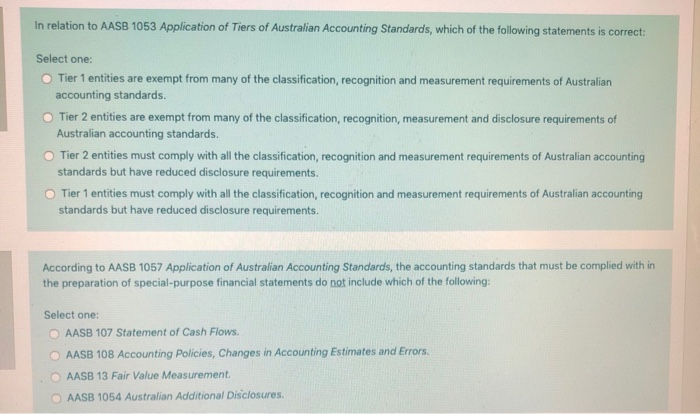

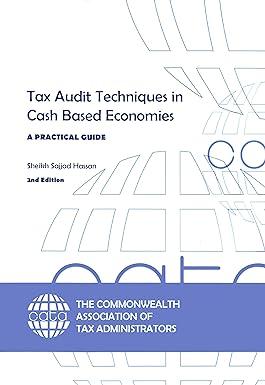

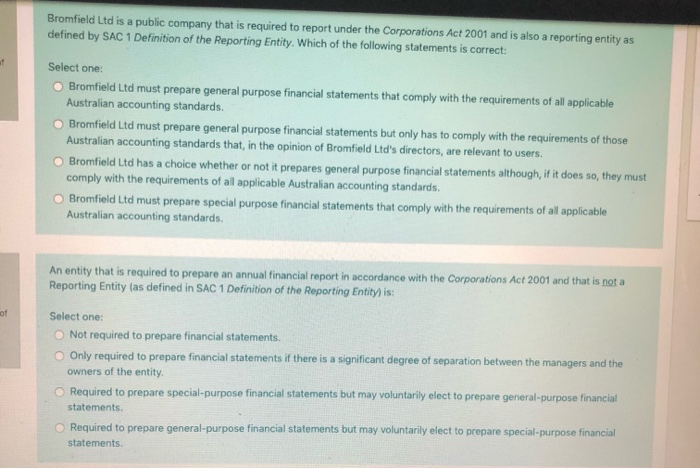

In relation to AASB 1053 Application of Tiers of Australian Accounting Standards, which of the following statements is correct: Select one: Tier 1 entities are exempt from many of the classification, recognition and measurement requirements of Australian accounting standards. Tier 2 entities are exempt from many of the classification, recognition, measurement and disclosure requirements of Australian accounting standards. Tier 2 entities must comply with all the classification, recognition and measurement requirements of Australian accounting standards but have reduced disclosure requirements. Tier 1 entities must comply with all the classification, recognition and measurement requirements of Australian accounting standards but have reduced disclosure requirements. According to AASB 1057 Application of Australian Accounting Standards, the accounting standards that must be complied with in the preparation of special-purpose financial statements do not include which of the following: Select one: AASB 107 Statement of Cash Flows. AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors. AASB 13 Fair Value Measurement AASB 1054 Australian Additional Disclosures Bromfield Ltd is a public company that is required to report under the Corporations Act 2001 and is also a reporting entity as defined by SAC 1 Definition of the Reporting Entity. Which of the following statements is correct: Select one: Bromfield Ltd must prepare general purpose financial statements that comply with the requirements of all applicable Australian accounting standards. Bromfield Ltd must prepare general purpose financial statements but only has to comply with the requirements of those Australian accounting standards that, in the opinion of Bromfield Ltd's directors, are relevant to users. Bromfield Ltd has a choice whether or not it prepares general purpose financial statements although, if it does so, they must comply with the requirements of all applicable Australian accounting standards. Bromfield Ltd must prepare special purpose financial statements that comply with the requirements of all applicable Australian accounting standards. An entity that is required to prepare an annual financial report in accordance with the Corporations Act 2001 and that is not a Reporting Entity (as defined in SAC 1 Definition of the Reporting Entity) is: Select one: Not required to prepare financial statements Only required to prepare financial statements if there is a significant degree of separation between the managers and the owners of the entity. Required to prepare special-purpose financial statements but may voluntarily elect to prepare general-purpose financial statements. Required to prepare general-purpose financial statements but may voluntarily elect to prepare special-purpose financial statements