Answered step by step

Verified Expert Solution

Question

1 Approved Answer

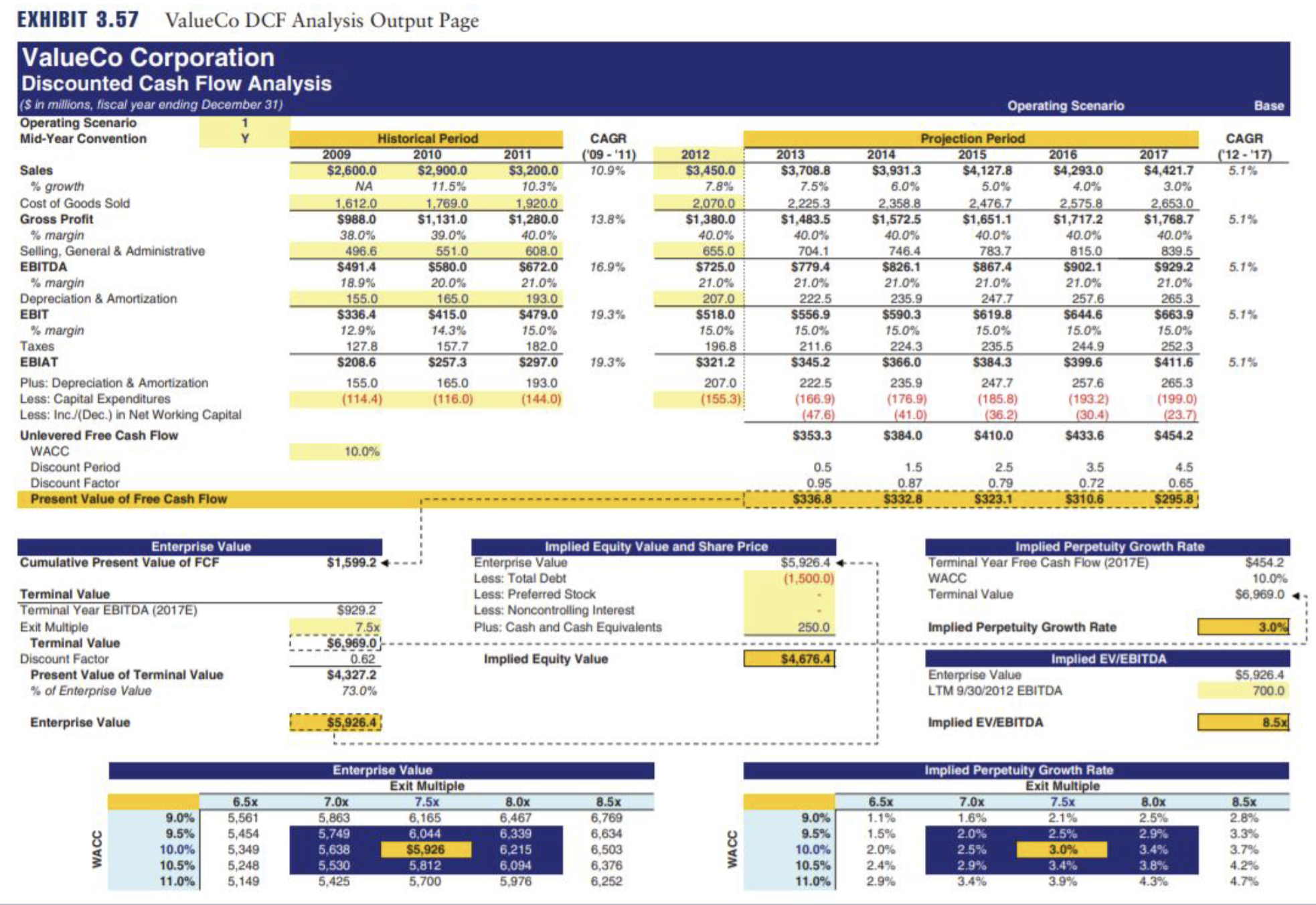

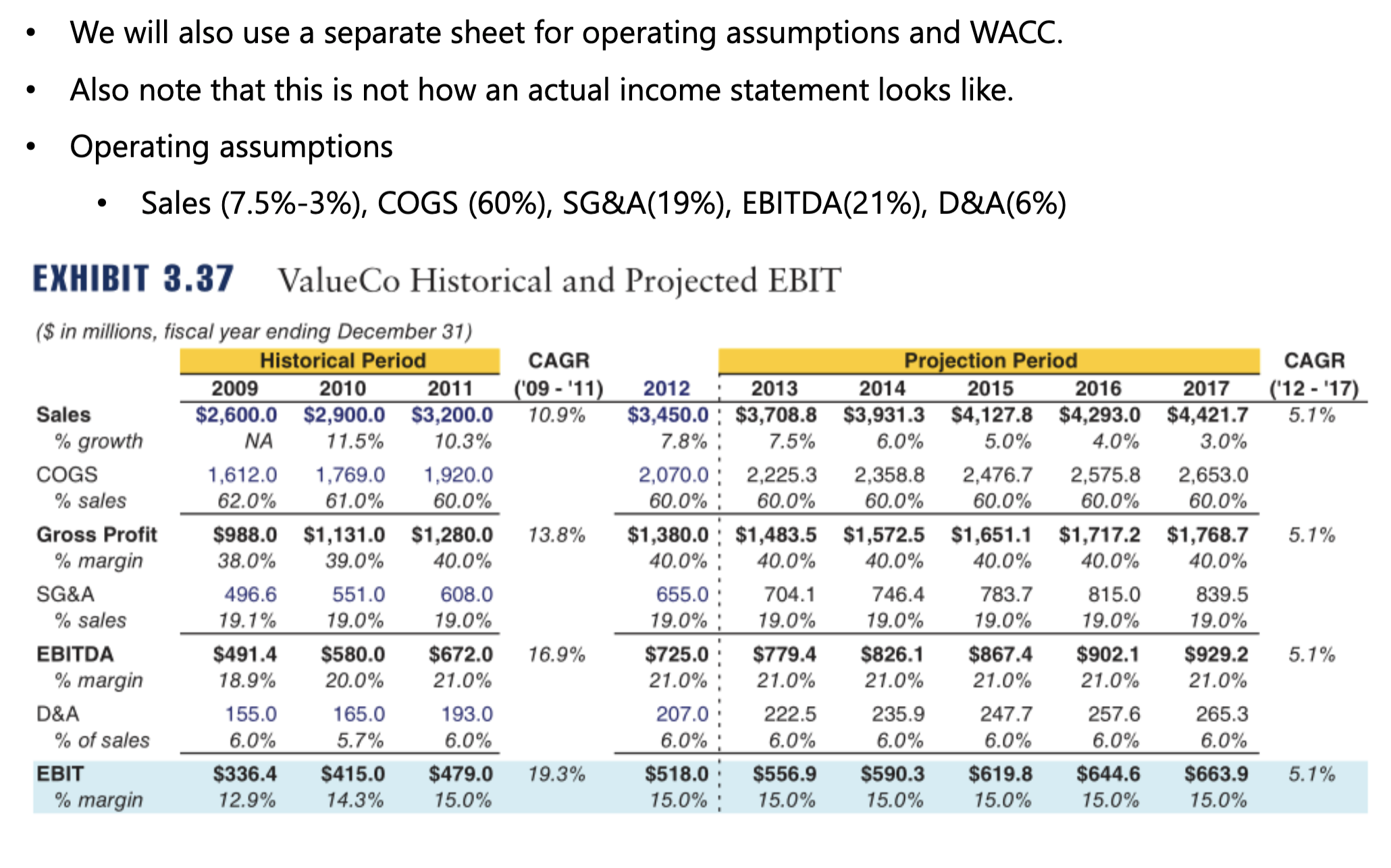

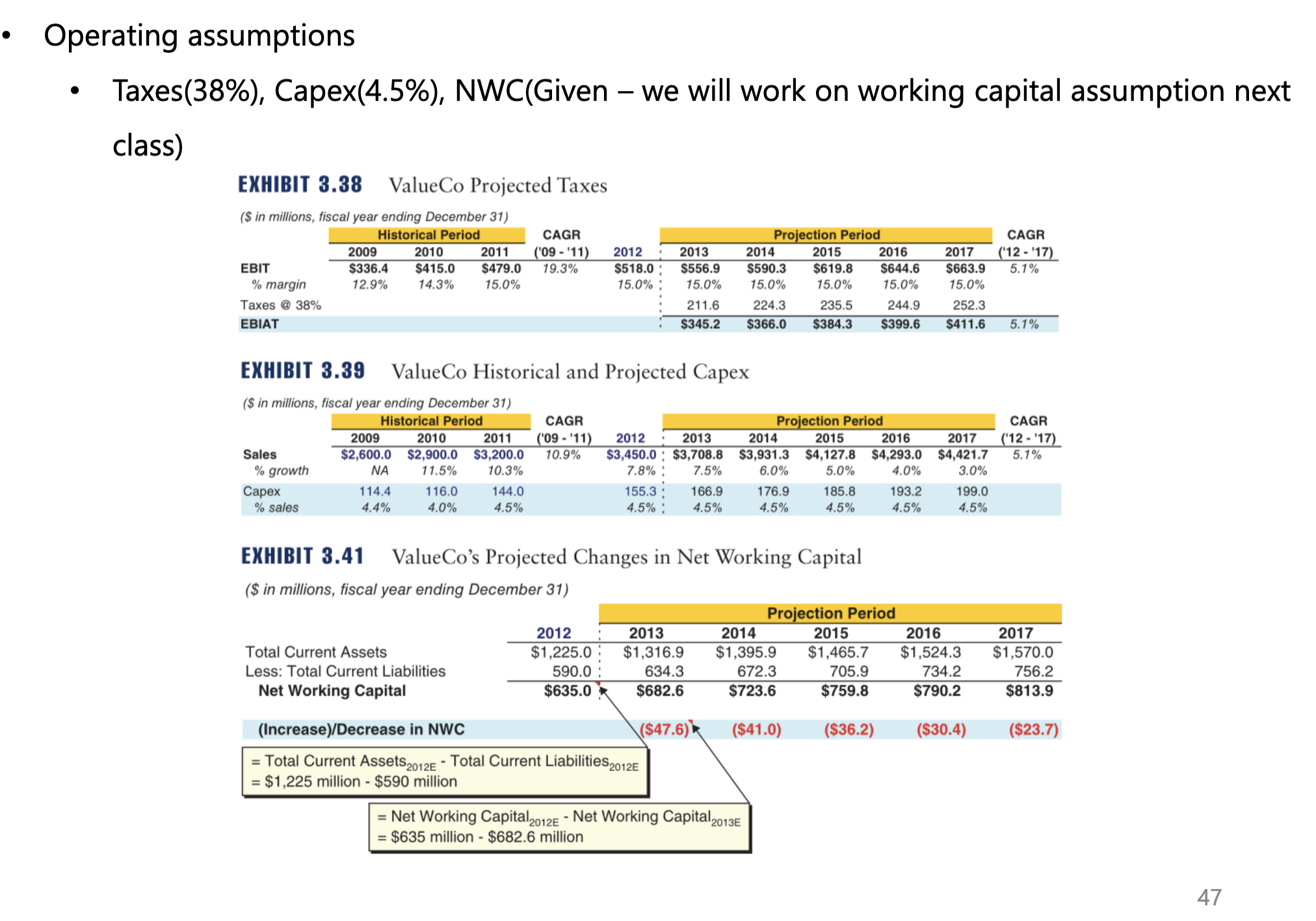

In the DCF analysis what is the enterprise value of ValueCo if the cost of goods sold is 55% and EBITDA margin is 26% of

In the DCF analysis what is the enterprise value of ValueCo if the cost of goods sold is 55% and EBITDA margin is 26%

of sales in years 2013 - 2015, keeping all other assumptions identical?

EXHIBIT 3.57 ValueCo DCF Analysis Output Page ValueCo Corporation Discounted Cash Flow Analysis (S in millions, fiscal year ending December 31) Operating Scenario Mid-Year Convention Sales % growth 2009 Historical Period 2010 2011 CAGR ('09-'11) 2012 2013 2014 Operating Scenario Projection Period 2015 $2,600.0 NA $2,900.0 11.5% $3,200.0 10.9% 10.3% $3,450.0 7.8% Cost of Goods Sold 1,612.0 1,769.0 1,920.0 2,070.0 $3,708.8 7.5% 2,225.3 $3,931.3 6.0% 2,358.8 $4,127.8 5.0% 2016 $4,293.0 4.0% 2017 Base CAGR (12-17) $4,421.7 3.0% 5.1% 2,476.7 Gross Profit $988.0 $1,131.0 $1,280.0 13.8% $1,380.0 $1,483.5 $1,572.5 $1,651.1 2,575.8 $1,717.2 2,653.0 $1,768.7 5.1% % margin 38.0% 39.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% Selling, General & Administrative 496.6 551.0 608.0 655.0 704.1 746.4 783.7 815.0 839.5 EBITDA $491.4 $580.0 $672.0 16.9% $725.0 $779.4 $826.1 $867.4 $902.1 $929.2 5.1% % margin 18.9% 20.0% 21.0% 21.0% 21.0% 21.0% 21.0% 21.0% 21.0% Depreciation & Amortization 155.0 165.0 193.0 207.0 222.5 235.9 247.7 257.6 265.3 EBIT $336.4 $415.0 $479.0 19.3% $518.0 $556.9 $590.3 $619.8 $644.6 $663.9 5.1% % margin 12.9% 14.3% 15.0% 15.0% 15.0% 15.0% 15.0% 15.0% 15.0% Taxes 127.8 157.7 182.0 196.8 211.6 224.3 235.5 244.9 252.3 EBIAT $208.6 $257.3 $297.0 19.3% $321.2 $345.2 $366.0 $384.3 $399.6 $411.6 5.1% Plus: Depreciation & Amortization 155.0 165.0 193.0 207.0 222.5 235.9 247.7 257.6 265.3 Less: Capital Expenditures (114.4) (116.0) (144.0) (155.3) (166.9) (176.9) (185.8) (193.2) (199.0) Less: Inc./(Dec.) in Net Working Capital (47.6) (41.0) (36.2) (30.4) (23.7) Unlevered Free Cash Flow $353.3 $384.0 $410.0 $433.6 $454.2 WACC 10.0% Discount Period 0.5 Discount Factor Present Value of Free Cash Flow 0.95 $336.8 1.5 0.87 $332.8 2.5 0.79 $323.1 3.5 4.5 0.72 $310.6 0.65 $295.8 Enterprise Value Implied Equity Value and Share Price Cumulative Present Value of FCF $1,599.24 Enterprise Value Less: Total Debt $5,926.4 (1,500.0) Implied Perpetuity Growth Rate Terminal Year Free Cash Flow (2017E) WACC $454.2 10.0% Terminal Value Less: Preferred Stock Terminal Value $6,969.0 Terminal Year EBITDA (2017E) $929.2 Less: Noncontrolling Interest Exit Multiple 7.5x Plus: Cash and Cash Equivalents 250.0 Implied Perpetuity Growth Rate 3.0% Terminal Value $6,969.0 Discount Factor 0.62 Implied Equity Value $4,676.4 Implied EV/EBITDA Present Value of Terminal Value $4,327.2 Enterprise Value $5,926.4 % of Enterprise Value 73.0% LTM 9/30/2012 EBITDA 700.0 Enterprise Value $5,926.4 Implied EV/EBITDA 8.5x WACC Enterprise Value Exit Multiple 6.5x 7.0x 7.5x 8.0x 8.5x 9.0% 5,561 5,863 6,165 6,467 6,769 9.5% 5,454 5,749 6,044 6,339 6,634 10.0% 5,349 5,638 $5,926 6,215 6,503 10.5% 5,248 5,530 5,812 6,094 6,376 11.0% 5,149 5,425 5,700 5,976 6,252 Implied Perpetuity Growth Rate Exit Multiple 6.5x 7.0x 7.5x 8.0x 8.5x 9.0% 1.1% 1.6% 2.1% 2.5% 2.8% WACC 9.5% 1.5% 2.0% 2.5% 2.9% 3.3% 10.0% 2.0% 2.5% 3.0% 3.4% 3.7% 10.5% 2.4% 2.9% 3.4% 3.8% 4.2% 11.0% 2.9% 3.4% 3.9% 4.3% 4.7%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started