Question

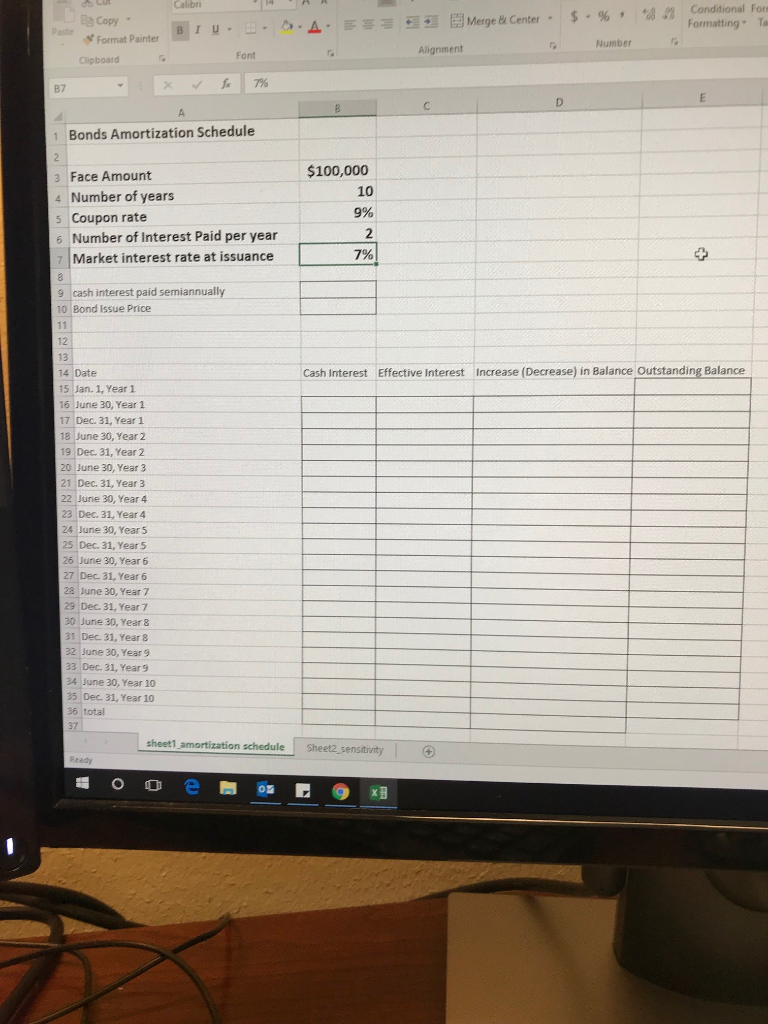

In sheet1_amortization schedule, you will find information about a 10-year bond with face amount $100,000 and coupon rate 9%. The bond is issued on Jan.

In sheet1_amortization schedule, you will find information about a 10-year bond with face amount $100,000 and coupon rate 9%. The bond is issued on Jan. 1, Year 1, and pays interests semiannually on June 30 and Dec. 31. The market interest rate at the time of issuance is 7%. Please calculate the cash interest paid semiannually and the bond issue price, and complete the amortization schedule. Put in the correct formulas, not just the numbers. The pv function in Excel will calculate present values for you.

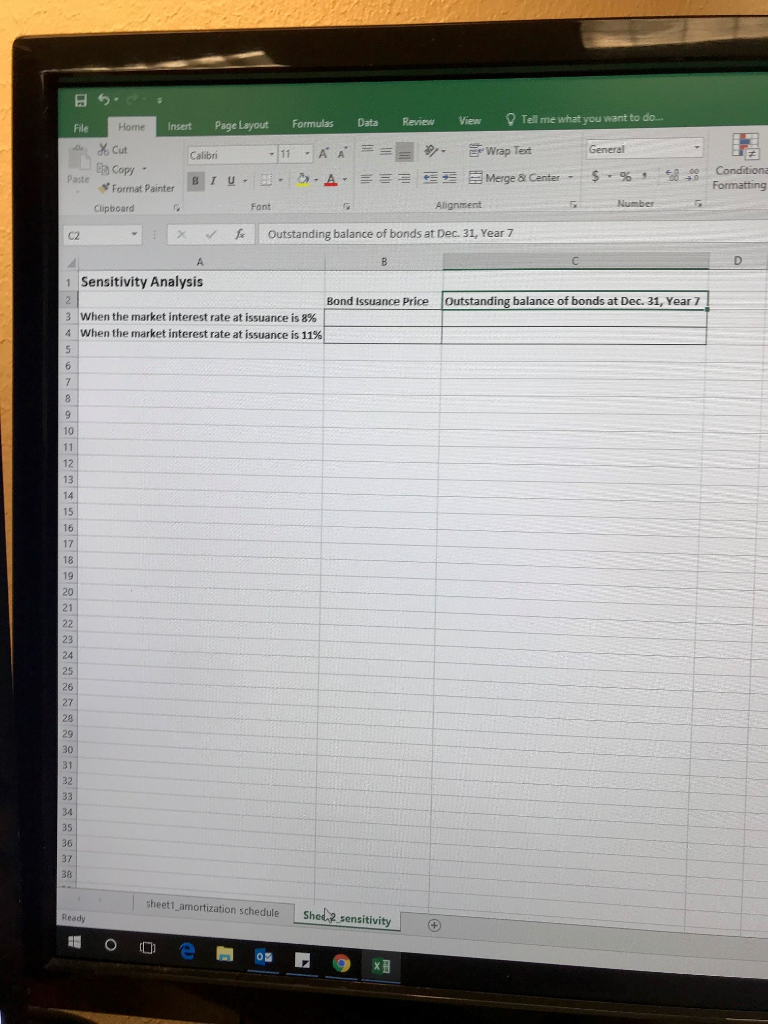

In sheet2_sensitivity, you will put in numbers, not formulas. You can obtain these numbers from sheet1_amortization schedule by changing the market interest rate at issuance. Please remember to change the market interest rate back to 7% in sheet1_amortization schedule before submission

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started