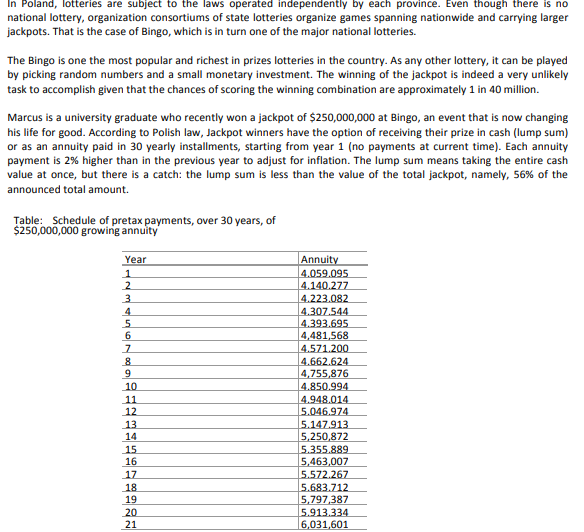

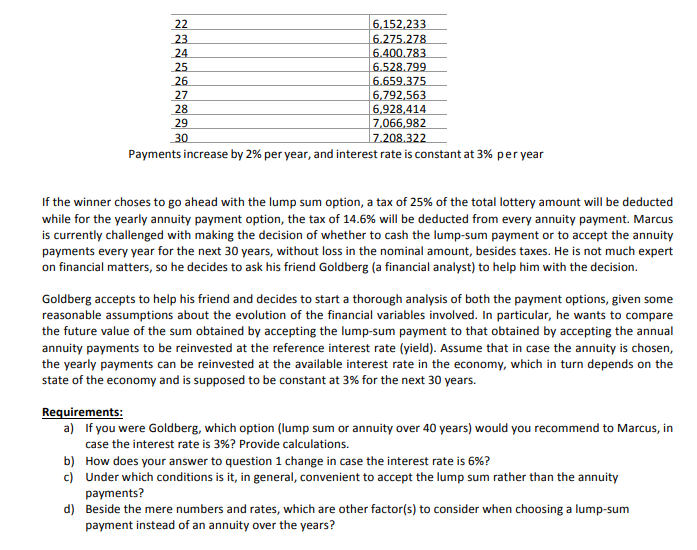

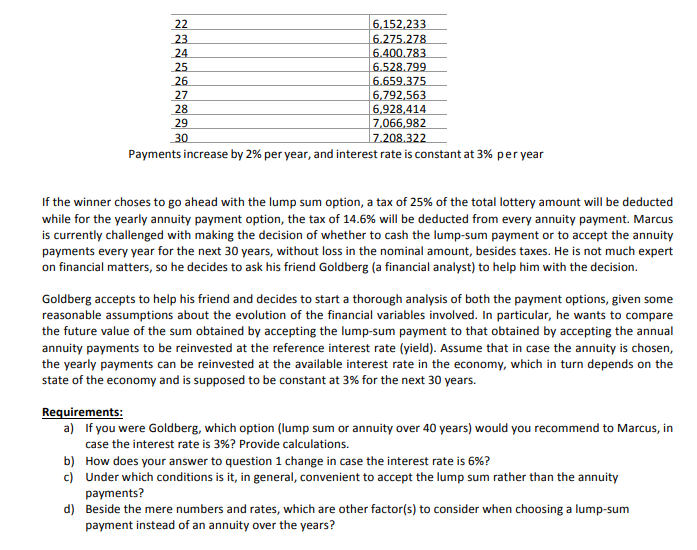

In Poland, lotteries are subject to the laws operated independently by each province. Even though there is no national lottery, organization consortiums of state lotteries organize games spanning nationwide and carrying larger jackpots. That is the case of Bingo, which is in turn one of the major national lotteries. The Bingo is one the most popular and richest in prizes lotteries in the country. As any other lottery, it can be played by picking random numbers and a small monetary investment. The winning of the jackpot is indeed a very unlikely task to accomplish given that the chances of scoring the winning combination are approximately 1 in 40 million. Marcus is a university graduate who recently won a jackpot of $250,000,000 at Bingo, an event that is now changing his life for good. According to Polish law, Jackpot winners have the option of receiving their prize in cash (lump sum) or as an annuity paid in 30 yearly installments, starting from year 1 (no payments at current time). Each annuity payment is 2% higher than in the previous year to adjust for inflation. The lump sum means taking the entire cash value at once, but there is a catch the lump sum is less than the value of the total jackpot, namely, 56% of the announced total amount. Table Schedule of pretax payments, over 30 years, of $250,000,000 growing annuity Year 1 2 3 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 Annuity 4.059.095 4.140.277 4.223.082 4.307.544 4.393.695 4,481,568 4.571.200 4.662.624 4,755,876 4.850.994 4.948.014 5.046.974 5.147.913 5,250,872 5.355.889 5,463,007 5.572.267 5.683.712 5,797,387 5.913.334 6,031,601 20 21 24 26 22 6,152,233 23 6.275.278 6.400.783 25 6.528.799 6.659.375 27 6,792,563 6.928,414 29 7,066,982 30 7.208.322 Payments increase by 2% per year, and interest rate is constant at 3% per year 28 If the winner choses to go ahead with the lump sum option, a tax of 25% of the total lottery amount will be deducted while for the yearly annuity payment option, the tax of 14.6% will be deducted from every annuity payment. Marcus is currently challenged with making the decision of whether to cash the lump-sum payment or to accept the annuity payments every year for the next 30 years, without loss in the nominal amount, besides taxes. He is not much expert on financial matters, so he decides to ask his friend Goldberg (a financial analyst) to help him with the decision. Goldberg accepts to help his friend and decides to start a thorough analysis of both the payment options, given some reasonable assumptions about the evolution of the financial variables involved. In particular, he wants to compare the future value of the sum obtained by accepting the lump-sum payment to that obtained by accepting the annual annuity payments to be reinvested at the reference interest rate (yield). Assume that in case the annuity is chosen, the yearly payments can be reinvested at the available interest rate in the economy, which in turn depends on the state of the economy and is supposed to be constant at 3% for the next 30 years. Requirements: a) If you were Goldberg, which option (lump sum or annuity over 40 years) would you recommend to Marcus, in case the interest rate is 3%? Provide calculations. b) How does your answer to question 1 change in case the interest rate is 6%? c) Under which conditions is it, in general, convenient to accept the lump sum rather than the annuity payments? d) Beside the mere numbers and rates, which are other factor(s) to consider when choosing a lump-sum payment instead of an annuity over the years