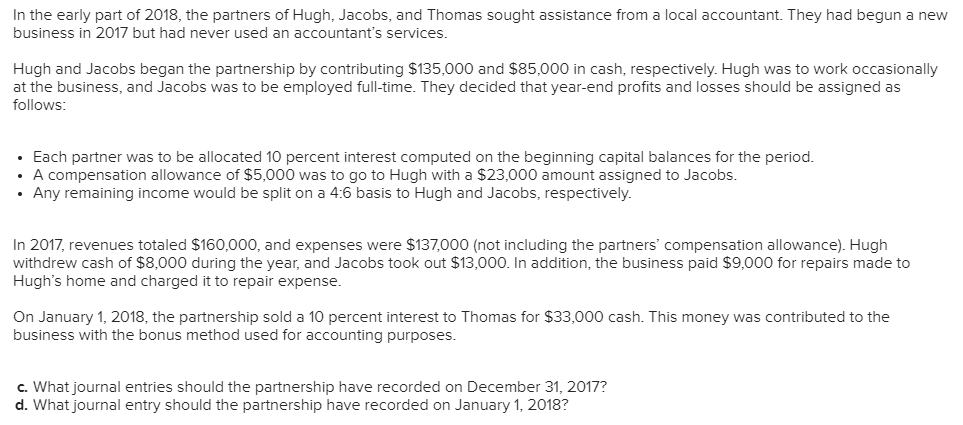

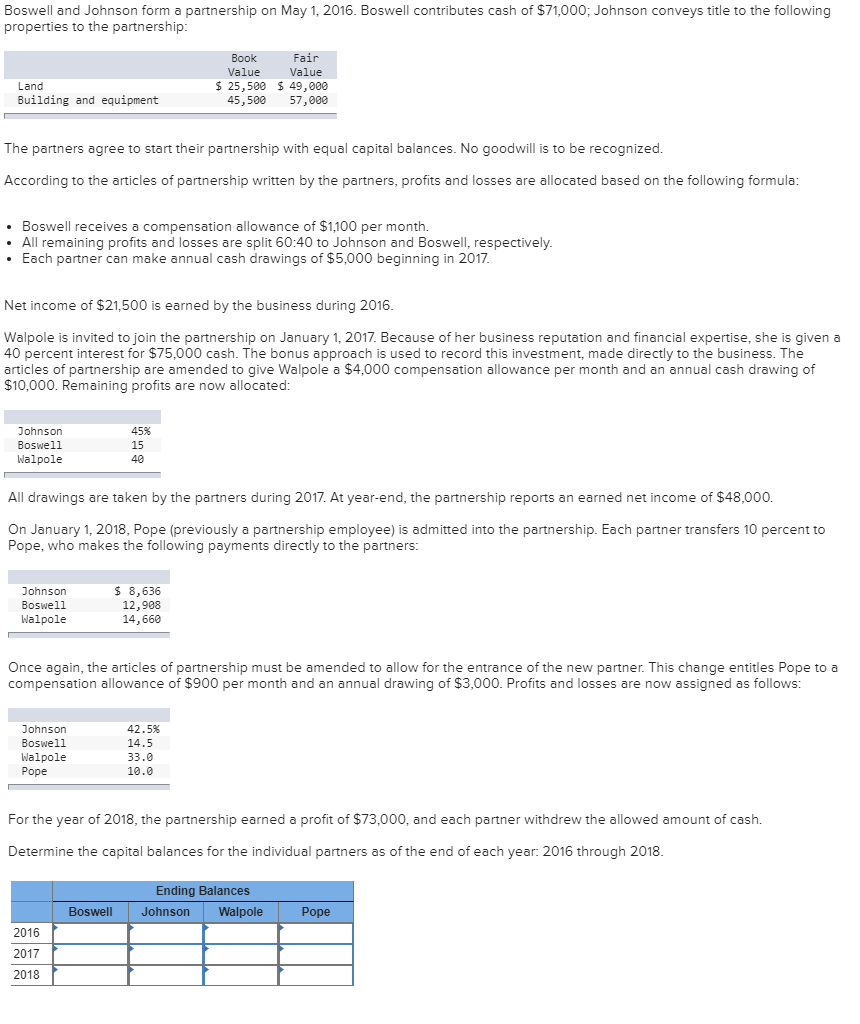

In the early part of 2018, the partners of Hugh, Jacobs, and Thomas sought assistance from a local accountant. They had begun a new business in 2017 but had never used an accountant's services. Hugh and Jacobs began the partnership by contributing $135,000 and $85,000 in cash, respectively. Hugh was to work occasionaly at the business, and Jacobs was to be employed full-time. They decided that year-end profits and losses should be assigned as follows: Each partner was to be allocated 10 percent interest computed on the beginning capital balances for the period. A compensation allowance of $5,000 was to go to Hugh with a $23,000 amount assigned to Jacobs. Any remaining income would be split on a 4:6 basis to Hugh and Jacobs, respectively. In 2017, revenues totaled $160,000, and expenses were $137000 (not including the partners' compensation allowance). Hugh withdrew cash of $8,000 during the year, and Jacobs took out $13,000. In addition, the business paid $9,000 for repairs made to Hugh's home and charged it to repair expense. On January 1, 2018, the partnership sold a 10 percent interest to Thomas for $33,000 cash. This money was contributed to the business with the bonus method used for accounting purposes c. What journal entries should the partnership have recorded on December 31, 2017? d. What journal entry should the partnership have recorded on January 1, 2018? Boswell and Johnson form a partnership on May 1, 2016. Boswell contributes cash of $71,000; Johnson conveys title to the following properties to the partnership Book Value Fair Value Land $ 25,500 $49,000 Building and equipment 45,500 57,000 The partners agree to start their partnership with equal capital balances. No goodwill is to be recognized. According to the articles of partnership written by the partners, profits and losses are allocated based on the following formula . Boswell receives a compensation allowance of $1,100 per month All remaining profits and losses are split 60:40 to Johnson and Boswell, respectively. . Each partner can make annual cash drawings of $5,000 beginning in 2017 Net income of $21,500 is earned by the business during 2016 Walpole is invited to join the partnership on January 1, 2017. Because of her business reputation and financial expertise, she is given a 40 percent interest for $75,000 cash. The bonus approach is used to record this investment, made directly to the business. The articles of partnership are amended to give Walpole a $4,000 compensation allowance per month and an annual cash drawing of $10,000. Remaining profits are now allocated Johnson Boswell Walpole 45% 15 40 All drawings are taken by the partners during 2017. At year-end, the partnership reports an earned net income of $48,000. On January 1, 2018, Pope (previously a partnership employee) is admitted into the partnership. Each partner transfers 10 percent to Pope, who makes the following payments directly to the partners Johnson Boswell Walpole $ 8,636 12,908 14,660 Once again, the articles of partnership must be amended to allow for the entrance of the new partner. This change entitles Pope to a compensation allowance of $900 per month and an annual drawing of $3,000. Profits and losses are now assigned as follows: Johnson Boswell Walpole Pope 425% 33.0 10.0 For the year of 2018, the partnership earned a profit of $73,000, and each partner withdrew the allowed amount of cash. Determine the capital balances for the individual partners as of the end of each year: 2016 through 2018 Ending Balances Boswell Johnson Walpole Pope 2016 2017 2018