Question

In the lecture, it was mentioned that many FIs have become insolvent due to trading losses on futures contracts. We also went through a futures

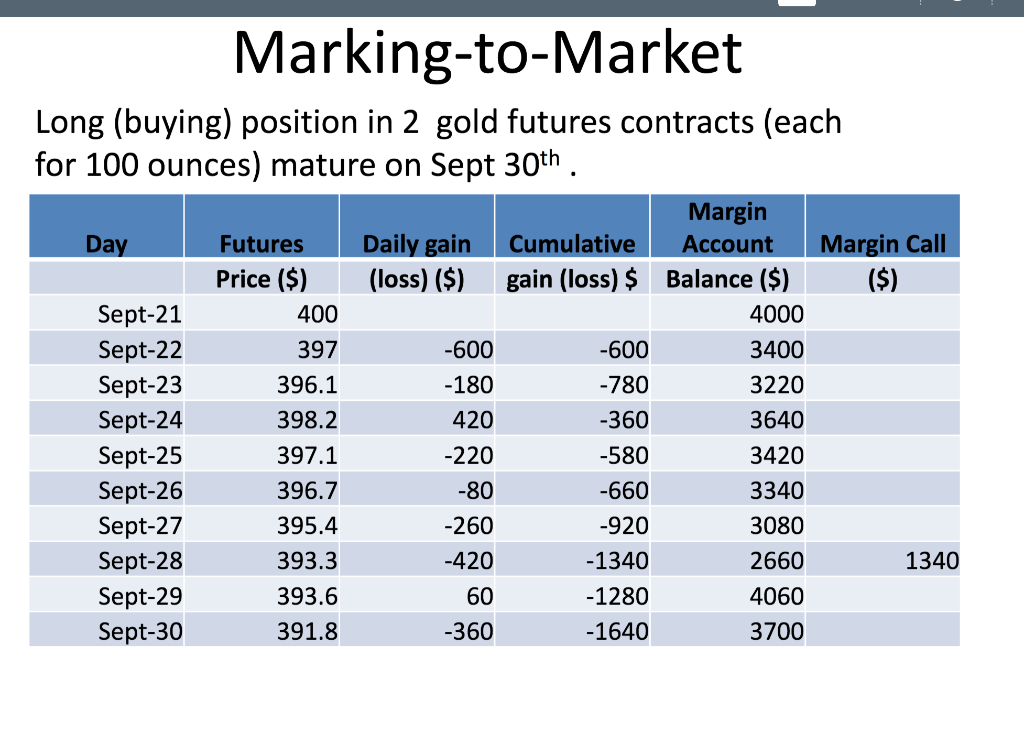

In the lecture, it was mentioned that many FIs have become insolvent due to trading losses on futures contracts. We also went through a futures example on Slide 15 of Topic 5, shown below:

(i) Perform 50 simulations in Excel of the data above (you need to simulate the futures price) above, and plot the cumulative gain/loss (for a single simulation). Plot a histogram of the final cumulative gain/loss (based on all of your simulations). Comment on your results.

(ii) Now perform a similar simulation (50 simulations) but this time assume that we are considering a 10-year Treasury bond futures contract. You will effectively have to simulate the 10-year Treasury bond yield (and calculate the corresponding bond price) in another column.

a. Using your results (based on all simulations or selected simulations from your 50 simulations), explain how the treasury bond futures contract can be used for speculative purposes.

b. Using your results (based on all simulations or selected simulations from your 50 simulations), explain how the treasury bond futures contract can be used for hedging purposes.

Marking-to-Market Long (buying) position in 2 gold futures contracts (each for 100 ounces) mature on Sept 30th. Margin Day Futures Daily gain Cumulative Account Margin Call Price ($) (loss) ($) gain (loss) $ Balance ($) ($) Sept-21 400 4000 Sept-22 397 -600 -600 3400 Sept-23 396.1 -180 -780 3220 Sept-24 398.2 420 -360 3640 Sept-25 397.1 -220 -580 3420 Sept-26 396.7 -80 -660 3340 Sept-27 395.4 -260 -920 3080 Sept-28 393.3 -420 -1340 2660 1340 Sept-29 393.6 60 -1280 4060 Sept-30 391.8 -360 -1640 3700 Marking-to-Market Long (buying) position in 2 gold futures contracts (each for 100 ounces) mature on Sept 30th. Margin Day Futures Daily gain Cumulative Account Margin Call Price ($) (loss) ($) gain (loss) $ Balance ($) ($) Sept-21 400 4000 Sept-22 397 -600 -600 3400 Sept-23 396.1 -180 -780 3220 Sept-24 398.2 420 -360 3640 Sept-25 397.1 -220 -580 3420 Sept-26 396.7 -80 -660 3340 Sept-27 395.4 -260 -920 3080 Sept-28 393.3 -420 -1340 2660 1340 Sept-29 393.6 60 -1280 4060 Sept-30 391.8 -360 -1640 3700Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started