Answered step by step

Verified Expert Solution

Question

1 Approved Answer

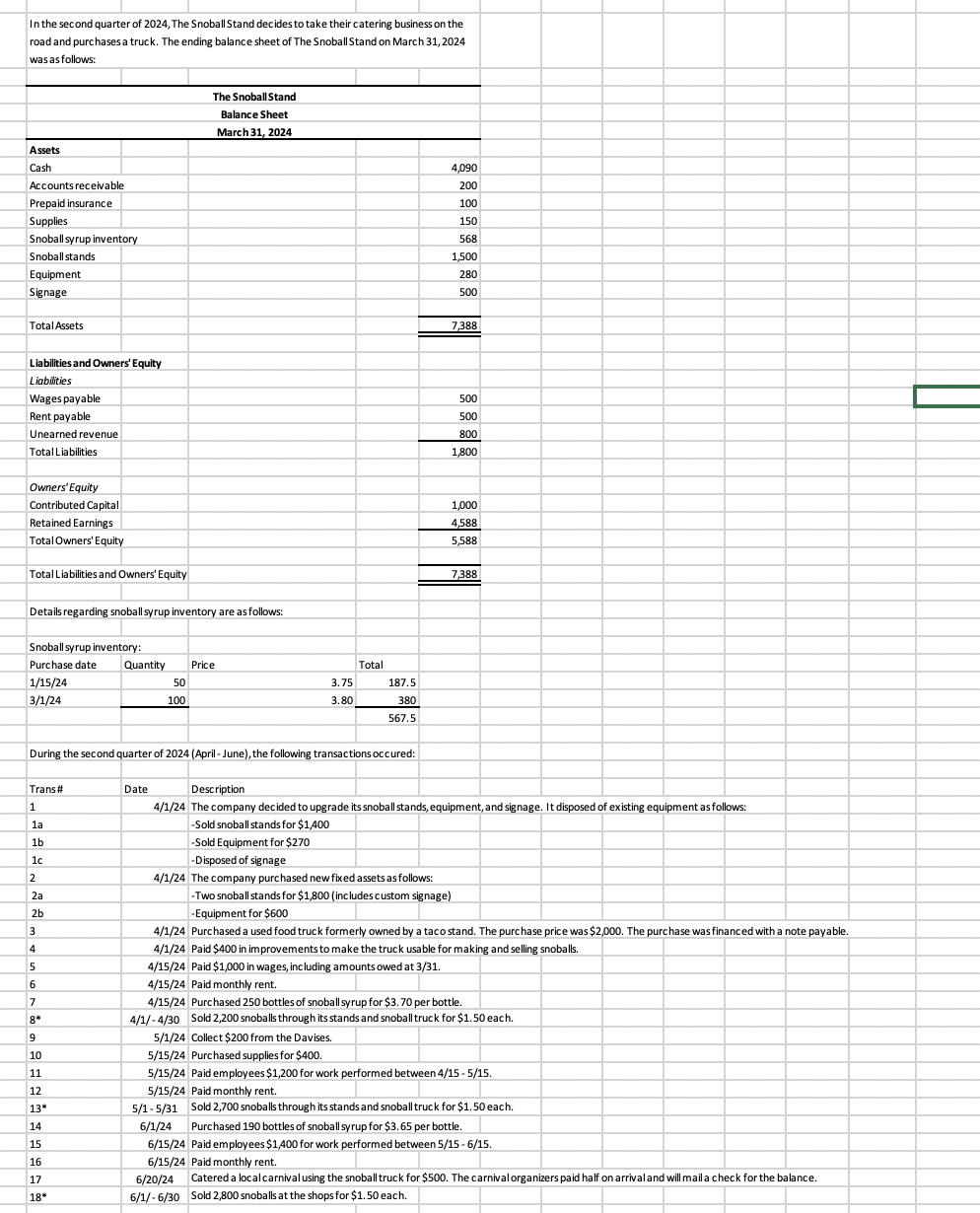

In the second quarter of 2024, The Snoball Stand decides to take their catering business on the road and purchases a truck. The ending balance

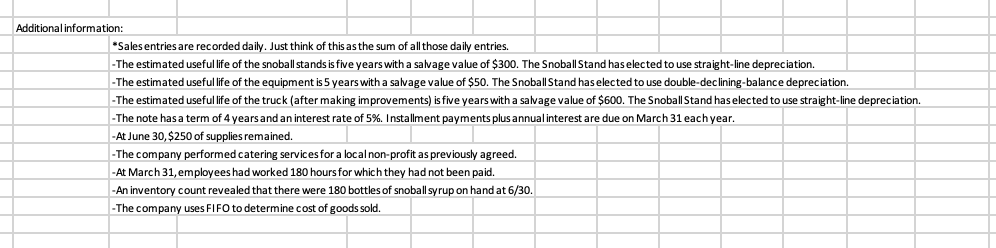

In the second quarter of 2024, The Snoball Stand decides to take their catering business on the road and purchases a truck. The ending balance sheet of The Snoball Stand on March 31, 2024 was as follows: Additional information: *Sales entries are recorded daily. Just think of this as the sum of all those daily entries. -The estimated useful life of the snoball stands is five years with a salvage value of $300. The Snoball Stand has elected to use straight-line depreciation. -The estimated useful life of the equipment is 5 years with a salvage value of $50. The Snoball Stand has elected to use double-declining-balance depreciation. -The estimated useful life of the truck (after making improvements) is five years with a salvage value of $600. The Snoball Stand has elected to use straight-line depreciation. -The note has a term of 4 years and an interest rate of 5%. Installment payments plus annual interest are due on March 31 each year. -At June 30,$250 of supplies remained. -The company performed catering services for a local non-profit as previously agreed. -At March 31, employees had worked 180 hours for which they had not been paid. -An inventory count revealed that there were 180 bottles of snoball syrup on hand at 6/30. -The company uses FIFO to determine cost of goods sold. In the second quarter of 2024, The Snoball Stand decides to take their catering business on the road and purchases a truck. The ending balance sheet of The Snoball Stand on March 31, 2024 was as follows: Additional information: *Sales entries are recorded daily. Just think of this as the sum of all those daily entries. -The estimated useful life of the snoball stands is five years with a salvage value of $300. The Snoball Stand has elected to use straight-line depreciation. -The estimated useful life of the equipment is 5 years with a salvage value of $50. The Snoball Stand has elected to use double-declining-balance depreciation. -The estimated useful life of the truck (after making improvements) is five years with a salvage value of $600. The Snoball Stand has elected to use straight-line depreciation. -The note has a term of 4 years and an interest rate of 5%. Installment payments plus annual interest are due on March 31 each year. -At June 30,$250 of supplies remained. -The company performed catering services for a local non-profit as previously agreed. -At March 31, employees had worked 180 hours for which they had not been paid. -An inventory count revealed that there were 180 bottles of snoball syrup on hand at 6/30. -The company uses FIFO to determine cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started