Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In order to complete the transaction analysis worksheet, I'd like to know where each event belongs in the sheet and whether it's income or expense

In order to complete the transaction analysis worksheet, I'd like to know where each event belongs in the sheet and whether it's income or expense

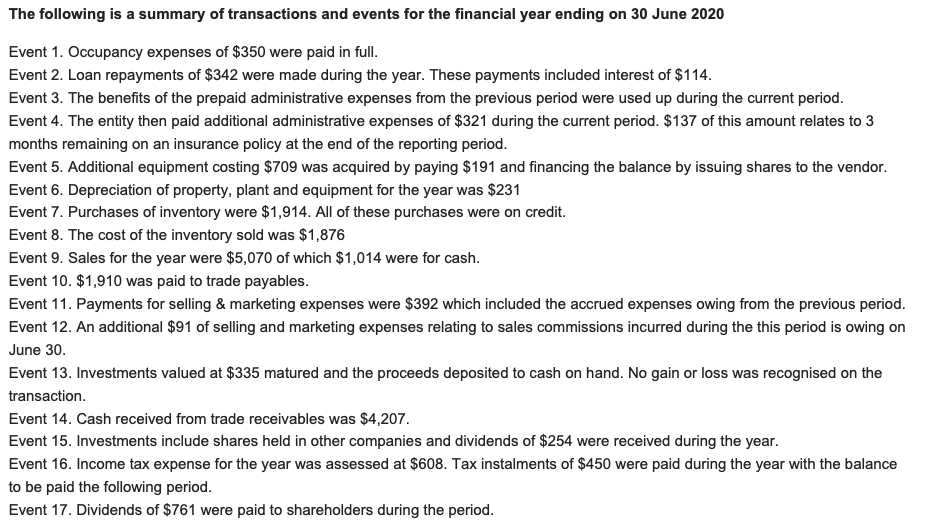

The following is a summary of transactions and events for the financial year ending on 30 June 2020 Event 1. Occupancy expenses of $350 were paid in full. Event 2. Loan repayments of $342 were made during the year. These payments included interest of $114. Event 3. The benefits of the prepaid administrative expenses from the previous period were used up during the current period. Event 4. The entity then paid additional administrative expenses of $321 during the current period. $137 of this amount relates to 3 months remaining on an insurance policy at the end of the reporting period. Event 5. Additional equipment costing $709 was acquired by paying $191 and financing the balance by issuing shares to the vendor. Event 6. Depreciation of property, plant and equipment for the year was $231 Event 7. Purchases of inventory were $1,914. All of these purchases were on credit. Event 8. The cost of the inventory sold was $1,876 Event 9. Sales for the year were $5,070 of which $1,014 were for cash. Event 10. $1,910 was paid to trade payables. Event 11. Payments for selling & marketing expenses were $392 which included the accrued expenses owing from the previous period. Event 12. An additional $91 of selling and marketing expenses relating to sales commissions incurred during the this period is owing on June 30. Event 13. Investments valued at $335 matured and the proceeds deposited to cash on hand. No gain or loss was recognised on the transaction Event 14. Cash received from trade receivables was $4,207. Event 15. Investments include shares held in other companies and dividends of $254 were received during the year. Event 16. Income tax expense for the year was assessed at $608. Tax instalments of $450 were paid during the year with the balance to be paid the following period. Event 17. Dividends of $761 were paid to shareholders during the periodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started