Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this final project you will create a spreadsheet which will calculate mortgage terms to build amortization schedules for a 30 year loan and

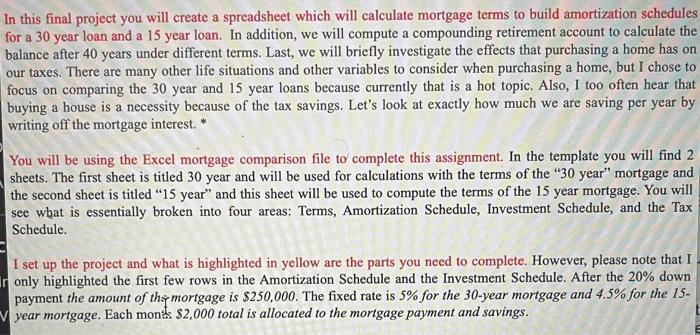

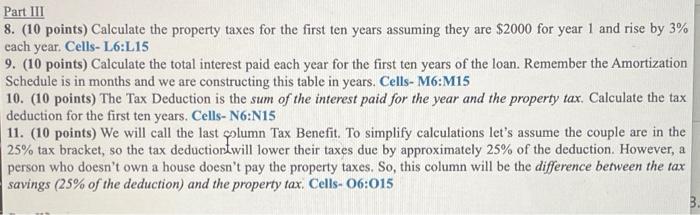

In this final project you will create a spreadsheet which will calculate mortgage terms to build amortization schedules for a 30 year loan and a 15 year loan. In addition, we will compute a compounding retirement account to calculate the balance after 40 years under different terms. Last, we will briefly investigate the effects that purchasing a home has on our taxes. There are many other life situations and other variables to consider when purchasing a home, but I chose to focus on comparing the 30 year and 15 year loans because currently that is a hot topic. Also, I too often hear that buying a house is a necessity because of the tax savings. Let's look at exactly how much we are saving per year by writing off the mortgage interest.* You will be using the Excel mortgage comparison file to complete this assignment. In the template you will find 2 sheets. The first sheet is titled 30 year and will be used for calculations with the terms of the "30 year" mortgage and the second sheet is titled "15 year" and this sheet will be used to compute the terms of the 15 year mortgage. You will see what is essentially broken into four areas: Terms, Amortization Schedule, Investment Schedule, and the Tax Schedule. I set up the project and what is highlighted in yellow are the parts you need to complete. However, please note that I only highlighted the first few rows in the Amortization Schedule and the Investment Schedule. After the 20% down payment the amount of the mortgage is $250,000. The fixed rate is 5% for the 30-year mortgage and 4.5% for the 15- year mortgage. Each mont: $2,000 total is allocated to the mortgage payment and savings. Part III 8. (10 points) Calculate the property taxes for the first ten years assuming they are $2000 for year 1 and rise by 3% each year. Cells- L6:L15 9. (10 points) Calculate the total interest paid each year for the first ten years of the loan. Remember the Amortization Schedule is in months and we are constructing this table in years. Cells- M6:M15 10. (10 points) The Tax Deduction is the sum of the interest paid for the year and the property tax. Calculate the tax deduction for the first ten years. Cells- N6:N15 11. (10 points) We will call the last column Tax Benefit. To simplify calculations let's assume the couple are in the 25% tax bracket, so the tax deduction will lower their taxes due by approximately 25% of the deduction. However, a person who doesn't own a house doesn't pay the property taxes. So, this column will be the difference between the tax savings (25% of the deduction) and the property tax. Cells- 06:015 B.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started