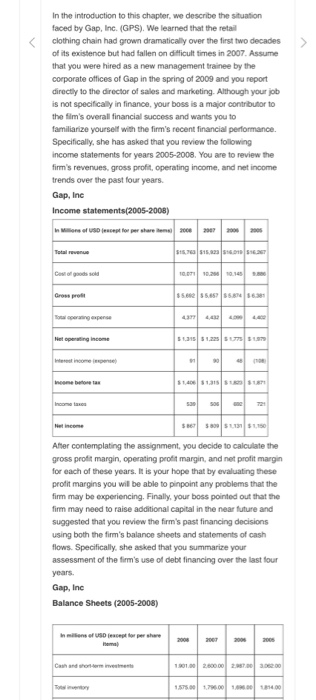

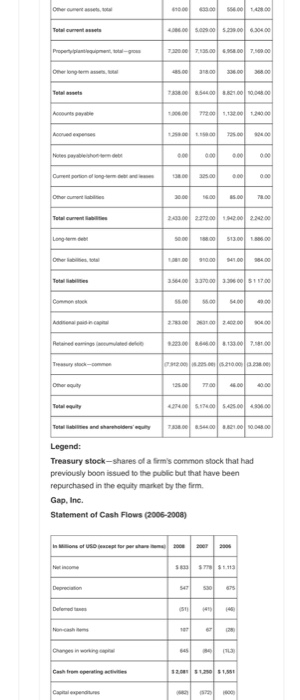

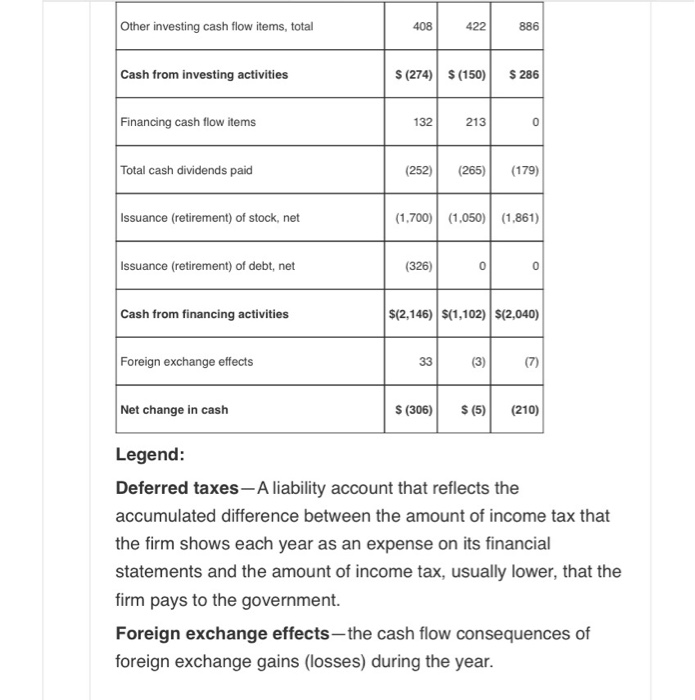

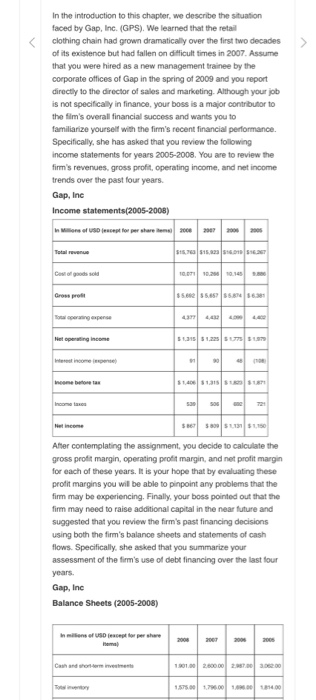

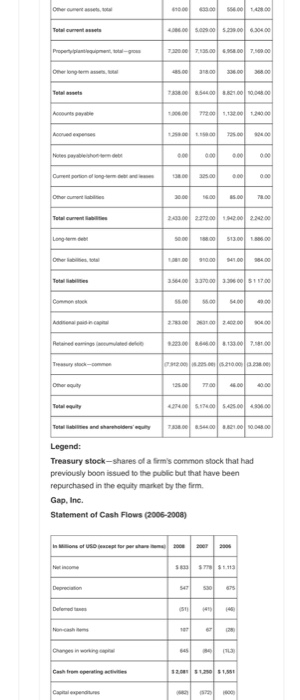

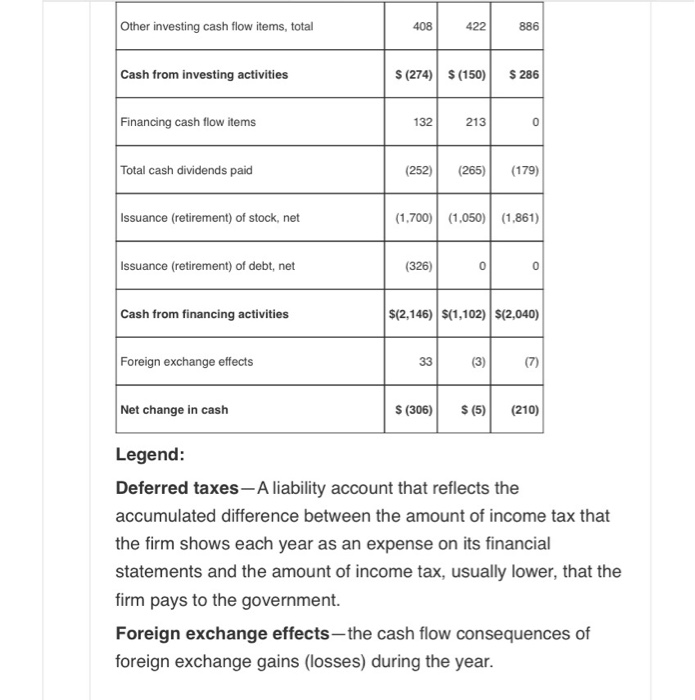

In the introduction to this chapter, we describe the situation faced by Gap, Inc. (GPS). We learned that the retail clothing chain had grown dramatically over the first two decades> of its existence but had fallen on dficult times in 2007. Assume that you were hired as a new management trainee by the corporate offices of Gap in the spring of 2009 and you report directly to the director of sales and marketing. Although your job is not specifically in finance, your boss is a major contributor to the flm's overall financial success and wants you to familiarize yourself with the firm's recent financial performance. Specifically, she has asked that you review the following income statements for years 2005-2008. You are to review the firm's revenues, gross profit, operating income, and net inoome trends over the past four years. Gap, Inc prost 5.8 1.225 187 After gross proft margin, operating profit margin, and net profit margin for each of these years. It is your hope that by evaluating these profit margins you wil be able to pinpoint any problems that the firm may be experiencing. Finally, your boss pointed out that the firm may need to raise additional capital in the near future and suggested that you review the firm's past financing decisions using both the firm's balance sheets and statements of cash flows. Specifically, she asked that you summarize your assessment of the firm's use of debt financing over the last four years Gap, Inc Balance Sheets (2005-2008) the assignment, you decide to calculate the In the introduction to this chapter, we describe the situation faced by Gap, Inc. (GPS). We learned that the retail clothing chain had grown dramatically over the first two decades> of its existence but had fallen on dficult times in 2007. Assume that you were hired as a new management trainee by the corporate offices of Gap in the spring of 2009 and you report directly to the director of sales and marketing. Although your job is not specifically in finance, your boss is a major contributor to the flm's overall financial success and wants you to familiarize yourself with the firm's recent financial performance. Specifically, she has asked that you review the following income statements for years 2005-2008. You are to review the firm's revenues, gross profit, operating income, and net inoome trends over the past four years. Gap, Inc prost 5.8 1.225 187 After gross proft margin, operating profit margin, and net profit margin for each of these years. It is your hope that by evaluating these profit margins you wil be able to pinpoint any problems that the firm may be experiencing. Finally, your boss pointed out that the firm may need to raise additional capital in the near future and suggested that you review the firm's past financing decisions using both the firm's balance sheets and statements of cash flows. Specifically, she asked that you summarize your assessment of the firm's use of debt financing over the last four years Gap, Inc Balance Sheets (2005-2008) the assignment, you decide to calculate the