Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the US, agriculture is financed using corporate bonds issued by agricultural banks, and bought by institutional investors. The use of proceeds of these bonds

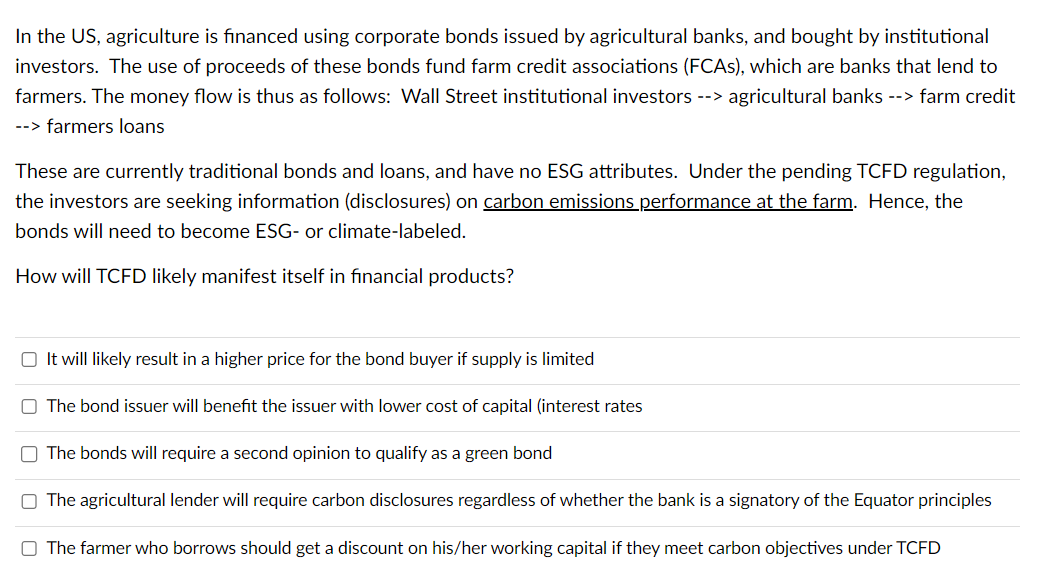

In the US, agriculture is financed using corporate bonds issued by agricultural banks, and bought by institutional investors. The use of proceeds of these bonds fund farm credit associations (FCAs), which are banks that lend to farmers. The money flow is thus as follows: Wall Street institutional investors --> agricultural banks --> farm credit --> farmers loans These are currently traditional bonds and loans, and have no ESG attributes. Under the pending TCFD regulation, the investors are seeking information (disclosures) on carbon emissions performance at the farm. Hence, the bonds will need to become ESG- or climate-labeled. How will TCFD likely manifest itself in financial products? It will likely result in a higher price for the bond buyer if supply is limited The bond issuer will benefit the issuer with lower cost of capital (interest rates The bonds will require a second opinion to qualify as a green bond The agricultural lender will require carbon disclosures regardless of whether the bank is a signatory of the Equator principles The farmer who borrows should get a discount on his/her working capital if they meet carbon objectives under TCFD

In the US, agriculture is financed using corporate bonds issued by agricultural banks, and bought by institutional investors. The use of proceeds of these bonds fund farm credit associations (FCAs), which are banks that lend to farmers. The money flow is thus as follows: Wall Street institutional investors --> agricultural banks --> farm credit --> farmers loans These are currently traditional bonds and loans, and have no ESG attributes. Under the pending TCFD regulation, the investors are seeking information (disclosures) on carbon emissions performance at the farm. Hence, the bonds will need to become ESG- or climate-labeled. How will TCFD likely manifest itself in financial products? It will likely result in a higher price for the bond buyer if supply is limited The bond issuer will benefit the issuer with lower cost of capital (interest rates The bonds will require a second opinion to qualify as a green bond The agricultural lender will require carbon disclosures regardless of whether the bank is a signatory of the Equator principles The farmer who borrows should get a discount on his/her working capital if they meet carbon objectives under TCFD Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started