Question

In the second scenario, Liam could pay back the loan in 20 years instead of 15 and reduce his monthly payments to $6,000 with an

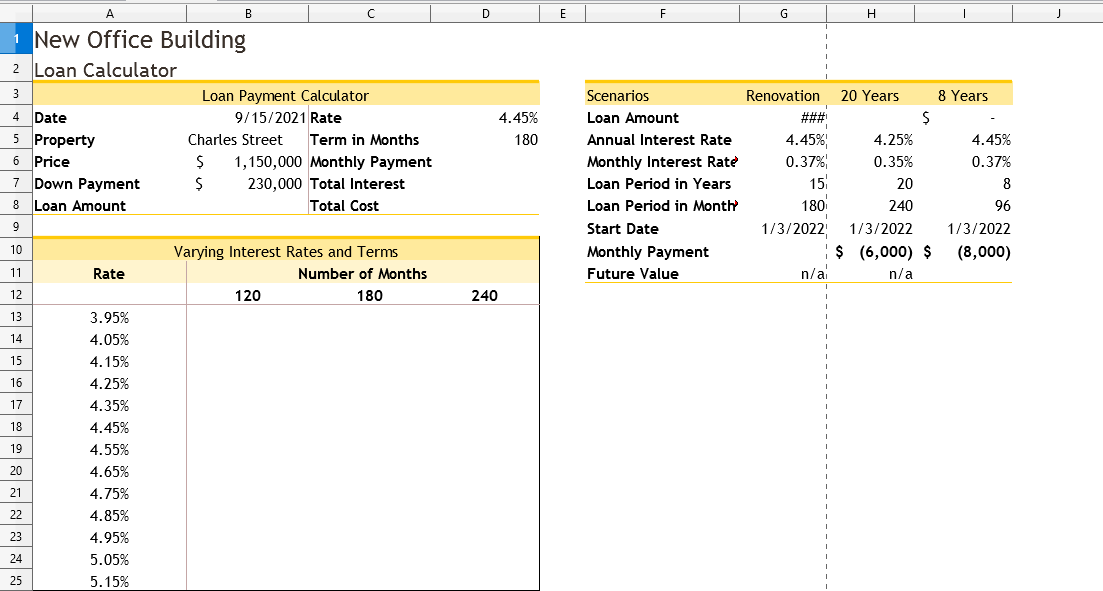

In the second scenario, Liam could pay back the loan in 20 years instead of 15 and reduce his monthly payments to $6,000 with an annual interest rate of 4.5%. He wants to know the loan amount he should request with those conditions. In cell H4, insert a formula using the PV function and the monthly interest rate (cell H6), the loan period in months (cell H8), and the monthly payment (cell H10) to calculate the loan amount for the 20-year scenario.

In the third scenario, Liam could pay back the loan for eight years with a monthly payment of $8,000 and then renegotiate better terms. He wants to know the amount remaining on the loan after eight years or the future value of the loan. In cell I11, insert a formula using the FV function and the rate (cell I6), the number of periods (cell I8), the monthly payment (cell I10), and the loan amount (cell I4) to calculate the future value of the loan for the eight-year scenario.

Liam plans to print parts of the Loan Calculator workbook. Prepare for printing as follows:

Set row 3 as the print titles for the worksheet.

Set the range F3:I11 as the print area.

Hide the Properties worksheet, which contains data Liam wants to keep private.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started