Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this problem you are to continue your fantasy that you are an Arbitrage Seeking Bond Trader (ASBT). Your fantasy is now a bit

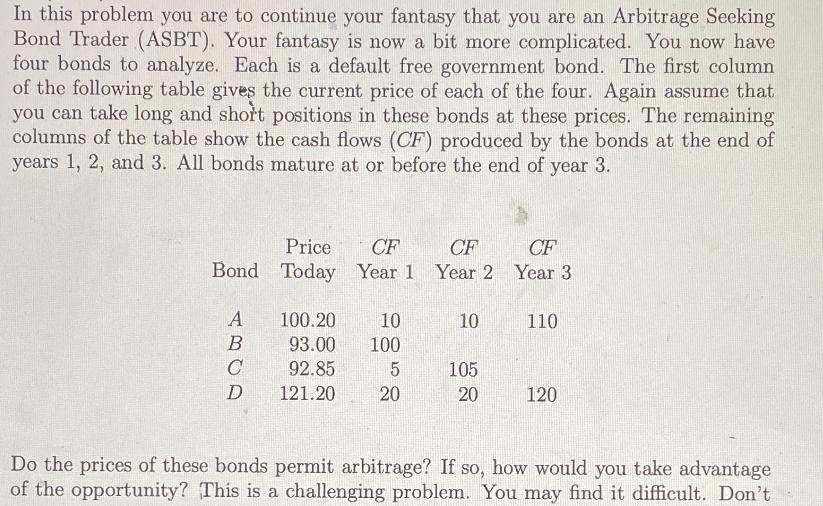

In this problem you are to continue your fantasy that you are an Arbitrage Seeking Bond Trader (ASBT). Your fantasy is now a bit more complicated. You now have four bonds to analyze. Each is a default free government bond. The first column of the following table gives the current price of each of the four. Again assume that you can take long and short positions in these bonds at these prices. The remaining columns of the table show the cash flows (CF) produced by the bonds at the end of years 1, 2, and 3. All bonds mature at or before the end of year 3. Bond A B C D Price CF Today Year 1 100.20 93.00 92.85 121.20 10 100 5 20 CF Year 2 10 105 20 CF Year 3 110 120 Do the prices of these bonds permit arbitrage? If so, how would you take advantage of the opportunity? This is a challenging problem. You may find it difficult. Don't

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

In this question were looking to see if we can create an arbitrage opportunity from the given bond prices and their cash flows Arbitrage is the practi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started