Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In period 0, a successful start-up company aggressively raises money on the capital market through a combination of stock and bond issuance. In the

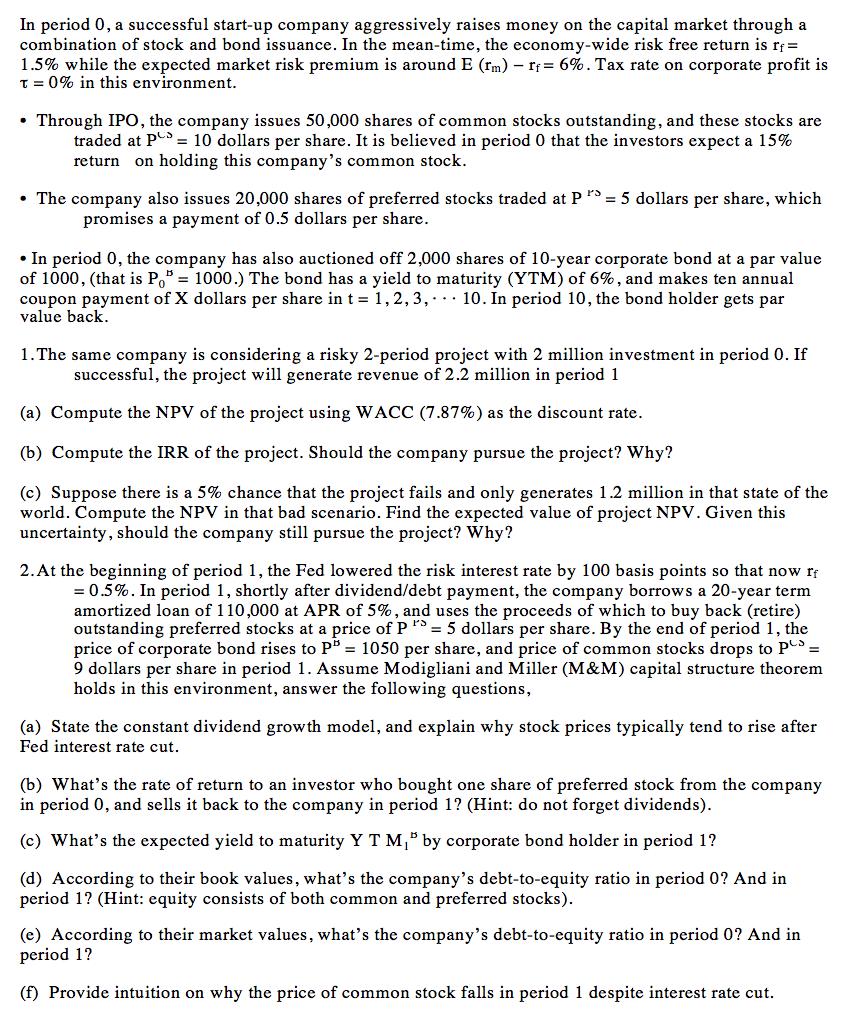

In period 0, a successful start-up company aggressively raises money on the capital market through a combination of stock and bond issuance. In the mean-time, the economy-wide risk free return is rf= 1.5% while the expected market risk premium is around E (rm) rf = 6%. Tax rate on corporate profit is T = 0% in this environment. Through IPO, the company issues 50,000 shares of common stocks outstanding, and these stocks are traded at P = 10 dollars per share. It is believed in period 0 that the investors expect a 15% return on holding this company's common stock. The company also issues 20,000 shares of preferred stocks traded at P S = 5 dollars per share, which promises a payment of 0.5 dollars per share. In period 0, the company has also auctioned off 2,000 shares of 10-year corporate bond at a par value of 1000, (that is P," = 1000.) The bond has a yield to maturity (YTM) of 6%, and makes ten annual coupon payment of X dollars per share in t = 1,2,3, 10. In period 10, the bond holder gets par value back. 1.The same company is considering a risky 2-period project with 2 million investment in period 0. If successful, the project will generate revenue of 2.2 million in period 1 (a) Compute the NPV of the project using WACC (7.87%) as the discount rate. (b) Compute the IRR of the project. Should the company pursue the project? Why? (c) Suppose there is a 5% chance that the project fails and only generates 1.2 million in that state of the world. Compute the NPV in that bad scenario. Find the expected value of project NPV. Given this uncertainty, should the company still pursue the project? Why? 2. At the beginning of period 1, the Fed lowered the risk interest rate by 100 basis points so that now rf = 0.5%. In period 1, shortly after dividend/debt payment, the company borrows a 20-year term amortized loan of 110,000 at APR of 5%, and uses the proceeds of which to buy back (retire) outstanding preferred stocks at a price of P = 5 dollars per share. By the end of period 1, the price of corporate bond rises to P" = 1050 per share, and price of common stocks drops to PS = 9 dollars per share in period 1. Assume Modigliani and Miller (M&M) capital structure theorem holds in this environment, answer the following questions, (a) State the constant dividend growth model, and explain why stock prices typically tend to rise after Fed interest rate cut. (b) What's the rate of return to an investor who bought one share of preferred stock from the company in period 0, and sells it back to the company in period 1? (Hint: do not forget dividends). (c) What's the expected yield to maturity Y T M," by corporate bond holder in period 1? (d) According to their book values, what's the company's debt-to-equity ratio in period 0? And in period 1? (Hint: equity consists of both common and preferred stocks). (e) According to their market values, what's the company's debt-to-equity ratio in period 0? And in period 1? (f) Provide intuition on why the price of common stock falls in period 1 despite interest rate cut.

Step by Step Solution

★★★★★

3.30 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

1 a The NPV of the project is 22000002000000787 137160 b The IRR of the project is 123 The company s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started