In preparation for the following transactions, prepare:

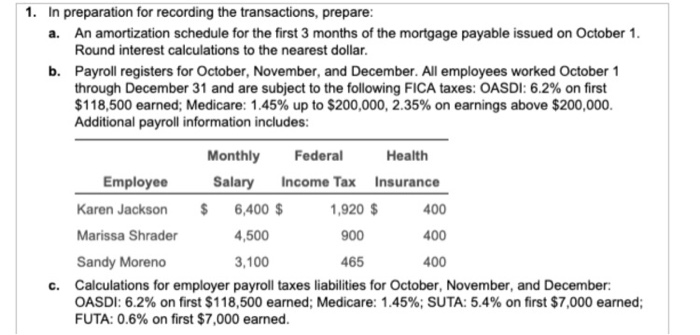

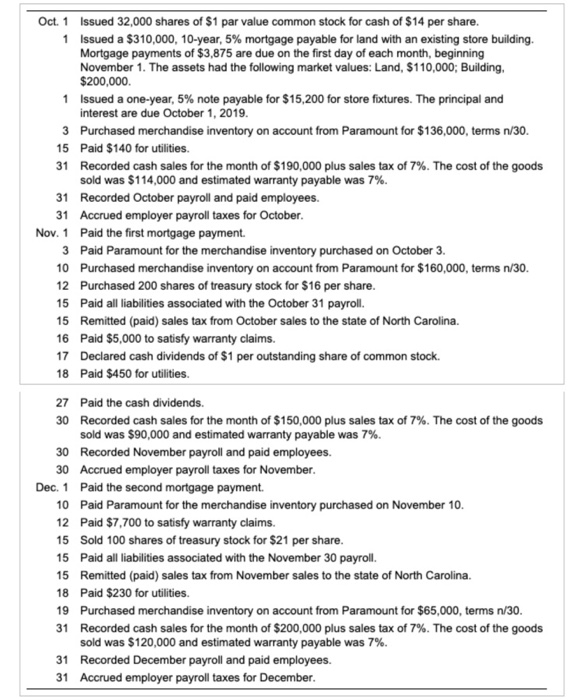

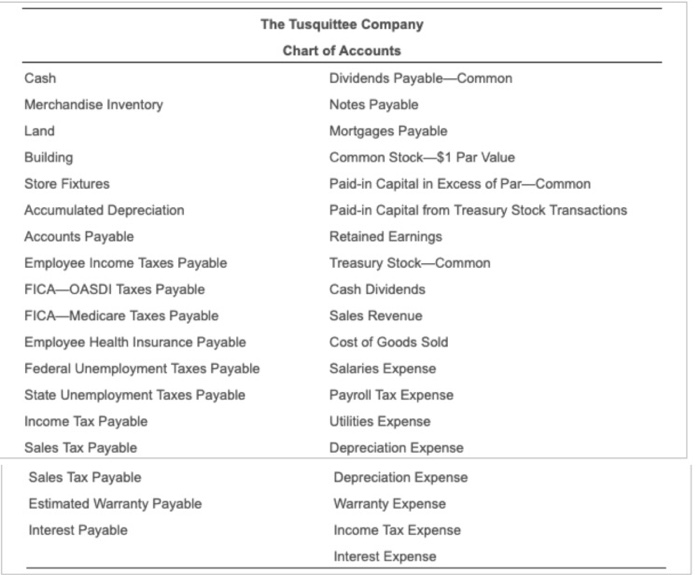

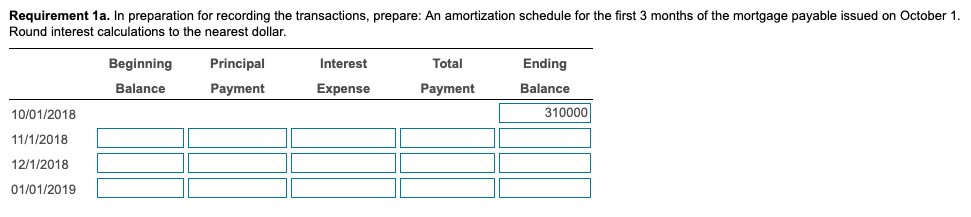

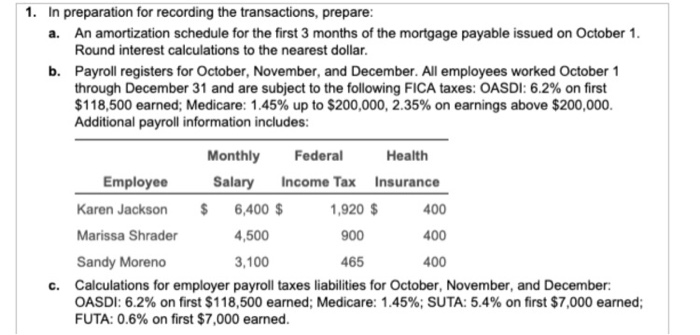

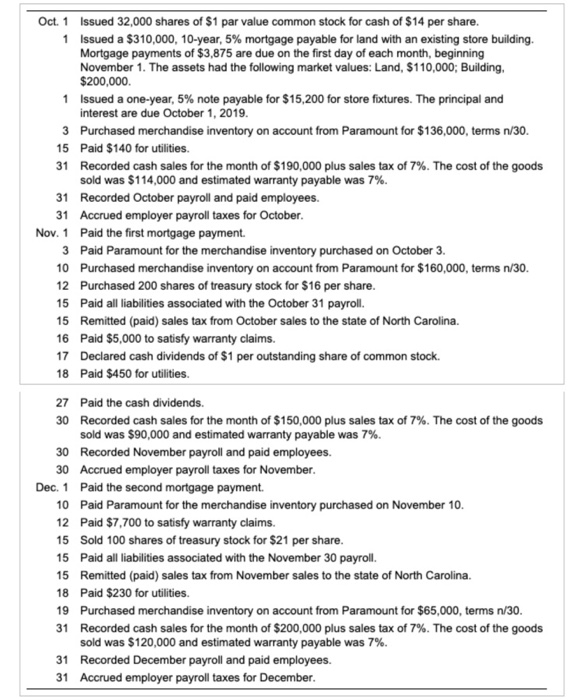

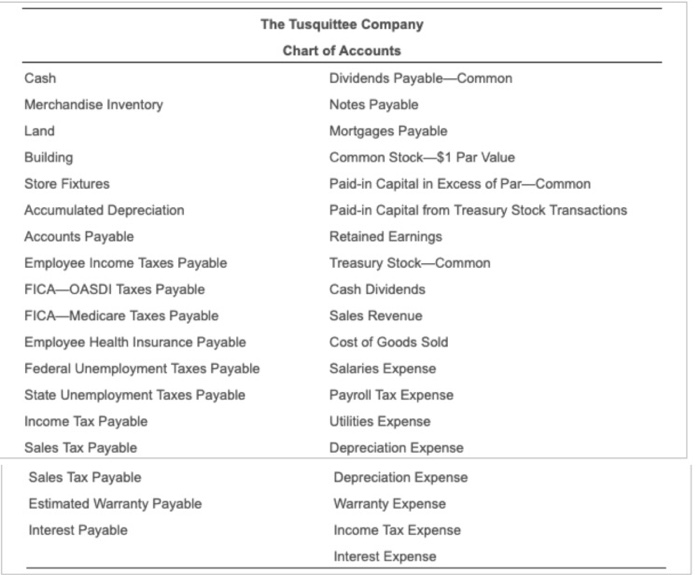

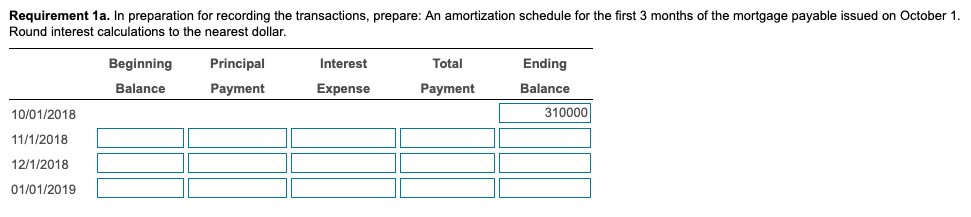

1.In preparation for recording the transactions, prepare: a. An amortization schedule for the first 3 months of the mortgage payable issued on October 1. Round interest calculations to the nearest dollar. b. Payroll registers for October, November, and December. All employees worked October 1 through December 31 and are subject to the following FICA taxes: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. Additional payroll information includes: Monthly Federal Health Salary Income Tax Insurance $ 6,400 $ Employee 1,920 $ 400 Karen Jackson Marissa Shrader 4,500 900 400 Sandy Moreno c. Calculations for employer payroll taxes liabilities for October, November, and December: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45%; SUTA: 5.4% on first $7,000 earned; FUTA: 0.6% on first $7,000 earned. 3,100 465 400 Oct. 1 Issued 32,000 shares of $1 par value common stock for cash of $14 per share. Issued a $310,000, 10-year, 5 % mortgage payable for land with an existing store building. Mortgage payments of $3,875 are due on the first day of each month, beginning November 1. The assets had the following market values: Land, $110,000; Building, $200,000. 1 Issued a one-year, 5 % note payable for $15,200 for store fixtures. The principal and interest are due October 1, 2019 1 Purchased merchandise inventory on account from Paramount for $136,000, terms n/30. 3 Paid $140 for utilities 15 31 Recorded cash sales for the month of $190,000 plus sales tax of 7%. The cost of the goods sold was $114,000 and estimated warranty payable was 7% . 31 Recorded October payroll and paid employees. Accrued employer payroll taxes for October. Paid the first mortgage payment 31 Nov. 1 3 Paid Paramount for the merchandise inventory purchased on October 3. Purchased merchandise inventory on account from Paramount for $160,000, terms n/30. Purchased 200 shares of treasury stock for $16 per share. Paid all liabilities associated with the October 31 payrol. Remitted (paid) sales tax from October sales to the state of North Carolina. Paid $5,000 to satisfy warranty claims Declared cash dividends of $1 per outstanding share of common stock. 10 12 15 15 16 17 Paid $450 for utilities. 18 27 Paid the cash dividends. Recorded cash sales for the month of $150,000 plus sales tax of 7%. The cost of the goods sold was $90,000 and estimated warranty payable was 7 %. Recorded November payroll and paid employees. 30 30 30 Accrued employer payroll taxes for November. Paid the second mortgage payment. Dec. 1 Paid Paramount for the merchandise inventory purchased on November 10 Paid $7,700 to satisfy warranty claims Sold 100 shares of treasury stock for $21 per share. 10 12 15 15 Paid all liabilities associated with the November 30 payroll. 15 Remitted (paid) sales tax from November sales to the state of North Carolina. 18 Paid $230 for utilities. Purchased merchandise inventory on account from Paramount for $65,000, terms n/30. 19 31 Recorded cash sales for the month of $200,000 plus sales tax of 7%. The cost of the goods sold was $120,000 and estimated warranty payable was 7%. Recorded December payroll and paid employees. 31 31 Accrued employer payroll taxes for December. The Tusquittee Company Chart of Accounts Cash Dividends Payable-Common Merchandise Inventory Notes Payable Mortgages Payable Land Building Common Stock-$1 Par Value Store Fixtures Paid-in Capital in Excess of Par-Common Accumulated Depreciation Paid-in Capital from Treasury Stock Transactions Accounts Payable Retained Earnings Employee Income Taxes Payable Treasury Stock-Common Cash Dividends FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Sales Revenue Employee Health Insurance Payable Cost of Goods Sold Federal Unemployment Taxes Payable Salaries Expense Payroll Tax Expense State Unemployment Taxes Payable Income Tax Payable Utilities Expense Sales Tax Payable Depreciation Expense Sales Tax Payable Depreciation Expense Estimated Warranty Payable Warranty Expense Interest Payable Income Tax Expense Interest Expense Requirement 1a. In preparation for recording the transactions, prepare: An amortization schedule for the first 3 months of the mortgage payable issued on October 1. Round interest calculations to the nearest dollar. Beginning Principal Interest Total Ending Balance Payment Expense Payment Balance 310000 10/01/2018 11/1/2018 12/1/2018 01/01/2019