Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts of the questions for a big thumbs up and a good rating. Thank you Instructions: Carefully read each of the following

Please answer all parts of the questions for a big thumbs up and a good rating.

Please answer all parts of the questions for a big thumbs up and a good rating.

Thank you

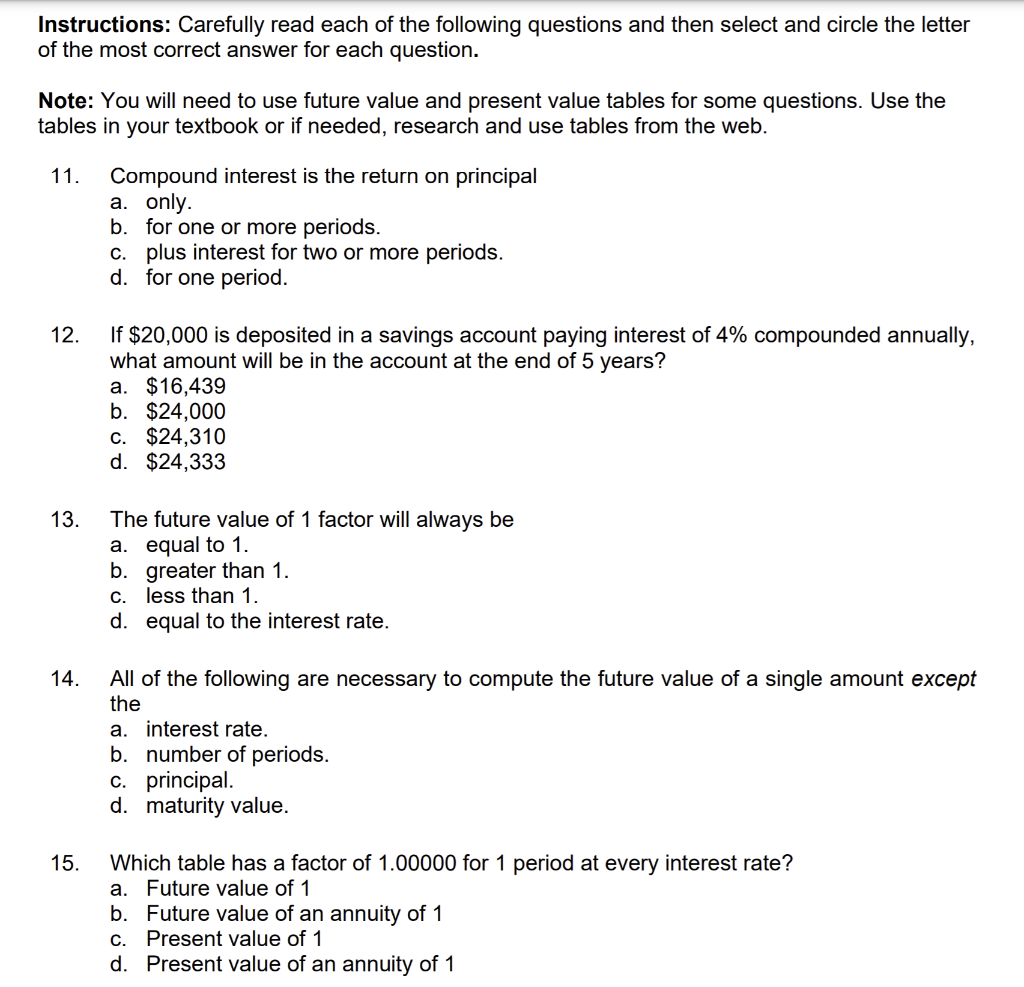

Instructions: Carefully read each of the following questions and then select and circle the letter of the most correct answer for each question. Note: You will need to use future value and present value tables for some questions. Use the tables in your textbook or if needed, research and use tables from the web. 11. Compound interest is the return on principal a. only. b. for one or more periods. c. plus interest for two or more periods. d. for one period. 12. If $20,000 is deposited in a savings account paying interest of 4% compounded annually, what amount will be in the account at the end of 5 years? a. $16,439 b. $24,000 c. $24,310 d. $24,333 13. The future value of 1 factor will always be a. equal to 1. b. greater than 1. c. less than 1. d. equal to the interest rate. 14. All of the following are necessary to compute the future value of a single amount except the a. interest rate. b. number of periods. c. principal. d. maturity value. 15. Which table has a factor of 1.00000 for 1 period at every interest rate? a. Future value of 1 b Future value of an annuity of 1 C. Present value of 1 d. Present value of an annuity of 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started