Question

In the fall of 2015, David Lee initiated a crowdfunding campaign with help from Equitise - a crowdfunding platform in Australia. His goal was to

In the fall of 2015, David Lee initiated a crowdfunding campaign with help from Equitise - a crowdfunding platform in Australia. His goal was to raise sufficient capital to launch Portable Energy, a privately held company that manufactures and sells portable “energy chews” for active people on the go. The company successfully raised $250,000 during the six-month campaign— sufficient to cover all costs related to the acquisition of equipment and materials needed to produce its single product, Dragon Energy. Dragon Energy is a portable energy chew favored by amateur and professional athletes. The product is extremely popular with bikers, runners, and biathletes because of its energy kick and the essential vitamins and minerals delivered naturally through its unique ingredients. The all-natural athletic fuel is produced using two components: maple syrup and a ‘secret’ caffeine blend consisting of coffee, coconut oil, and dragon fruit extract that the company promotes as the “Dragon Blend.” The company grows its own fruits; this process is complex and carefully managed. The plants produce fruit for five months each year, generally from September through March, in greenhouses situated in Dandenong South, Victoria, Australia. The pure maple syrup is imported from Canada. The maple syrup and “Dragon Blend” are mixed together at the company’s rented facility. The energy chews are packaged and sold online through the company’s website. At the beginning of 2018, Portable Energy entered into a contract with a property owner to use Retail Unit A in a department store in downtown Melbourne to sell its products. The contract is for five years, and Retail Unit A is part of a larger retail space with many retail units in the department store.

Portable Energy began producing energy chews in 2017 and has experienced consistent demand since the product hit the market. The unique product and manufacturing process attracted the attention of several private investors. Given these developments, Assurance International, an audit firm, was hired to audit the company’s financial statements for the year ending 30 June 2018. The financial statements will be prepared in accordance with Australia Accounting Standards; the monetary unit is the Australian dollars.

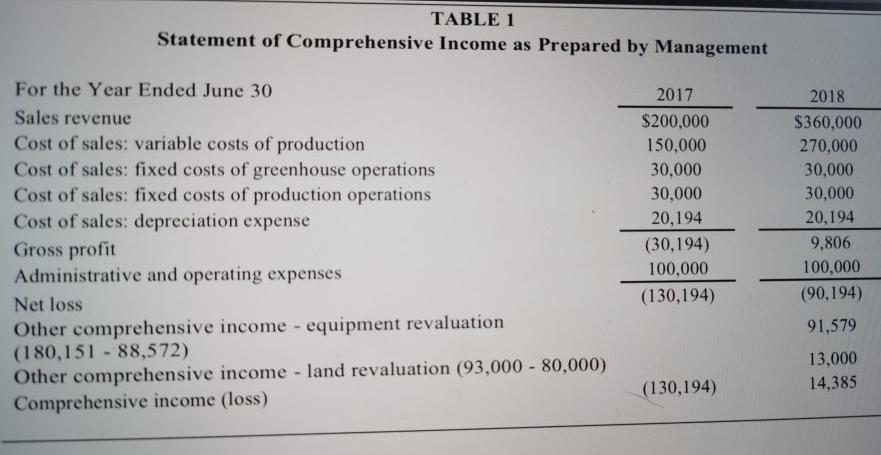

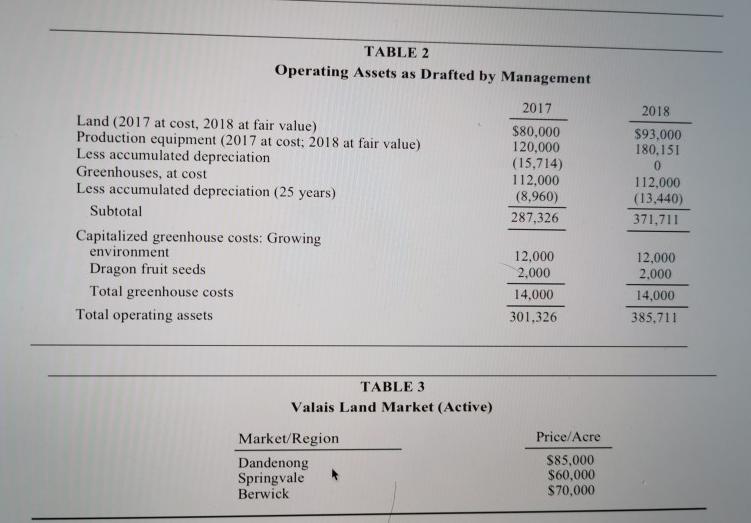

Portable Energy treats land, equipment, and greenhouses as separate asset classes. Since its inception, the company has used the cost model for valuing property, plants, and equipment. However, management now believes that the revaluation model for both land and equipment is more appropriate, under the presumption that fair value presents more relevant financial information to the potential investors. Some financial information, prepared by Portable Energy’s accountant, is presented in Tables 1 and 2. The company treats the payments associated with the use of Retail Unit A in the department store as part of its operating expenses.

Land for Growing Purposes

At the end of 2015, Portable Energy paid $80,000 for one acre of land on the outskirts of Dandenong South. An active market exists for similar pieces of land in the region; Portable Energy can access the markets at any time. Management believes the fair value estimate for the land should be classified as Level 1 in the fair value hierarchy. They are fairly certain that the land would not sell for less than $100,000, less selling costs of $5,000 and greenhouse removal costs of $2,000. As such, they propose that the land be reported at a fair value of $93,000, i.e., at

their assessment of its fair value fewer costs of disposal. The recent selling prices of land in the area are presented in Table 3.

Production Equipment

Production Equipment

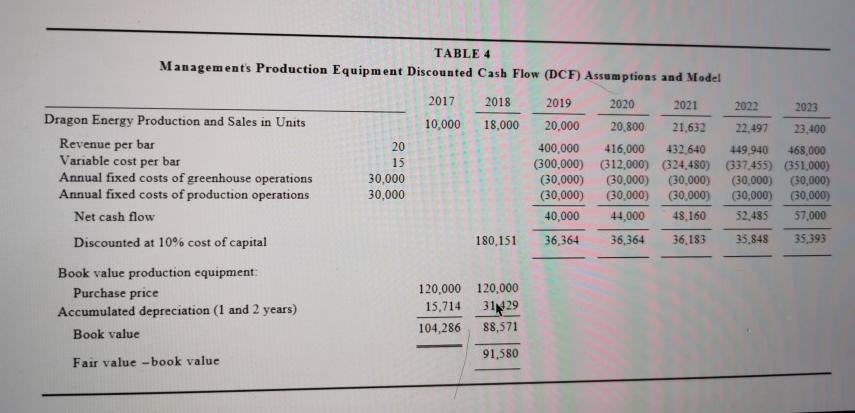

On 1 July 2016, the company acquired a one-of-a-kind, customized piece of production equipment for blending and packaging the energy chews. The equipment was purchased for $120,000, has a salvage value of $10,000, and an estimated useful life of seven years. Portable Energy elected to depreciate the equipment using the straight-line method over seven years, with one full year of depreciation taken in the first and last years of the asset’s life. Management believes all components of the equipment depreciate at the same rate. The initial batches of Dragon Energy were produced in 2017. Management believes that neither the market nor the cost approach included in AASB13 is relevant in this situation. As of 30 June 2018, management calculated the fair value of the equipment as $180,151 based on a discounted cash flow (DCF) model calculated using its estimated cost of capital and its own assumptions about future cash flows. Table 4 presents Portable Energy’s DCF model and the resulting calculations.

The auditors cautioned Portable Energy’s management team that the fair value revaluation model described in AASB 116 must be used for all assets within the same class. The auditors also emphasized that AASB 116 allows for revaluation when “the fair value can be measured reliably,” and that, after the revaluation, management needs to monitor the fair value of the asset to assure that the asset’s carrying value continues to approximate the fair value. They added that AASB 13 clearly explains that present value measurements should be based on the risk-free rate and a risk premium that represents the price for bearing the uncertainty inherent in the cash flows. Management replied that they believe the fair value is important to report under the company’s current circumstances and that they believe their estimates are appropriate. Based upon a conversation between the auditors and the equipment manufacturer, the cost for a similar piece of production equipment, roughly approximating the current condition of Portable Energy’s equipment, ranges from $110,000 to $125,000.

Required

Required

(1)What is the valuation of land

(2)what is the valuation of production equipment

TABLE 1 Statement of Comprehensive Income as Prepared by Management For the Year Ended June 30 Sales revenue Cost of sales: variable costs of production Cost of sales: fixed costs of greenhouse operations Cost of sales: fixed costs of production operations Cost of sales: depreciation expense Gross profit Administrative and operating expenses Net loss Other comprehensive income - equipment revaluation (180,151 - 88,572) Other comprehensive income - land revaluation (93,000 - 80,000) Comprehensive income (loss) 2017 $200,000 150,000 30,000 30,000 20,194 (30,194) 100,000 (130,194) (130,194) 2018 $360,000 270,000 30,000 30,000 20,194 9,806 100,000 (90,194) 91,579 13,000 14,385

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

What is the valuation of land The valuation of land is 93000 In order to calculate the valuation of the land we must first consider the information pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started