Answered step by step

Verified Expert Solution

Question

1 Approved Answer

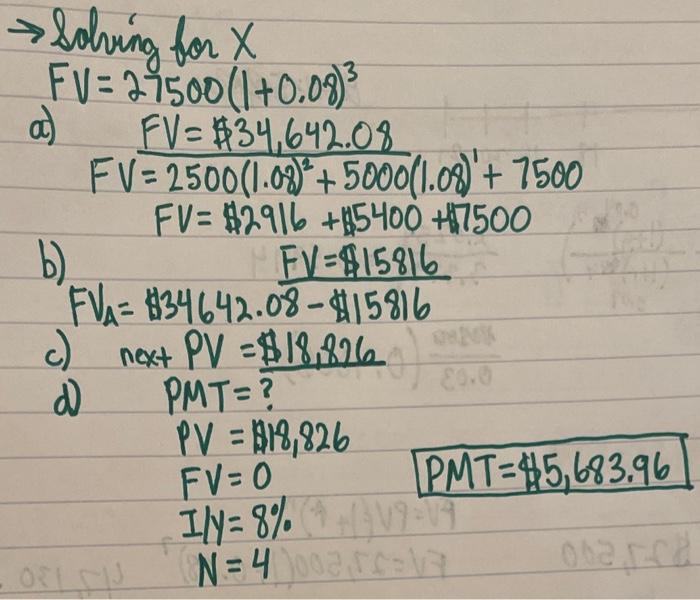

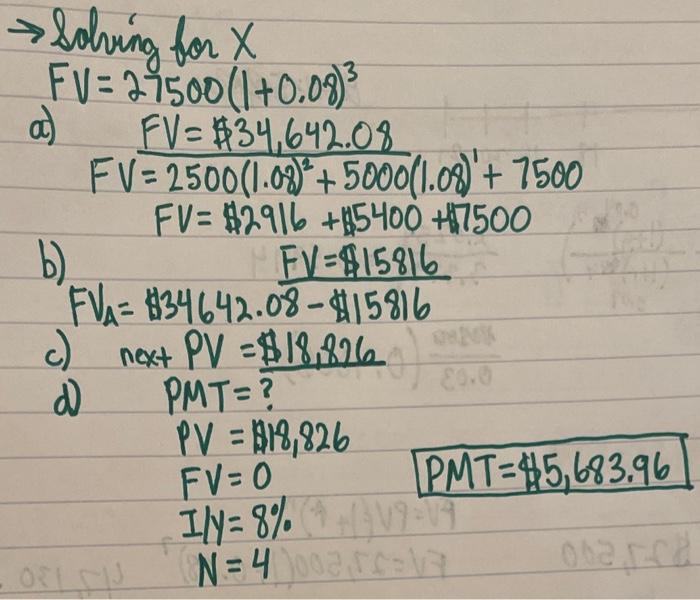

in part a, why are the exponents in decreasing order from 2500(1.08)^2+ 5000(1.08)^1 + 7500? 3 8 Solving for X FV = 24500(1+0.09) FV= $34,642.08

in part a, why are the exponents in decreasing order from 2500(1.08)^2+ 5000(1.08)^1 + 7500?

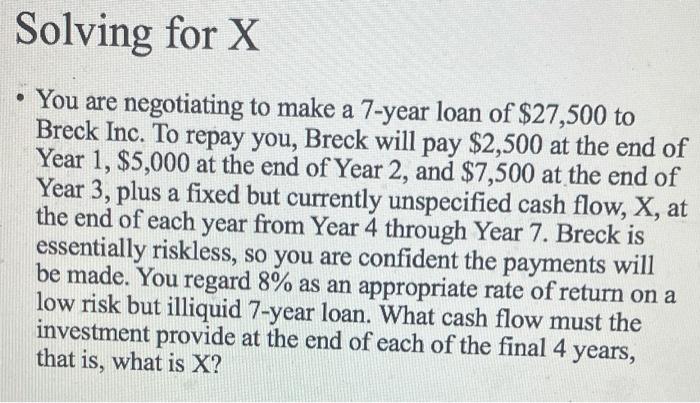

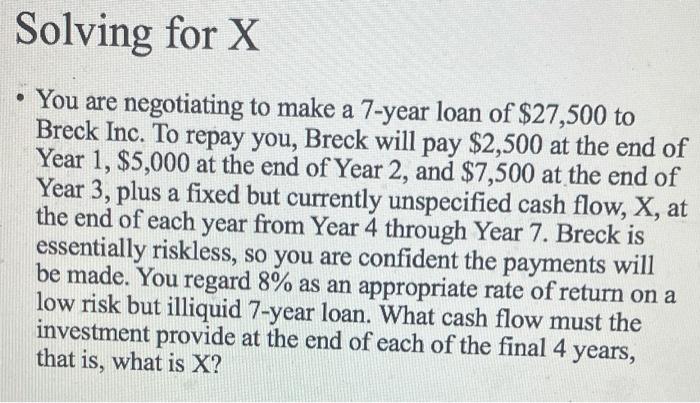

3 8 Solving for X FV = 24500(1+0.09) FV= $34,642.08 FV = 2500(1.00)*+ 5000(1.08) + 7500 FV=82916 +85400 +7500 b) FV=$15816 EVA = $34642.08-$15816 c) next PV =$18,826 d. PMT=? PV = 114,826 PMT=45,683.96 IN=8% 02 N=402 C OL 205 - FV=0 Solving for X You are negotiating to make a 7-year loan of $27,500 to Breck Inc. To repay you, Breck will pay $2,500 at the end of Year 1, $5,000 at the end of Year 2, and $7,500 at the end of Year 3, plus a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Breck is essentially riskless, so you are confident the payments will be made. You regard 8% as an appropriate rate of return on a low risk but illiquid 7-year loan. What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X? 3 8 Solving for X FV = 24500(1+0.09) FV= $34,642.08 FV = 2500(1.00)*+ 5000(1.08) + 7500 FV=82916 +85400 +7500 b) FV=$15816 EVA = $34642.08-$15816 c) next PV =$18,826 d. PMT=? PV = 114,826 PMT=45,683.96 IN=8% 02 N=402 C OL 205 - FV=0 Solving for X You are negotiating to make a 7-year loan of $27,500 to Breck Inc. To repay you, Breck will pay $2,500 at the end of Year 1, $5,000 at the end of Year 2, and $7,500 at the end of Year 3, plus a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Breck is essentially riskless, so you are confident the payments will be made. You regard 8% as an appropriate rate of return on a low risk but illiquid 7-year loan. What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started