Question: we will be playing with the US stock data collected in the past few months. You can download the file stock.zip from Canvas. The

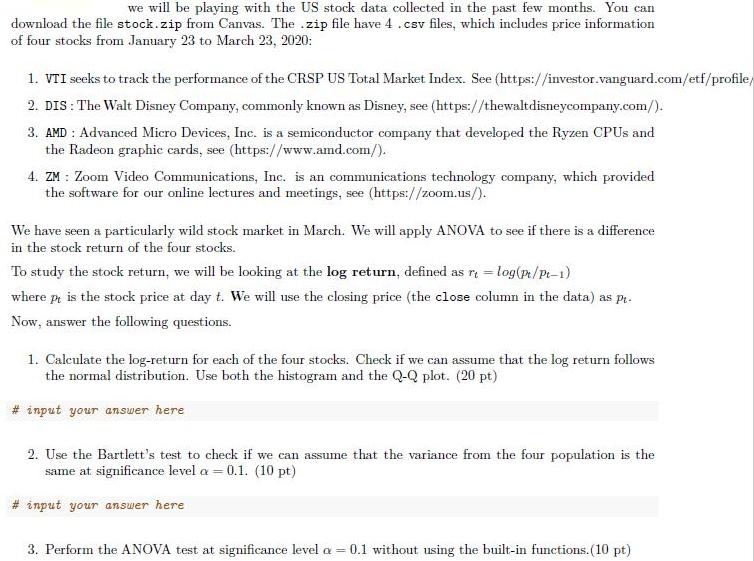

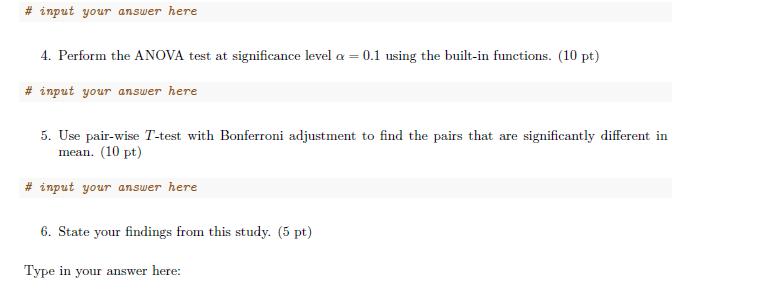

we will be playing with the US stock data collected in the past few months. You can download the file stock.zip from Canvas. The .zip file have 4 .csv files, which includes price information of four stocks from January 23 to March 23, 2020: 1. VTI seeks to track the performance of the CRSP US Total Market Index. See (https://investor.vanguard.com/etf/profile/ 2. DIS : The Walt Disney Company, commonly known as Disney, see (https://thewaltdisneycompany.com/). 3. AMD : Advanced Micro Devices, Inc. is a semiconductor company that developed the Ryzen CPUS and the Radeon graphic cards, see (https://www.amd.com/). 4. ZM : Zoom Video Communications, Inc. is an communications technology company, which provided the software for our online lectures and meetings, see (https://zoom.us/). We have seen a particularly wild stock market in March. We will apply ANOVA to see if there is a difference in the stock return of the four stocks. To study the stock return, we will be looking at the log return, defined as r = log(p/Pt-1) where pr is the stock price at day t. We will use the closing price (the close column in the data) as Pt. Now, answer the following questions. 1. Calculate the log-return for each of the four stocks. Check if we can assume that the log return follows the normal distribution. Use both the histogram and the Q-Q plot. (20 pt) # input your answer here 2. Use the Bartlett's test to check if we can assume that the variance from the four population is the same at significance level a = 0.1. (10 pt) # input your answer here 3. Perform the ANOVA test at significance level a = 0.1 without using the built-in functions. (10 pt) # input your answer here 4. Perform the ANOVA test at significance level a = 0.1 using the built-in functions. (10 pt) # input your answer here 5. Use pair-wise T-test with Bonferroni adjustment to find the pairs that are significantly different in mean. (10 pt) # input your answer here 6. State your findings from this study. (5 pt) Type in your answer here:

Step by Step Solution

3.44 Rating (173 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts