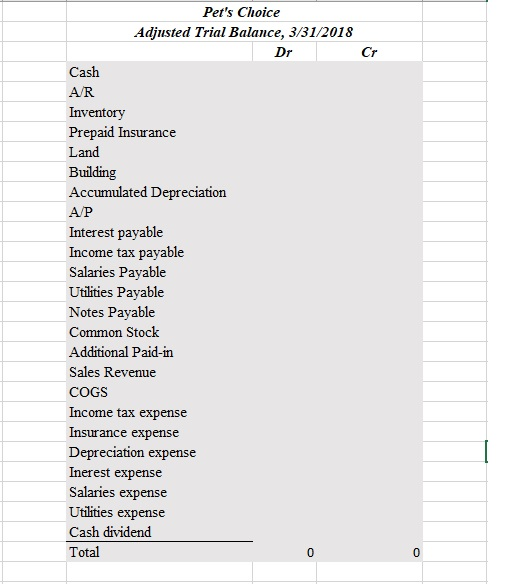

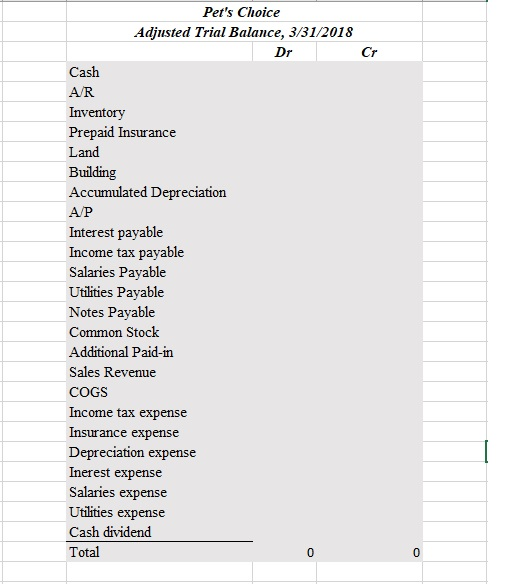

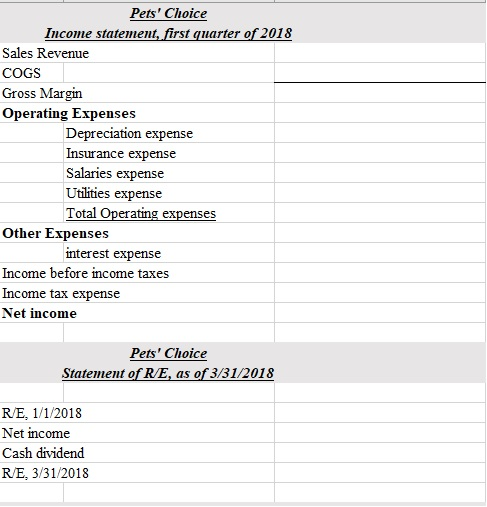

In Q2, prepare the Adjusted trial balance based on the Trial Balance provided in Sheet TB and your answer in Q1. Make sure that you List account names, then place the $ amount on the correct side (debit or credit) Your total debits should equal your total credits. 3. In Q3, prepare the Financial Statements based on your answer in Q2.

TB Q1

Q1 Q2

Q2

Q3 Q3

Q3

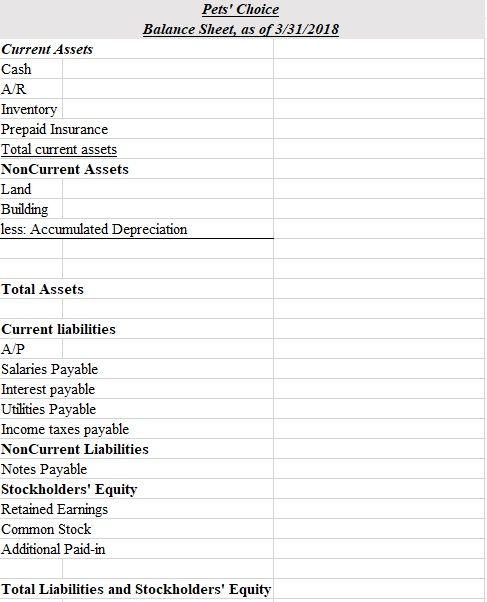

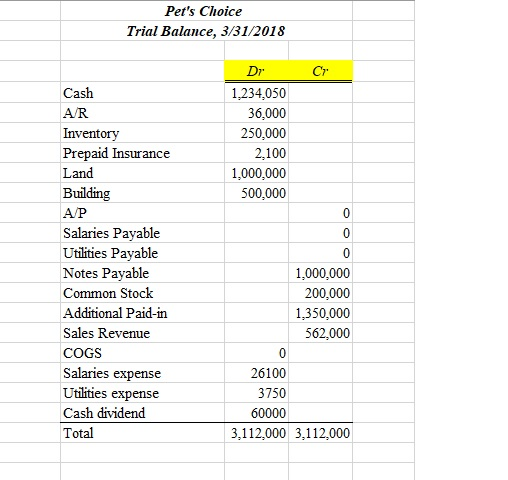

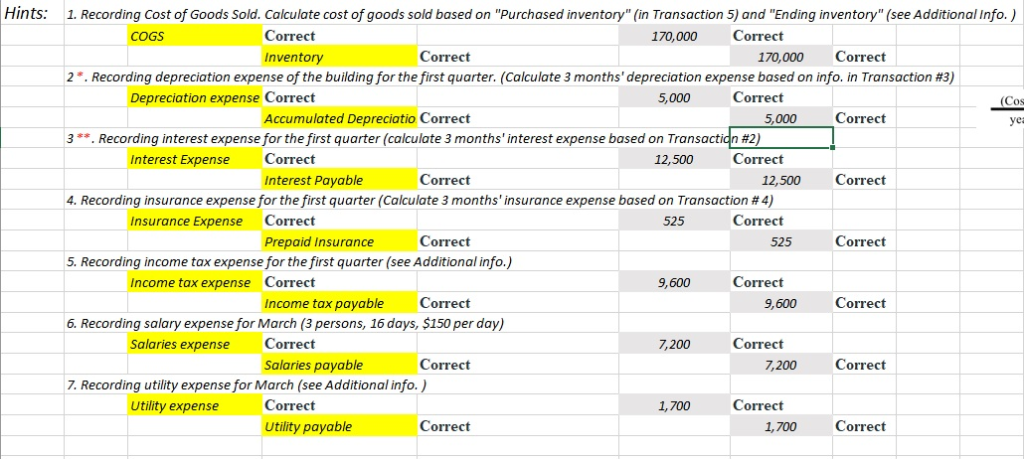

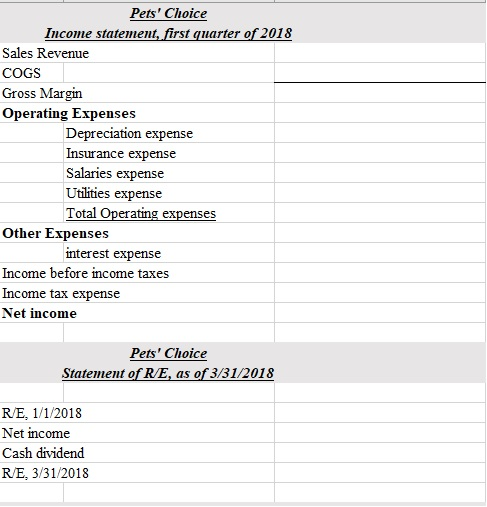

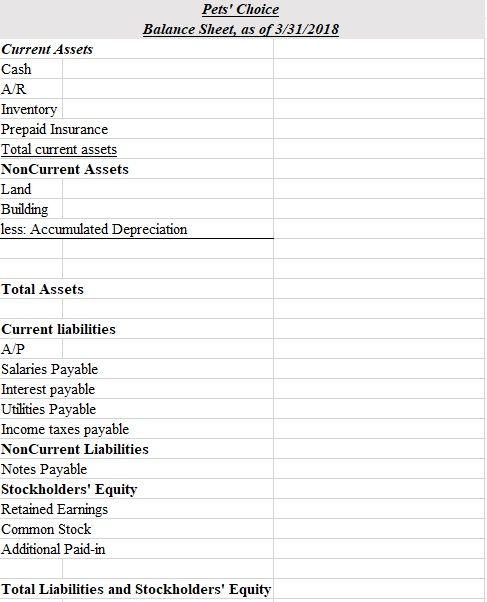

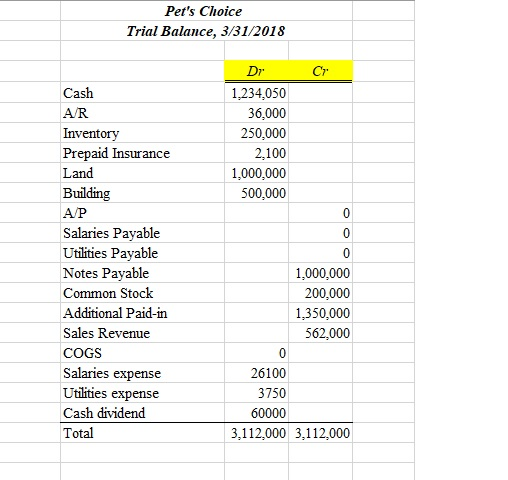

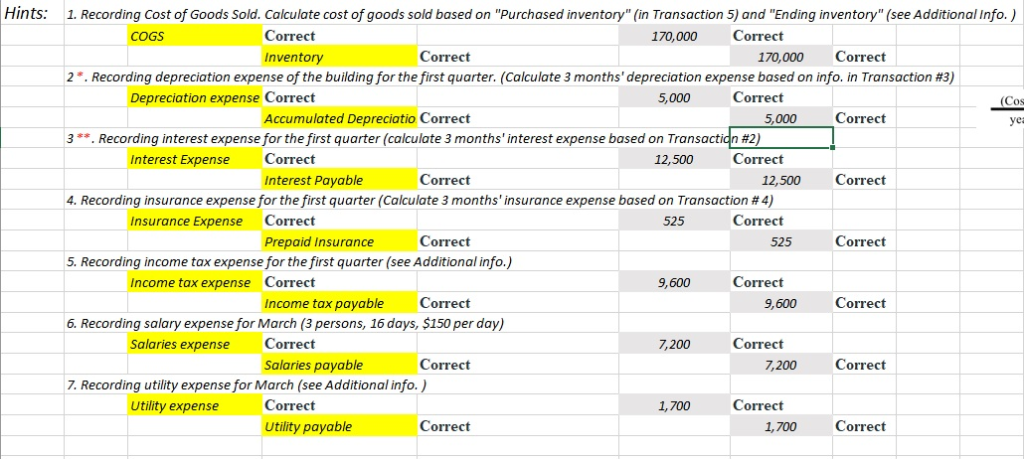

Pet's Choice Trial Balance, 3/31/2018 Dr Cr Cash AR Inventory Prepaid Insurance Land Building A/P Salaries Payable Utilities Payable Notes Payable Common Stock Additional Paid-in Sales Revenue COGS Salaries expense Utilities expense Cash dividend Total 1,234,050 36,000 250,000 2,100 1,000,000 500,000 1,000,000 200,000 1,350,000 562,000 26100 3750 60000 3,112,000 3,112,000 Hints: 1. Recording Cost of Goods Sold. Calculate cost of goods sold based on "Purchased inventory"(in Transaction 5) and "Ending inventory" (see Additional Info.) Correct Inventory COGS 170,000 Correct Correct 170,000 Correct 2" . Recording depreciation expense of the building for the first quarter. (Calculate 3 months' depreciation expense based on info in Transaction #3) Depreciation expense Correct 5,000 Correct Cos Accumulated Depreciatio Correct 5,000 Correct yea 3 Recording interest expense or the first quarter calculate 3 months interest expense based on Transact n #2 Correct Correct Interest Payable Interest Expense 12,500 Correct 12,500 orrect 4. Recording insurance expense for the first quarter (Calculate 3 months' insurance expense based on Transaction # 4) Insurance Expense Correct 525 Correct Prepaid Insurance Correct 525 Correct 5. Recording income tax expense for the first quarter(see Additional info.) Correct Income tax payable Income tax expense 9,600 Correct Correct 9,600 Correct 6. Recording salary expense for March (3 persons, 16 days, $150 per day) alaries expense Correct 7,200 Correct Salaries payable Correct 7,200 Correct 7. Recording utility expense for March (see Additional info. Correct Utility payable Utility expense 1,700 Correct Correct 1,700 Correct Pet's Choice Adjusted Trial Balance, 3/31/2018 Cash AR Inventory Prepaid Insurance Land Building Accumulated Depreciation A/P Interest payable Income tax payable Salaries Payable Utilities Payable Notes Payable Common Stock Additional Paid-in Sales Revenue COGS Income tax expense Insurance expense Depreciation expense Inerest expense Salaries expense Utilities expense Cash dividend Total Pets' Choice Income statement, first quarter of 2018 Sales Revenue COGS Gross Margin Operating Expenses Depreciation expense Insurance expense Salaries expense Utilities expense Total Operating expenses Other Expenses nterest expense Income before income taxes Income tax expense Net income Pets' Choice Statement of RE, as of 3/31/2018 R/E, 1/1/2018 Net income Cash dividend R/E, 3/31/2018 Pets' Choice Balance Sheet, as of 3/31/2018 Current Assets Cash AR Inventory Prepaid Insurance Total current assets NonCurrent Assets Land Building less: Accumulated Depreciation Total Assets Current liabilities A/P Salaries Payable Interest payable Utilities Payable Income taxes payable NonCurrent Liabilities Notes Payable Stockholders' Equity Retained Earnings Common Stock Additional Paid-in Total Liabilities and Stockholders' Equity

Q1

Q1 Q2

Q2

Q3

Q3