Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In order to clarify the mechanics of the margin operation, please look at the following: Buying on margin - Let's assume we are buying N

In order to clarify the mechanics of the margin operation, please look at the following:

Buying on margin Let's assume we are buying N shares of a certain stock at a price PO

We will start with a loan from the broker at Reg T levels Loan PO The margin

will be

At the start and thus As the market moves the value of the Margin will change

but what we want to examine is when do we get a Margin Call. Remember, the value of the

Loan does not change, no matter what we owe that to the BD Margin Call comes when our

Margin is less than Maintenance Margin, which is set by the BD

Solving this for the price we get:

Once the price falls below we will get a Margin Call, which would require us to raise the

Margin to the initial level.

Short Sales in this case we borrow securities from the BD and sell them on the market,

hoping that the price will fall. The proceeds of the sale are kept as a collateral with the BD

and additional cashmarketable securities needs to be posted. The Reg T still applies,

therefore we need to post additional at least of the initial value of the sale: Collateralo

NPO. The margin will be given by:

Expanded:

It's important to understand here that the proceeds of the initial sale NPO are fixed and stay

in the account as cash. The value of Collateral might fluctuate if we posted securities

although that will likely be very small since the requirement for high quality collatera

In order to clarify the mechanics of the margin operation, please look at the following:

Buying on margin Let's assume we are buying N shares of a certain stock at a price PO

We will start with a loan from the broker at Reg T levels Loan The margin

will be

At the start and thus As the market moves the value of the Margin will change

but what we want to examine is when do we get a Margin Call. Remember, the value of the

Loan does not change, no matter what we owe that to the BD Margin Call comes when our

Margin is less than Maintenance Margin, which is set by the BD

Solving this for the price we get:

Once the price falls below we will get a Margin Call, which would require us to raise the

Margin to the initial level.

Short Sales in this case we borrow securities from the BD and sell them on the market,

hoping that the price will fall. The proceeds of the sale are kept as a collateral with the BD

and additional cashmarketable securities needs to be posted. The Reg T still applies,

therefore we need to post additional at least of the initial value of the sale: Collateralo

NPO. The margin will be given by:

Expanded:

It's important to understand here that the proceeds of the initial sale NPO are fixed and stay

in the account as cash. The value of Collateral might fluctuate if we posted securities

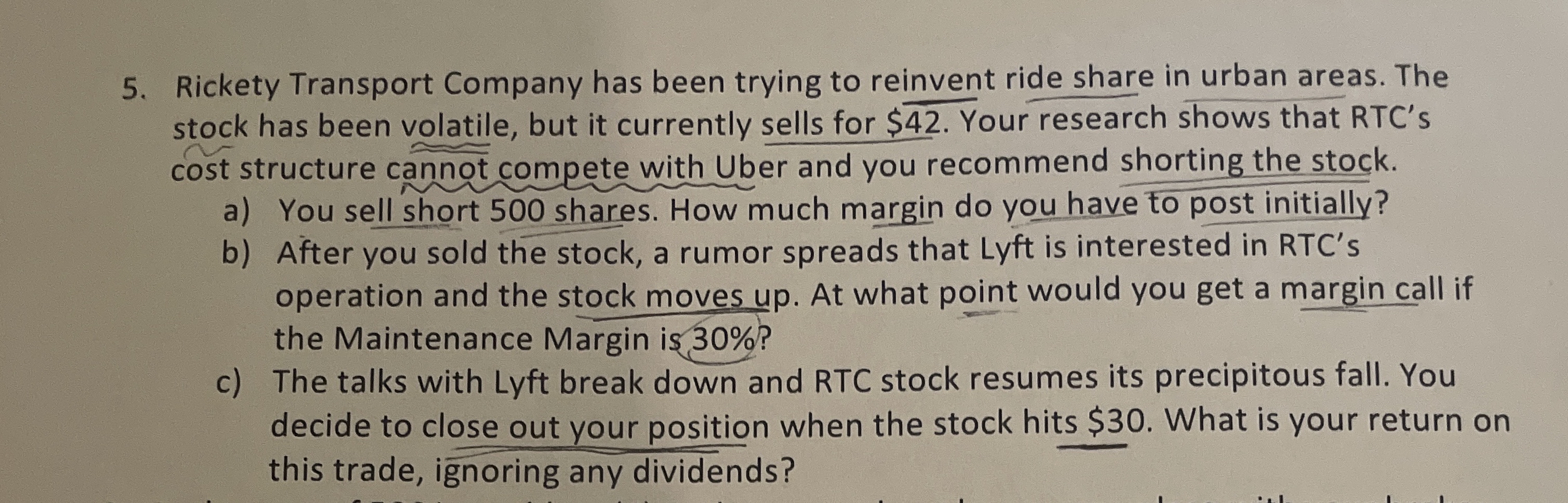

Rickety Transport Company has been trying to reinvent ride share in urban areas. The

stock has been volatile, but it currently sells for $ Your research shows that RTCs

cost structure cannot compete with Uber and you recommend shorting the stock.

a You sell short shares. How much margin do you have to post initially?

b After you sold the stock, a rumor spreads that Lyft is interested in RTCs

operation and the stock moves up At what point would you get a margin call if

the Maintenance Margin is

c The talks with Lyft break down and RTC stock resumes its precipitous fall. You

decide to close out your position when the stock hits $ What is your return on

this trade, ignoring any dividends?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started