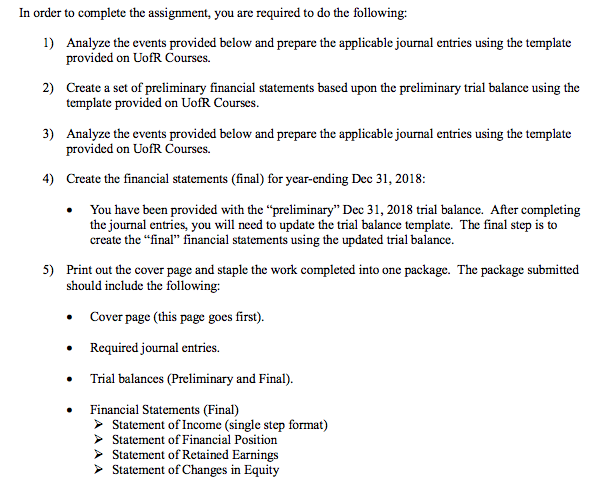

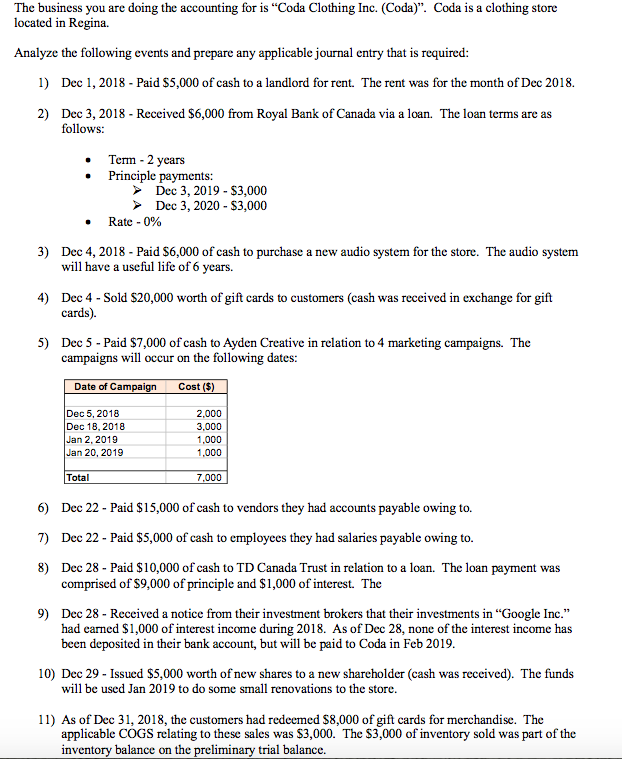

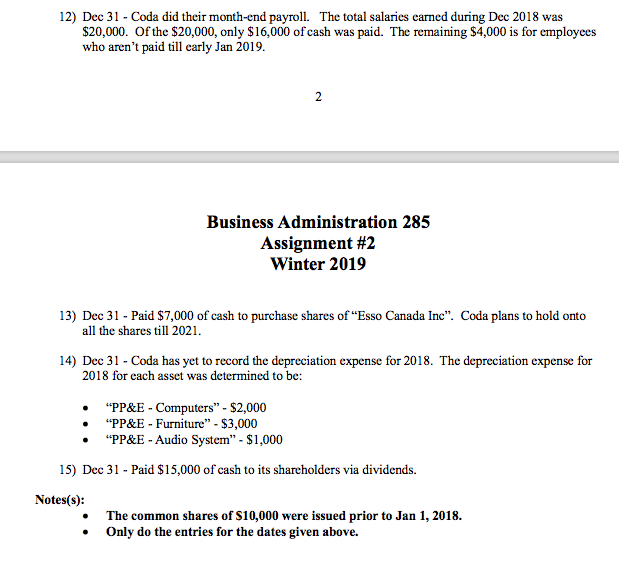

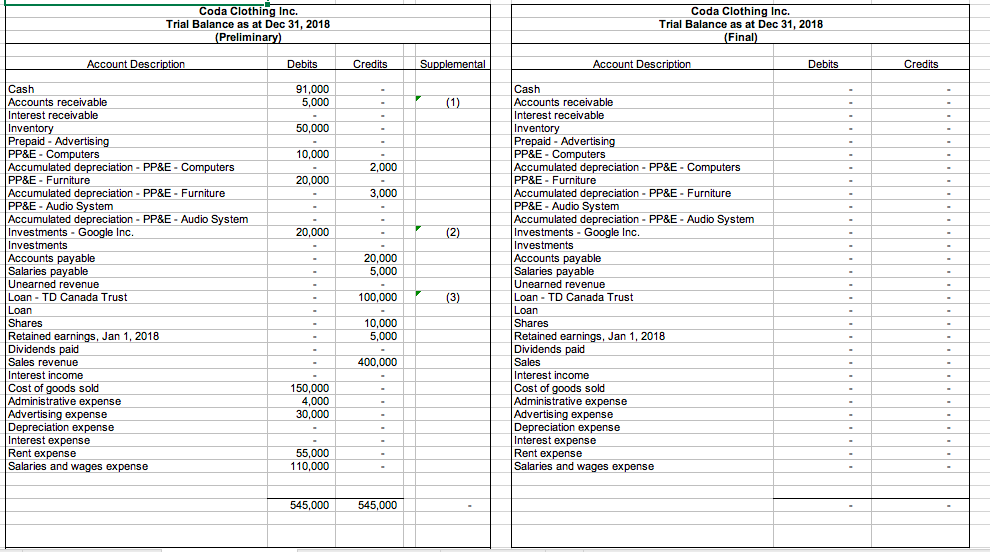

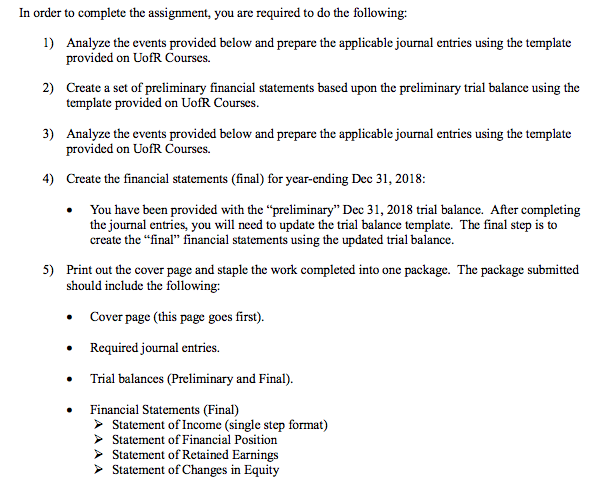

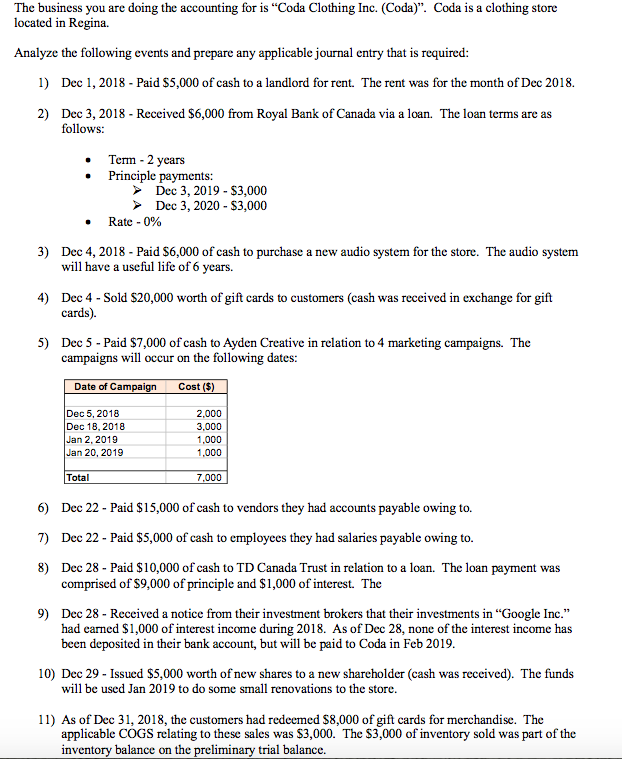

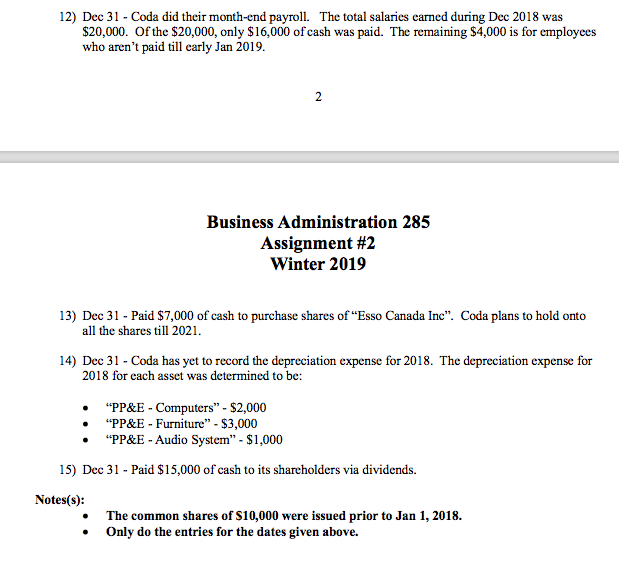

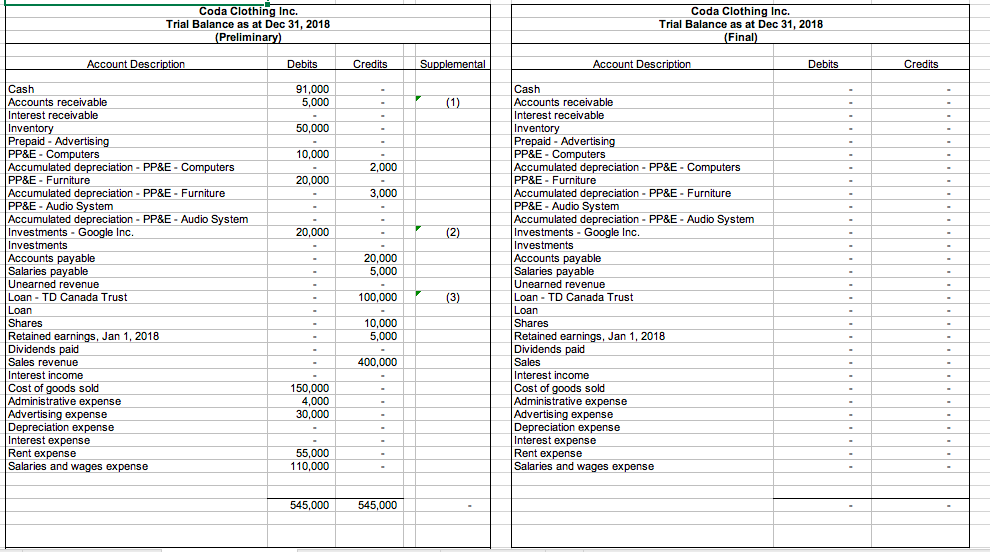

In order to complete the assignment, you are required to do the following: Analyzetheeventsprovidedbelowandpreparethe plicableju male tresusingthetemplate provided on UofR Courses. l) Create a set of preliminary financial statements based upon the preliminary trial balance using the template provided on UofR Courses. 2) provided on UofR Courses. ) Create the financial statements (final) for year-ending Dec 31, 2018: .You have been provided with the "preliminary" Dec 31, 2018 trial balance. After completing the journal entries, you will need to update the trial balance template. The final step is to create the "final" financial statements using the updated trial balance. 5) Print out the cover page and staple the work completed into one package. The package submitted should include the following: .Cover page (this page goes first) Required journal entries. Trial balances (Preliminary and Final). Financial Statements (Final) Statement of Income (single step format) Statement of Financial Position Statement of Retained Earnings Statement of Changes in Equity The business you are doing the accounting for is "Coda Clothing Inc. (Coda)". Coda is a clothing store located in Regina. Analyze the following events and prepare any applicable journal entry that is required: 1) Dec 1, 2018 - Paid S5,000 of cash to a landlord for rent. The rent was for the month of Dec 2018. 2) Dec 3, 2018 - Received $6,000 from Royal Bank of Canada via a loan. The loan terms are as follows: .Term 2 years . Principle payments: > Dec 3, 2019 - S3,000 >Dec 3, 2020 - S3,000 Rate-0% 3) Dec 4, 2018 - Paid S6,000 of cash to purchase a new audio system for the store. The audio system will have a useful life of 6 years. 4) Dec4 - Sold S20,000 worth of gift cards to customers (cash was received in exchange for gift cards). 5) Dec 5 - Paid $7,000 of cash to Ayden Creative in relation to 4 marketing campaigns. The campaigns will occur on the following dates: Date of Campaign Cost Dec 5,2018 Dec 18, 2018 Jan 2,2019 Jan 20, 2019 2,000 3,000 1,000 1,000 Total 6) 7) 8) Dec 22 - Paid S15,000 of cash to vendors they had accounts payable owing to. Dec 22 - Paid S5,000 of cash to employees they had salaries payable owing to. Dec 28 - Paid S10,000 of cash to TD Canada Trust in relation to a loan. The loan payment was comprised of S9,000 of principle and $1,000 of interest. The 9) Dec 28 - Received a notice from their investment brokers that their investments in "Google Inc." had carned $1,000 of interest income during 2018. As of Dec 28, none of the interest income has been deposited in their bank account, but will be paid to Coda in Feb 2019 10) Dec 29 - Issued $5,000 worth of new shares to a new shareholder (cash was received). The funds will be used Jan 2019 to do some small renovations to the store. 11) As of Dec 31, 2018, the customers had redeemed S8,000 of gift cards for merchandise. The applicable COGS relating to these sales was $3,000. The S3,000 of inventory sold was part of the inventory balance on the preliminary trial balance 12) Dec 31 - Coda did their month-end payroll. The total salaries earned during Dec 2018 was $20,000. Of the $20,000, only $16,000 of cash was paid. The remaining $4,000 is for employees who aren't paid till carly Jan 2019. Business Administration 285 Assignment #2 Winter 2019 13) Dec 31- Paid $7,000 of cash to purchase shares of " Esso Canada Inc". Coda plans to hold onto all the shares till 2021 14) Dec 31- Coda has yet to record the depreciation expense for 2018. The depreciation expense for 2018 for each asset was determined to be: "PP&E - Computers" $2,000 ."PP&E - Audio System" S1,000 15) Dec 31- Paid $15,000 of cash to its shareholders via dividends. Notes(s): The common shares of S10,000 were issued prior to Jan 1, 2018. Only do the entries for the dates given above. Coda Clothing Inc Trial Balance as at Dec 31, 2018 Prelimina Coda Clothing Inc. Trial Balance as at Dec 31, 2018 Final ebit Accounts receivable Prepaid Prepaid depreciation-PP&E-Computers 2,000 depreciation-PP&E-Computers 3,000 Accumulated depreciation PP&E-Furniture PP&E-Audio Systenm Accumulated depreciation PP&E- Audio Systenm Accumulated depreciation-PP&E-Furniture PP&E-Audio Systenm Accumulated depreciation- PP&E-Audio System 20,000 2 Loan TD Canada Trust 100,000 Loan TD Canada Trust Retained earnings, Jan 1, 2018 Retained earnings, Jan 1, 2018 400,000 Administrative expense Administrative expense Advertising expense 110,000 Salaries and wages expense 545,000