Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In September, Eve Fabrics, Inc. had direct labor payrolls with 8,000 hours at P90 an hour and 4,000 hours at P100 an hour. All

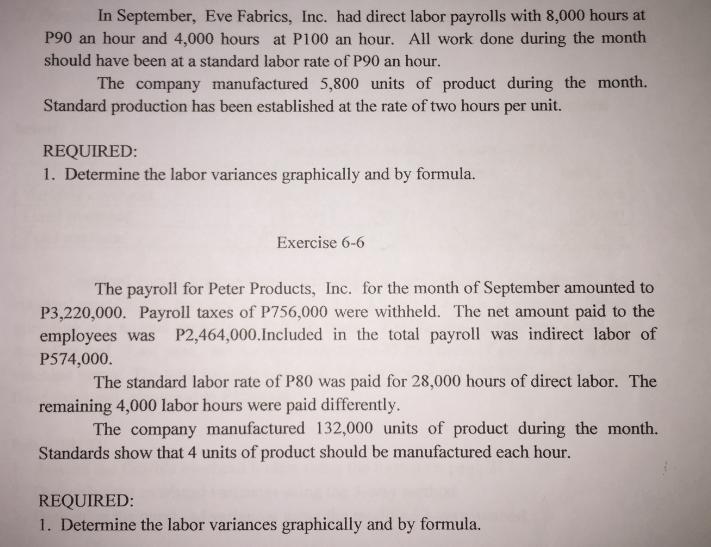

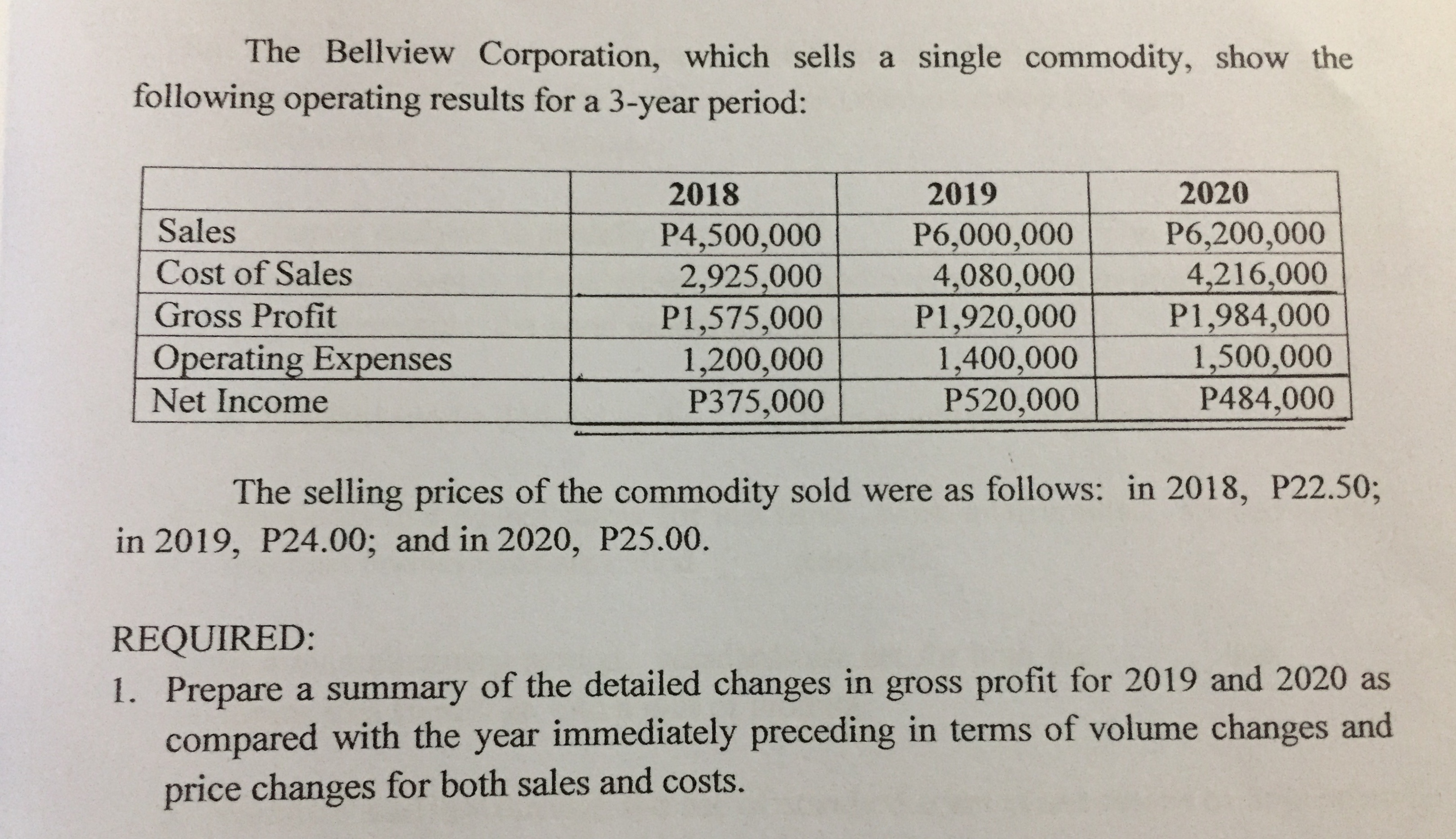

In September, Eve Fabrics, Inc. had direct labor payrolls with 8,000 hours at P90 an hour and 4,000 hours at P100 an hour. All work done during the month should have been at a standard labor rate of P90 an hour. The company manufactured 5,800 units of product during the month. Standard production has been established at the rate of two hours per unit. REQUIRED: 1. Determine the labor variances graphically and by formula. Exercise 6-6 The payroll for Peter Products, Inc. for the month of September amounted to P3,220,000. Payroll taxes of P756,000 were withheld. The net amount paid to the employees was P2,464,000.Included in the total payroll was indirect labor of P574,000. The standard labor rate of P80 was paid for 28,000 hours of direct labor. The remaining 4,000 labor hours were paid differently. The company manufactured 132,000 units of product during the month. Standards show that 4 units of product should be manufactured each hour. REQUIRED: 1. Determine the labor variances graphically and by formula. The Bellview Corporation, which sells a single commodity, show the following operating results for a 3-year period: Sales Cost of Sales Gross Profit Net Income Operating Expenses 2018 2019 2020 P4,500,000 P6,000,000 P6,200,000 2,925,000 4,080,000 4,216,000 P1,575,000 P1,920,000 P1,984,000 1,200,000 1,400,000 1,500,000 P375,000 P520,000 P484,000 The selling prices of the commodity sold were as follows: in 2018, P22.50; in 2019, P24.00; and in 2020, P25.00. REQUIRED: 1. Prepare a summary of the detailed changes in gross profit for 2019 and 2020 as compared with the year immediately preceding in terms of volume changes and price changes for both sales and costs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started