Answered step by step

Verified Expert Solution

Question

1 Approved Answer

in part (i) please make reference to how to calculate the continuing value and show all steps to get answers please. 2. At the beginning

in part (i) please make reference to how to calculate the continuing value and show all steps to get answers please.

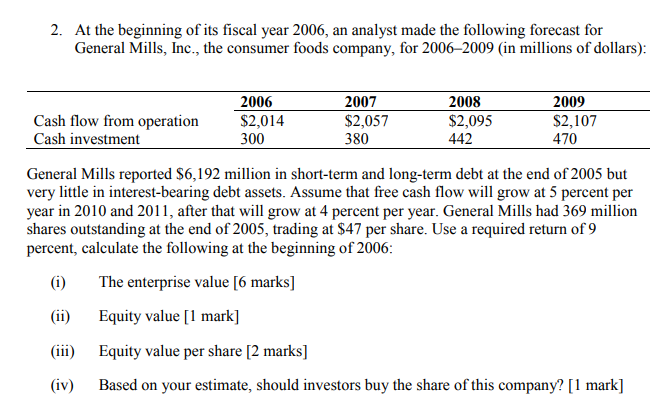

2. At the beginning of its fiscal year 2006, an analyst made the following forecast for General Mills, Inc., the consumer foods company, for 2006-2009 (in millions of dollars): 2006 2007 2008 2009 $2,057 Cash flow from operation Cash investment $2,014 $2,095 $2,107 470 300 380 442 General Mills reported $6,192 million in short-term and long-term debt at the end of 2005 but very little in interest-bearing debt assets. Assume that free cash flow will grow at 5 percent per year in 2010 and 2011, after that will grow at 4 percent per year. General Mills had 369 million shares outstanding at the end of 2005, trading at $47 per share. Use a required return of 9 percent, calculate the following at the beginning of 2006: The enterprise value [6 marks] (ii) Equity value [1 mark] Equity value per share [2 marks] (ii) (iv) Based on your estimate, should investors buy the share of this company? [1 mark] 2. At the beginning of its fiscal year 2006, an analyst made the following forecast for General Mills, Inc., the consumer foods company, for 2006-2009 (in millions of dollars): 2006 2007 2008 2009 $2,057 Cash flow from operation Cash investment $2,014 $2,095 $2,107 470 300 380 442 General Mills reported $6,192 million in short-term and long-term debt at the end of 2005 but very little in interest-bearing debt assets. Assume that free cash flow will grow at 5 percent per year in 2010 and 2011, after that will grow at 4 percent per year. General Mills had 369 million shares outstanding at the end of 2005, trading at $47 per share. Use a required return of 9 percent, calculate the following at the beginning of 2006: The enterprise value [6 marks] (ii) Equity value [1 mark] Equity value per share [2 marks] (ii) (iv) Based on your estimate, should investors buy the share of this company? [1 mark]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started