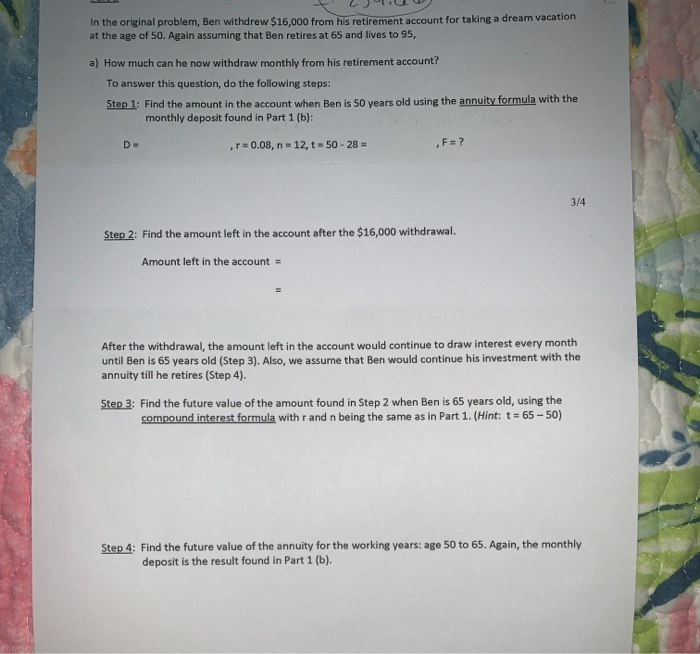

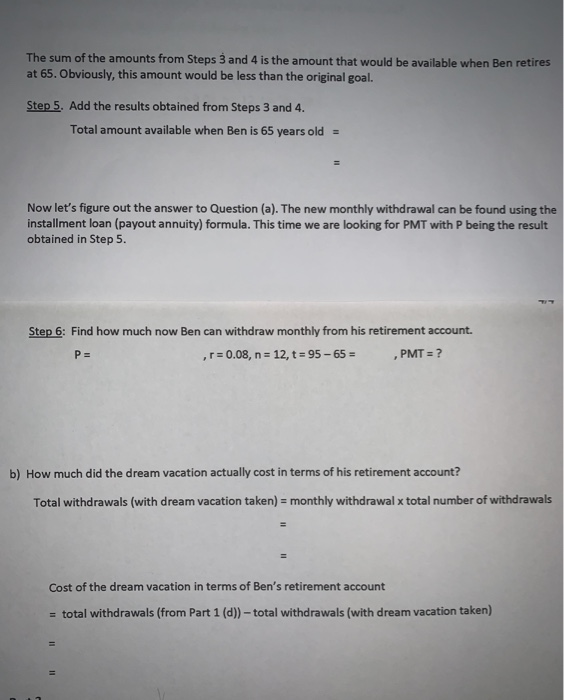

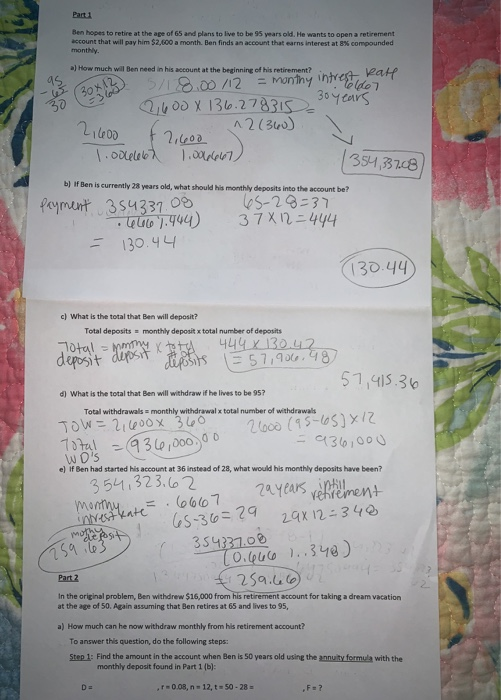

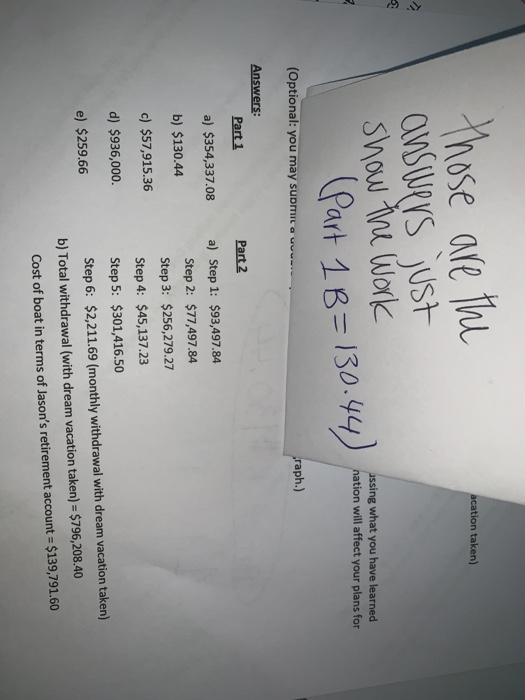

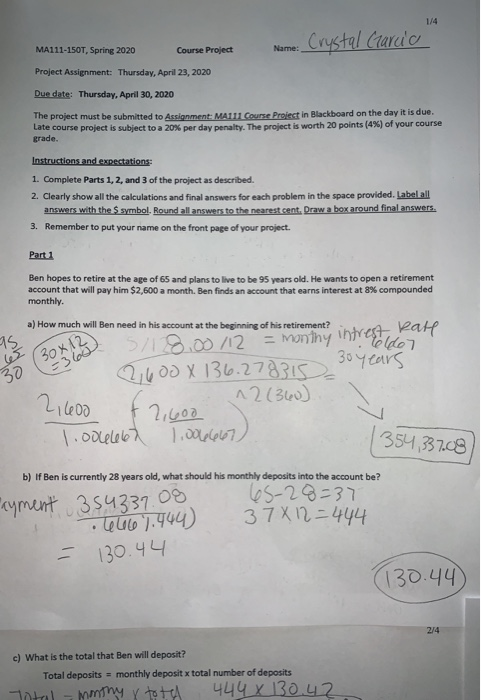

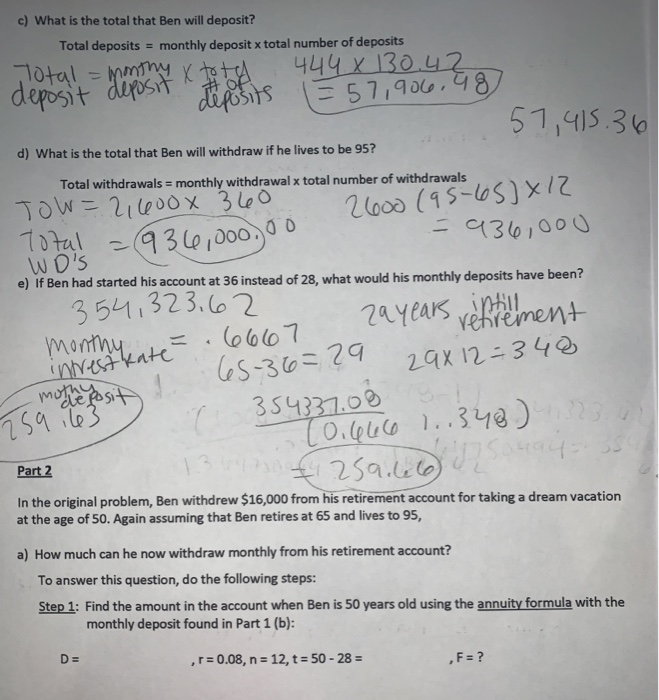

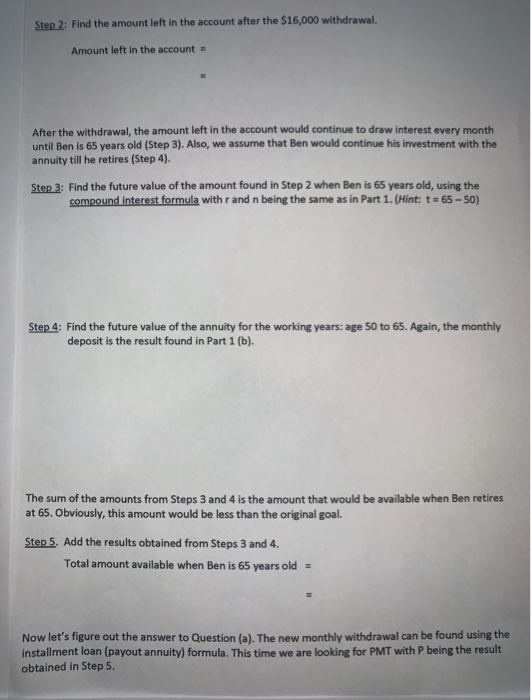

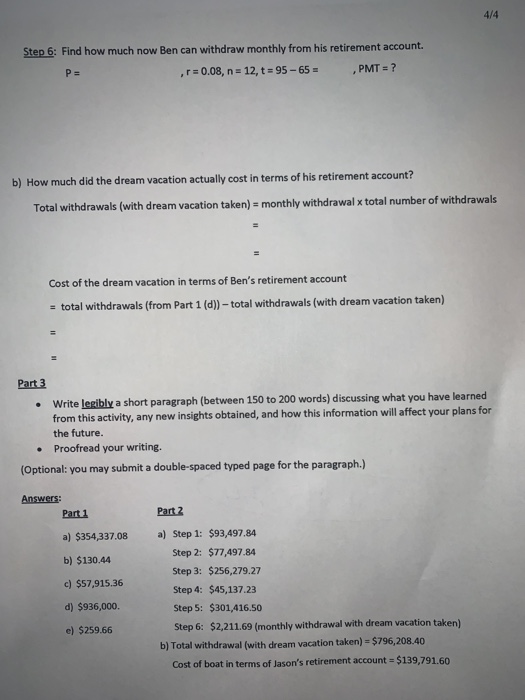

In the original problem, Ben withdrew $16,000 from his retirement account for taking a dream vacation at the age of 50. Again assuming that Ben retires at 65 and lives to 95, a) How much can he now withdraw monthly from his retirement account? To answer this question, do the following steps: Step 1: Find the amount in the account when Ben is 50 years old using the annuity formula with the monthly deposit found in Part 1 (b): D- , r=0.08, n = 12, t = 50 - 28 = F = ? 3/4 Step 2: Find the amount left in the account after the $16,000 withdrawal. Amount left in the account = After the withdrawal, the amount left in the account would continue to draw interest every month until Ben is 65 years old (Step 3). Also, we assume that Ben would continue his investment with the annuity till he retires (Step 4). Step 3: Find the future value of the amount found in Step 2 when Ben is 65 years old, using the compound interest formula with rand n being the same as in Part 1. (Hint: t = 65-50) Step 4: Find the future value of the annuity for the working years: age 50 to 65. Again, the monthly deposit is the result found in Part 1 (b). The sum of the amounts from Steps 3 and 4 is the amount that would be available when Ben retires at 65. Obviously, this amount would be less than the original goal. Step 5. Add the results obtained from Steps 3 and 4. Total amount available when Ben is 65 years old = Now let's figure out the answer to Question (a). The new monthly withdrawal can be found using the installment loan (payout annuity) formula. This time we are looking for PMT with P being the result obtained in Step 5. Step 6: Find how much now Ben can withdraw monthly from his retirement account. P= ,r= 0.08, n = 12, t = 95-65 = PMT = ? b) How much did the dream vacation actually cost in terms of his retirement account? Total withdrawals (with dream vacation taken) = monthly withdrawal x total number of withdrawals Cost of the dream vacation in terms of Ben's retirement account = total withdrawals (from Part 1 (d)) - total withdrawals (with dream vacation taken) Part Ben hopes to retire at the age of 65 and plans to live to be 95 years old. He wants to open a retirement account that will pay him $2,600 a month. Den finds an account that earns interest at 8% compounded monthly. M a) How much wil Ben need in his account at the beginning of his retirement? 303 5 /1 8.00/12 = monthy intresser 2,600 X 136.278315 so years ^2 (360) 1. odeleed 1.006667) 2,400 2,400 1354,337.08) b) Ben is currently 28 years old, what should his monthly deposits into the account be? payment 354337.08 65-28=37 .646.944) 37x12 - 444 = 130.44 130.44 c) What is the total that Ben will deposit? Total deposits = monthly deposit x total number of deposits Total = montry x tota 444 X 130.42 deposit deposit s 57,906:48 - 57,415.36 d) What is the total that Ben will withdraw if he lives to be 95? Total withdrawals a monthly withdrawal x total number of withdrawals 2 TOW=21600X 360 7600 (95-65] X2 Total = 936,000.00 = 936,000 's e) if Ben had started his account at 36 instead of 28, what would his monthly deposits have been? 354,323.62 29 years rentement intrest kate 65-36=29 29x12=340 mother posit ! 75963) 6667 29 years vintillons northy cente I 354337.00 sul 10.666 1.,348) Part 2 1 259.002 In the original problem, Ben withdrew $16,000 from his retirement account for taking a dream vacation at the age of 50. Again assuming that Ben retires at 65 and lives to 95, a) How much can he now withdraw monthly from his retirement account? To answer this question, do the following steps: Step 1: Find the amount in the account when Ben is 50 years old using the annuity formula with the monthly deposit found in Part 1 (b): Da = 0 38, n = 12,t= 50 - 28 = F = ? acation taken) those are the answers just show the work (Part 1 B=130.44) nation will afect your plans for assing what you have learned nation will affect your plans for (Optional: you may submit a -- raph.) Answers: Part 1 a) $354,337.08 b) $130.44 c) $57,915.36 Part 2 a) Step 1: $93,497.84 Step 2: $77,497.84 Step 3: $256,279.27 Step 4: $45,137.23 Step 5: $301,416.50 Step 6: $2,211.69 (monthly withdrawal with dream vacation taken) b) Total withdrawal (with dream vacation taken) = $796,208.40 Cost of boat in terms of Jason's retirement account = $139,791.60 d) $936,000 e) $259.66 MA111-150T, Spring 2020 Course Project Name: Crystal Craru's Project Assignment: Thursday, April 23, 2020 Due date: Thursday, April 30, 2020 The project must be submitted to Assignment: MAU Course Project in Blackboard on the day it is due. Late course project is subject to a 20% per day penalty. The project is worth 20 points (4%) of your course Brade. Instructions and expectations: 1. Complete Parts 1, 2, and 3 of the project as described. 2. Clearly show all the calculations and final answers for each problem in the space provided. Label all answers with the symbol. Round all answers to the nearest cent. Draw a box around finalanswers. 3. Remember to put your name on the front page of your project. Part 1 Ben hopes to retire at the age of 65 and plans to live to be 95 years old. He wants to open a retirement account that will pay him $2,600 a month. Ben finds an account that earns interest at 8% compounded monthly. a) How much will Ben need in his account at the beginning of his retirement? it interest rate 5/19.00/12 = monihy intresti 30 years 2,600 X 136.278315 " 12 (360) 2,600 2,600 1.0064667 1.006667) 354,337.08 b) If Ben is currently 28 years old, what should his monthly deposits into the account be? ayment 354337.08 65- 28=37 16667.444) 37812=444 = 130.44 (130.44) 2/4 c) What is the total that Ben will deposit? Total deposits = monthly deposit x total number of deposits Total - montry r totd 444 X 130.42 00 c) What is the total that Ben will deposit? Total deposits = monthly deposit x total number of deposits Total = monthy & tota 444 X 130.42 deposit deposit osts 1 57,906, 48 57,415.36 d) What is the total that Ben will withdraw if he lives to be 95? Total withdrawals = monthly withdrawal x total number of withdrawals TOW=21600x 360 26000 (95-65] x 12 Total =9346,000.) = 936,000 WD'S e) If Ben had started his account at 36 instead of 28, what would his monthly deposits have been? 354,323,62 zayears rentement monthy ate.6667 intrest kate mothy 65-36=79 29x12=348 759 163 354337.08 S 10.666 1..3.48) 323.00 Part 2 259.4060 a son gesit ! In the original problem, Ben withdrew $16,000 from his retirement account for taking a dream vacation at the age of 50. Again assuming that Ben retires at 65 and lives to 95, a) How much can he now withdraw monthly from his retirement account? To answer this question, do the following steps: Step 1: Find the amount in the account when Ben is 50 years old using the annuity formula with the monthly deposit found in Part 1 (b): D = ,r=0.08, n = 12, t = 50 - 28 = ,F= ? Step 2: Find the amount left in the account after the $16,000 withdrawal. Amount left in the account = After the withdrawal, the amount left in the account would continue to draw interest every month until Ben is 65 years old (Step 3). Also, we assume that Ben would continue his investment with the annuity till he retires (Step 4). Step 3: Find the future value of the amount found in Step 2 when Ben is 65 years old, using the compound interest formula with rand n being the same as in Part 1. (Hint: t65-50) Step 4: Find the future value of the annuity for the working years: age 50 to 65. Again, the monthly deposit is the result found in Part 1 (b). The sum of the amounts from Steps 3 and 4 is the amount that would be available when Ben retires at 65. Obviously, this amount would be less than the original goal. Step 5. Add the results obtained from Steps 3 and 4. Total amount available when Ben is 65 years old - Now let's figure out the answer to Question (a). The new monthly withdrawal can be found using the installment loan (payout annuity) formula. This time we are looking for PMT with P being the result obtained in Step 5. 4/4 Step 6: Find how much now Ben can withdraw monthly from his retirement account. r = 0.08, n = 12,t=95-65 = PMT = ? P= b) How much did the dream vacation actually cost in terms of his retirement account? Total withdrawals (with dream vacation taken) = monthly withdrawal x total number of withdrawals Cost of the dream vacation in terms of Ben's retirement account = total withdrawals (from Part 1 (d)) - total withdrawals (with dream vacation taken) Part 3 Write leribly a short paragraph (between 150 to 200 words) discussing what you have learned from this activity, any new insights obtained, and how this information will affect your plans for the future. Proofread your writing. (Optional: you may submit a double-spaced typed page for the paragraph.) Answers: Part 1 Part 2 a) $354,337.08 b) $130.44 c) $57,915.36 a) Step 1: $93,497.84 Step 2: $77,497.84 Step 3: $256,279.27 Step 4: $45,137.23 Step 5: $301,416.50 Step 6: $2,211.69 (monthly withdrawal with dream vacation taken) b) Total withdrawal (with dream vacation taken) = $796,208.40 Cost of boat in terms of Jason's retirement account = $139,791.60 d) $936,000 e) $259.66 In the original problem, Ben withdrew $16,000 from his retirement account for taking a dream vacation at the age of 50. Again assuming that Ben retires at 65 and lives to 95, a) How much can he now withdraw monthly from his retirement account? To answer this question, do the following steps: Step 1: Find the amount in the account when Ben is 50 years old using the annuity formula with the monthly deposit found in Part 1 (b): D- , r=0.08, n = 12, t = 50 - 28 = F = ? 3/4 Step 2: Find the amount left in the account after the $16,000 withdrawal. Amount left in the account = After the withdrawal, the amount left in the account would continue to draw interest every month until Ben is 65 years old (Step 3). Also, we assume that Ben would continue his investment with the annuity till he retires (Step 4). Step 3: Find the future value of the amount found in Step 2 when Ben is 65 years old, using the compound interest formula with rand n being the same as in Part 1. (Hint: t = 65-50) Step 4: Find the future value of the annuity for the working years: age 50 to 65. Again, the monthly deposit is the result found in Part 1 (b). The sum of the amounts from Steps 3 and 4 is the amount that would be available when Ben retires at 65. Obviously, this amount would be less than the original goal. Step 5. Add the results obtained from Steps 3 and 4. Total amount available when Ben is 65 years old = Now let's figure out the answer to Question (a). The new monthly withdrawal can be found using the installment loan (payout annuity) formula. This time we are looking for PMT with P being the result obtained in Step 5. Step 6: Find how much now Ben can withdraw monthly from his retirement account. P= ,r= 0.08, n = 12, t = 95-65 = PMT = ? b) How much did the dream vacation actually cost in terms of his retirement account? Total withdrawals (with dream vacation taken) = monthly withdrawal x total number of withdrawals Cost of the dream vacation in terms of Ben's retirement account = total withdrawals (from Part 1 (d)) - total withdrawals (with dream vacation taken) Part Ben hopes to retire at the age of 65 and plans to live to be 95 years old. He wants to open a retirement account that will pay him $2,600 a month. Den finds an account that earns interest at 8% compounded monthly. M a) How much wil Ben need in his account at the beginning of his retirement? 303 5 /1 8.00/12 = monthy intresser 2,600 X 136.278315 so years ^2 (360) 1. odeleed 1.006667) 2,400 2,400 1354,337.08) b) Ben is currently 28 years old, what should his monthly deposits into the account be? payment 354337.08 65-28=37 .646.944) 37x12 - 444 = 130.44 130.44 c) What is the total that Ben will deposit? Total deposits = monthly deposit x total number of deposits Total = montry x tota 444 X 130.42 deposit deposit s 57,906:48 - 57,415.36 d) What is the total that Ben will withdraw if he lives to be 95? Total withdrawals a monthly withdrawal x total number of withdrawals 2 TOW=21600X 360 7600 (95-65] X2 Total = 936,000.00 = 936,000 's e) if Ben had started his account at 36 instead of 28, what would his monthly deposits have been? 354,323.62 29 years rentement intrest kate 65-36=29 29x12=340 mother posit ! 75963) 6667 29 years vintillons northy cente I 354337.00 sul 10.666 1.,348) Part 2 1 259.002 In the original problem, Ben withdrew $16,000 from his retirement account for taking a dream vacation at the age of 50. Again assuming that Ben retires at 65 and lives to 95, a) How much can he now withdraw monthly from his retirement account? To answer this question, do the following steps: Step 1: Find the amount in the account when Ben is 50 years old using the annuity formula with the monthly deposit found in Part 1 (b): Da = 0 38, n = 12,t= 50 - 28 = F = ? acation taken) those are the answers just show the work (Part 1 B=130.44) nation will afect your plans for assing what you have learned nation will affect your plans for (Optional: you may submit a -- raph.) Answers: Part 1 a) $354,337.08 b) $130.44 c) $57,915.36 Part 2 a) Step 1: $93,497.84 Step 2: $77,497.84 Step 3: $256,279.27 Step 4: $45,137.23 Step 5: $301,416.50 Step 6: $2,211.69 (monthly withdrawal with dream vacation taken) b) Total withdrawal (with dream vacation taken) = $796,208.40 Cost of boat in terms of Jason's retirement account = $139,791.60 d) $936,000 e) $259.66 MA111-150T, Spring 2020 Course Project Name: Crystal Craru's Project Assignment: Thursday, April 23, 2020 Due date: Thursday, April 30, 2020 The project must be submitted to Assignment: MAU Course Project in Blackboard on the day it is due. Late course project is subject to a 20% per day penalty. The project is worth 20 points (4%) of your course Brade. Instructions and expectations: 1. Complete Parts 1, 2, and 3 of the project as described. 2. Clearly show all the calculations and final answers for each problem in the space provided. Label all answers with the symbol. Round all answers to the nearest cent. Draw a box around finalanswers. 3. Remember to put your name on the front page of your project. Part 1 Ben hopes to retire at the age of 65 and plans to live to be 95 years old. He wants to open a retirement account that will pay him $2,600 a month. Ben finds an account that earns interest at 8% compounded monthly. a) How much will Ben need in his account at the beginning of his retirement? it interest rate 5/19.00/12 = monihy intresti 30 years 2,600 X 136.278315 " 12 (360) 2,600 2,600 1.0064667 1.006667) 354,337.08 b) If Ben is currently 28 years old, what should his monthly deposits into the account be? ayment 354337.08 65- 28=37 16667.444) 37812=444 = 130.44 (130.44) 2/4 c) What is the total that Ben will deposit? Total deposits = monthly deposit x total number of deposits Total - montry r totd 444 X 130.42 00 c) What is the total that Ben will deposit? Total deposits = monthly deposit x total number of deposits Total = monthy & tota 444 X 130.42 deposit deposit osts 1 57,906, 48 57,415.36 d) What is the total that Ben will withdraw if he lives to be 95? Total withdrawals = monthly withdrawal x total number of withdrawals TOW=21600x 360 26000 (95-65] x 12 Total =9346,000.) = 936,000 WD'S e) If Ben had started his account at 36 instead of 28, what would his monthly deposits have been? 354,323,62 zayears rentement monthy ate.6667 intrest kate mothy 65-36=79 29x12=348 759 163 354337.08 S 10.666 1..3.48) 323.00 Part 2 259.4060 a son gesit ! In the original problem, Ben withdrew $16,000 from his retirement account for taking a dream vacation at the age of 50. Again assuming that Ben retires at 65 and lives to 95, a) How much can he now withdraw monthly from his retirement account? To answer this question, do the following steps: Step 1: Find the amount in the account when Ben is 50 years old using the annuity formula with the monthly deposit found in Part 1 (b): D = ,r=0.08, n = 12, t = 50 - 28 = ,F= ? Step 2: Find the amount left in the account after the $16,000 withdrawal. Amount left in the account = After the withdrawal, the amount left in the account would continue to draw interest every month until Ben is 65 years old (Step 3). Also, we assume that Ben would continue his investment with the annuity till he retires (Step 4). Step 3: Find the future value of the amount found in Step 2 when Ben is 65 years old, using the compound interest formula with rand n being the same as in Part 1. (Hint: t65-50) Step 4: Find the future value of the annuity for the working years: age 50 to 65. Again, the monthly deposit is the result found in Part 1 (b). The sum of the amounts from Steps 3 and 4 is the amount that would be available when Ben retires at 65. Obviously, this amount would be less than the original goal. Step 5. Add the results obtained from Steps 3 and 4. Total amount available when Ben is 65 years old - Now let's figure out the answer to Question (a). The new monthly withdrawal can be found using the installment loan (payout annuity) formula. This time we are looking for PMT with P being the result obtained in Step 5. 4/4 Step 6: Find how much now Ben can withdraw monthly from his retirement account. r = 0.08, n = 12,t=95-65 = PMT = ? P= b) How much did the dream vacation actually cost in terms of his retirement account? Total withdrawals (with dream vacation taken) = monthly withdrawal x total number of withdrawals Cost of the dream vacation in terms of Ben's retirement account = total withdrawals (from Part 1 (d)) - total withdrawals (with dream vacation taken) Part 3 Write leribly a short paragraph (between 150 to 200 words) discussing what you have learned from this activity, any new insights obtained, and how this information will affect your plans for the future. Proofread your writing. (Optional: you may submit a double-spaced typed page for the paragraph.) Answers: Part 1 Part 2 a) $354,337.08 b) $130.44 c) $57,915.36 a) Step 1: $93,497.84 Step 2: $77,497.84 Step 3: $256,279.27 Step 4: $45,137.23 Step 5: $301,416.50 Step 6: $2,211.69 (monthly withdrawal with dream vacation taken) b) Total withdrawal (with dream vacation taken) = $796,208.40 Cost of boat in terms of Jason's retirement account = $139,791.60 d) $936,000 e) $259.66