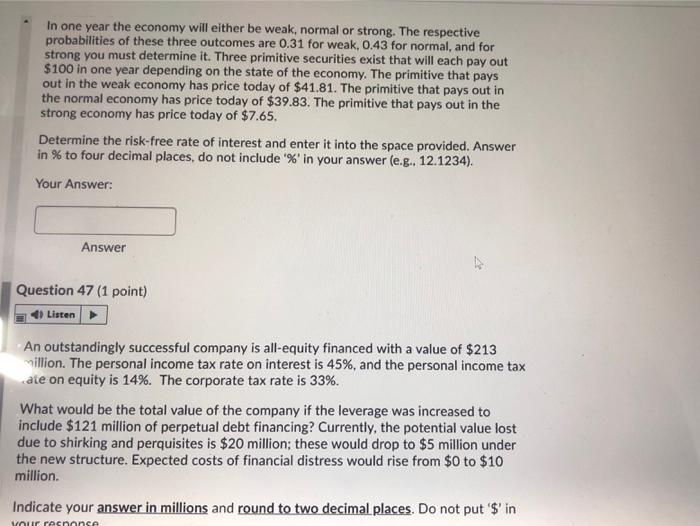

In one year the economy will either be weak, normal or strong. The respective probabilities of these three outcomes are 0.31 for weak, 0.43 for normal, and for strong you must determine it. Three primitive securities exist that will each pay out $100 in one year depending on the state of the economy. The primitive that pays out in the weak economy has price today of $41.81. The primitive that pays out in the normal economy has price today of $39.83. The primitive that pays out in the strong economy has price today of $7.65. Determine the risk-free rate of interest and enter it into the space provided. Answer in % to four decimal places, do not include '%' in your answer (e.g., 12.1234). Your Answer: Answer Question 47 (1 point) Listen An outstandingly successful company is all-equity financed with a value of $213 million. The personal income tax rate on interest is 45%, and the personal income tax ate on equity is 14%. The corporate tax rate is 33%. What would be the total value of the company if the leverage was increased to include $121 million of perpetual debt financing? Currently, the potential value lost due to shirking and perquisites is $20 million; these would drop to $5 million under the new structure. Expected costs of financial distress would rise from $0 to $10 million. Indicate your answer in millions and round to two decimal places. Do not put '$' in your resnonse In one year the economy will either be weak, normal or strong. The respective probabilities of these three outcomes are 0.31 for weak, 0.43 for normal, and for strong you must determine it. Three primitive securities exist that will each pay out $100 in one year depending on the state of the economy. The primitive that pays out in the weak economy has price today of $41.81. The primitive that pays out in the normal economy has price today of $39.83. The primitive that pays out in the strong economy has price today of $7.65. Determine the risk-free rate of interest and enter it into the space provided. Answer in % to four decimal places, do not include '%' in your answer (e.g., 12.1234). Your Answer: Answer Question 47 (1 point) Listen An outstandingly successful company is all-equity financed with a value of $213 million. The personal income tax rate on interest is 45%, and the personal income tax ate on equity is 14%. The corporate tax rate is 33%. What would be the total value of the company if the leverage was increased to include $121 million of perpetual debt financing? Currently, the potential value lost due to shirking and perquisites is $20 million; these would drop to $5 million under the new structure. Expected costs of financial distress would rise from $0 to $10 million. Indicate your answer in millions and round to two decimal places. Do not put '$' in your resnonse