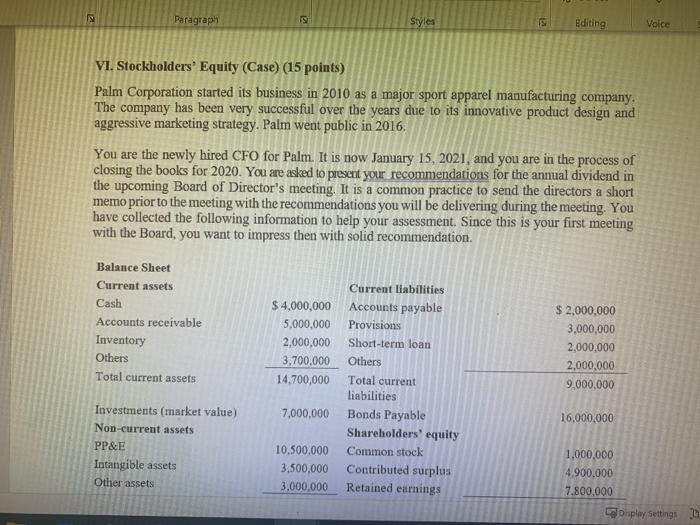

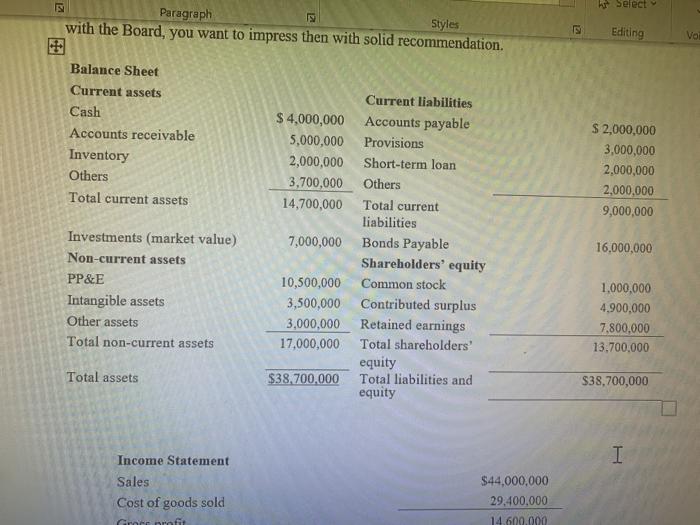

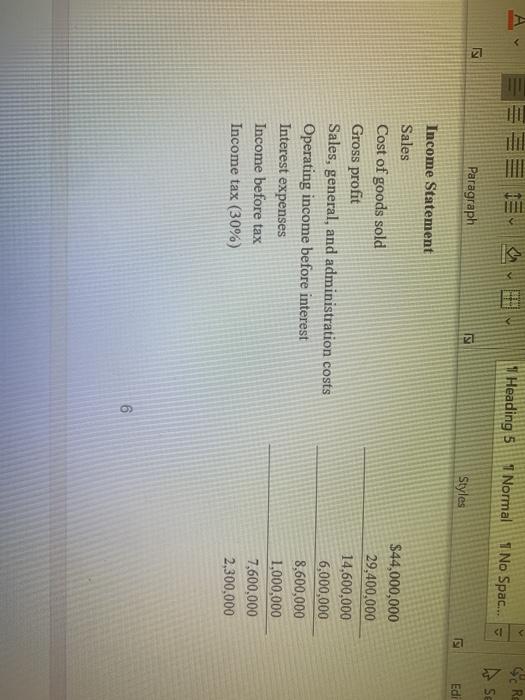

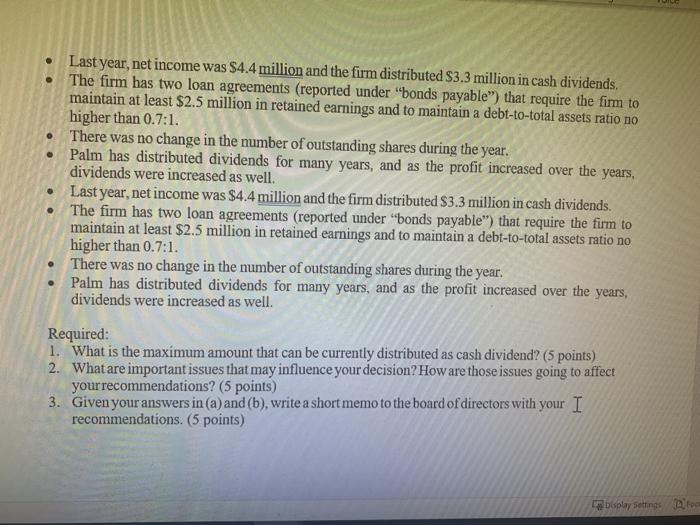

IN Paragraph 15 Styles Editing Voice VI. Stockholders' Equity (Case) (15 points) Palm Corporation started its business in 2010 as a major sport apparel manufacturing company. The company has been very successful over the years due to its innovative product design and aggressive marketing strategy. Palm went public in 2016. You are the newly hired CFO for Palm. It is now January 15, 2021, and you are in the process of closing the books for 2020. You are asked to present your recommendations for the annual dividend in the upcoming Board of Director's meeting. It is a common practice to send the directors a short memo prior to the meeting with the recommendations you will be delivering during the meeting. You have collected the following information to help your assessment. Since this is your first meeting with the Board, you want to impress then with solid recommendation Balance Sheet Current assets Cash Accounts receivable Inventory Others Total current assets $ 4,000,000 5.000.000 2,000,000 3.700,000 14,700,000 Current liabilities Accounts payable Provisions Short-term loan Others Total current liabilities Bonds Payable Shareholders' equity Common stock Contributed sucplus Retained earnings $ 2,000,000 3,000,000 2,000,000 2,000,000 9,000,000 7,000,000 16,000.000 Investments (market value) Non-current assets PP&E Intangible assets Other assets 10,500,000 3.500.000 3,000,000 1,000,000 4.900.000 7,800,000 oplay settings hr Select Paragraph Styles with the Board, you want to impress then with solid recommendation. Editing Voi Balance Sheet Current assets Cash Accounts receivable Inventory Others Total current assets $ 2,000,000 3,000,000 2,000,000 2,000,000 9,000,000 Current liabilities $ 4,000,000 Accounts payable 5,000,000 Provisions 2,000,000 Short-term loan 3,700,000 Others 14,700,000 Total current liabilities 7,000,000 Bonds Payable Shareholders' equity 10,500,000 Common stock 3,500,000 Contributed surplus 3,000,000 Retained earnings 17,000,000 Total shareholders' equity $38,700,000 Total liabilities and equity Investments (market value) Non-current assets PP&E Intangible assets Other assets Total non-current assets 16,000,000 1,000,000 4.900,000 7.800,000 13.700.000 Total assets $38,700,000 I Income Statement Sales Cost of goods sold Ginace profit $44,000,000 29,400,000 14.600.000