Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In order to forecast the stock price of Google, a financial analyst used two different forecasting methods: an ARIMA method, and a GARCH method.

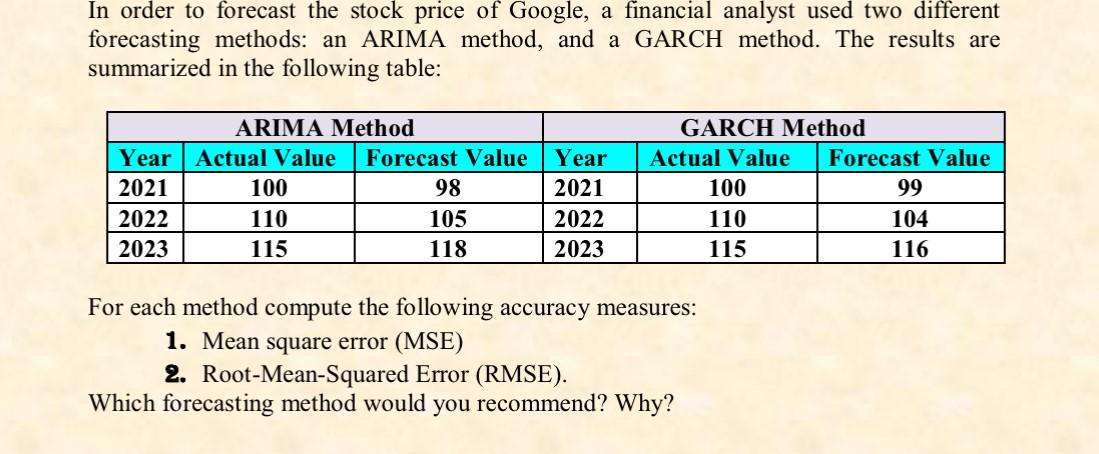

In order to forecast the stock price of Google, a financial analyst used two different forecasting methods: an ARIMA method, and a GARCH method. The results are summarized in the following table: ARIMA Method GARCH Method Year Actual Value Forecast Value Year Actual Value Forecast Value 2021 100 98 2021 100 99 2022 110 105 2022 110 104 2023 115 118 2023 115 116 For each method compute the following accuracy measures: 1. Mean square error (MSE) 2. Root-Mean-Squared Error (RMSE). Which forecasting method would you recommend? Why?

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer To compute the accuracy measures for each forecasting method we will calculate the Mean Squar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663df896bd651_960733.pdf

180 KBs PDF File

663df896bd651_960733.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started