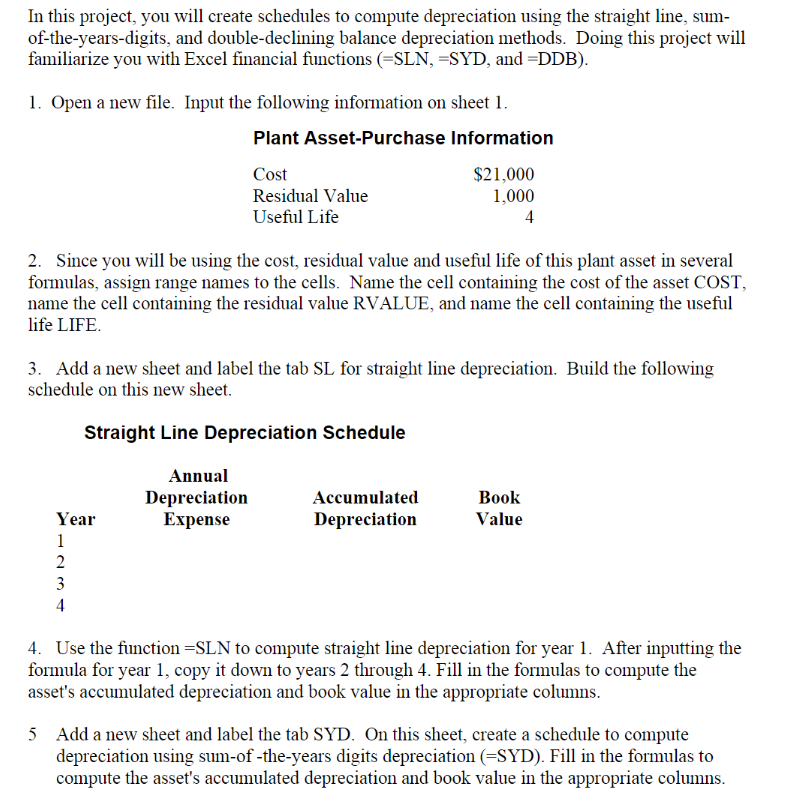

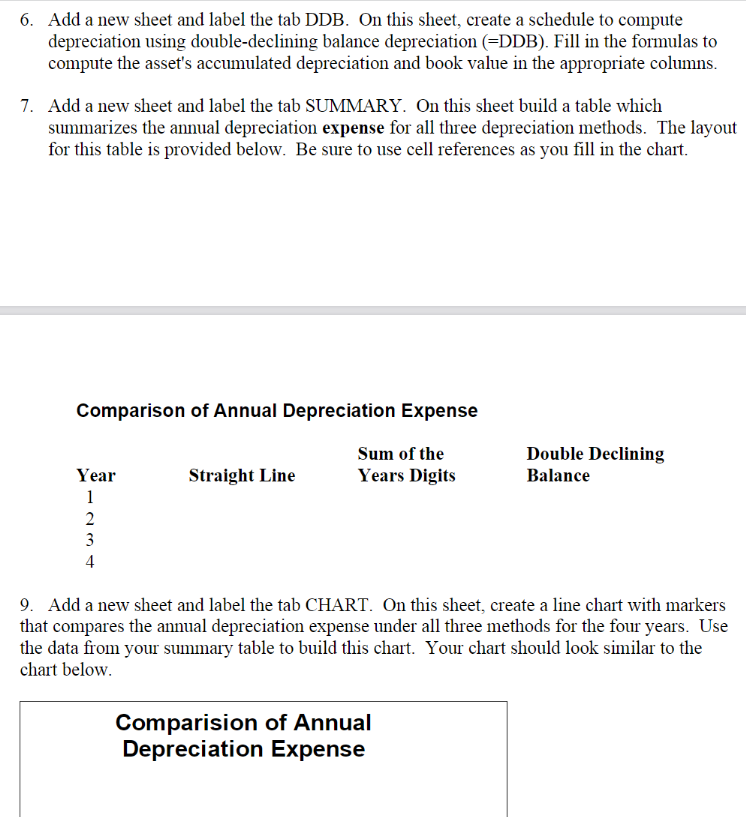

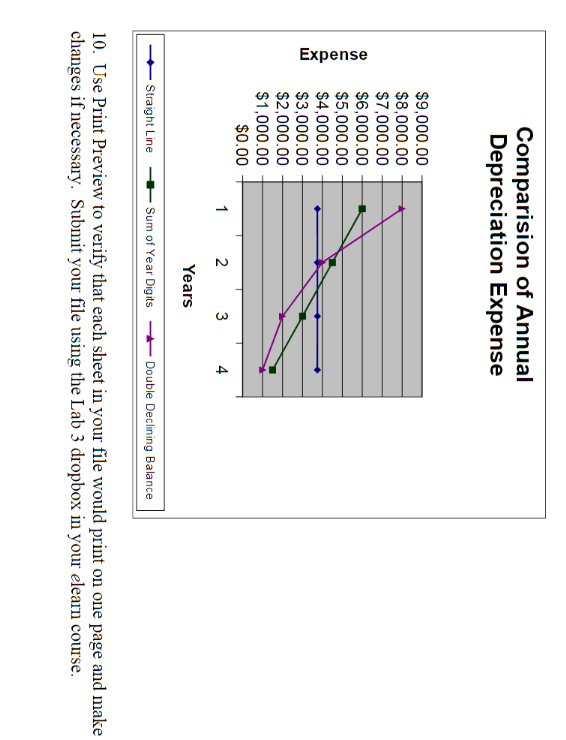

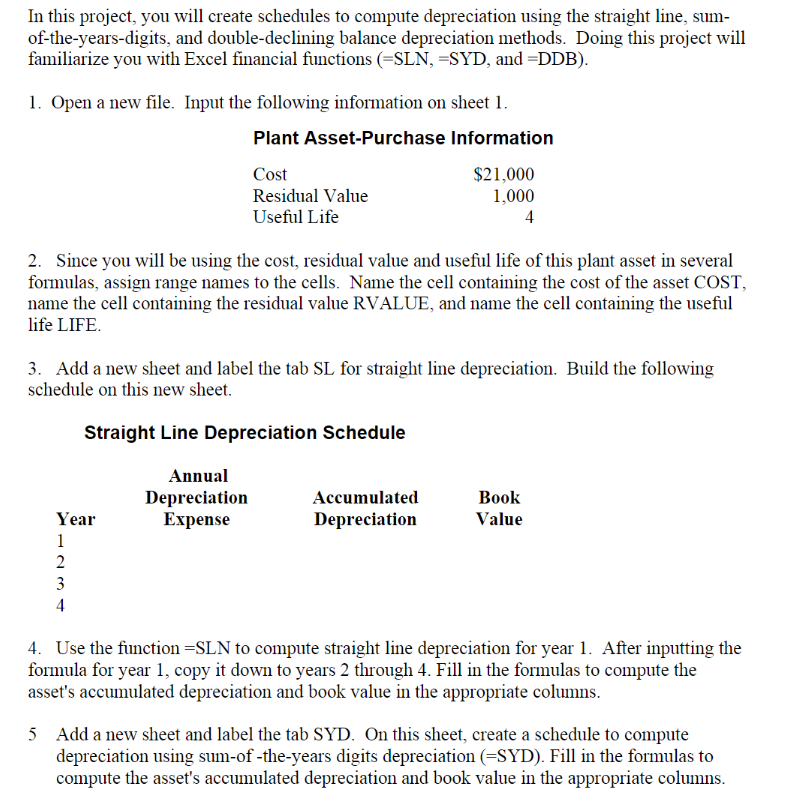

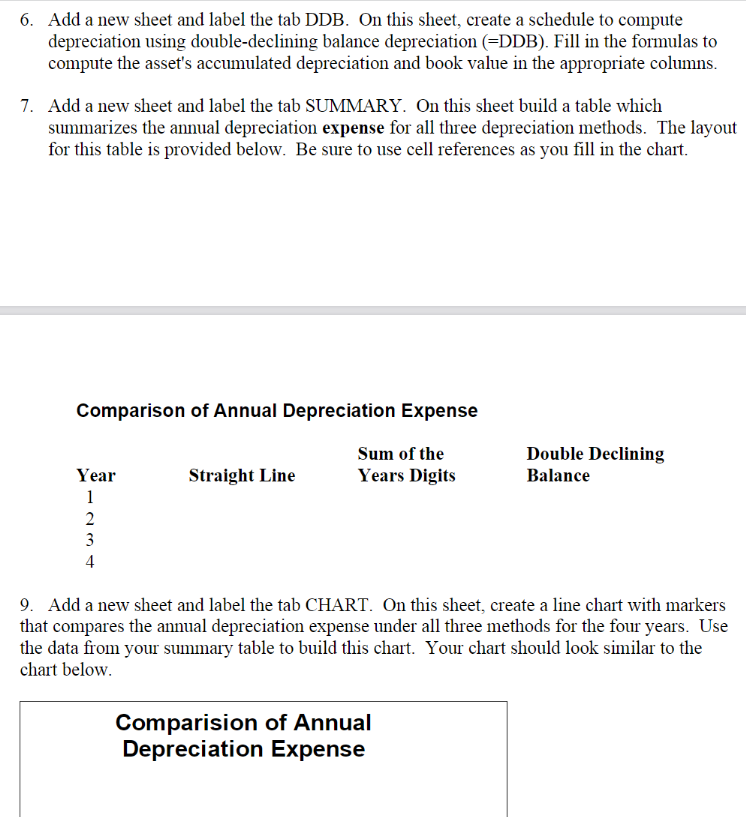

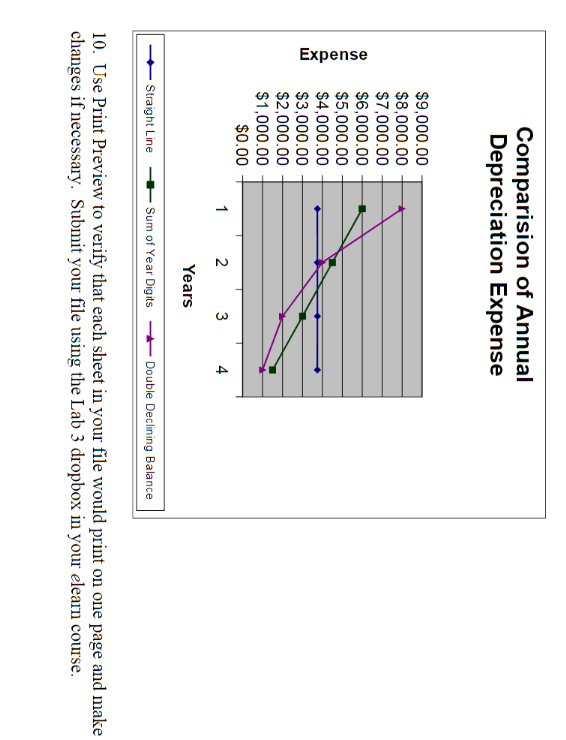

In this project, you will create schedules to compute depreciation using the straight line, sumof-the-years-digits, and double-declining balance depreciation methods. Doing this project will familiarize you with Excel financial functions ( = SLN, = SYD, and =DDB). 1. Open a new file. Input the following information on sheet 1 . 2. Since you will be using the cost, residual value and useful life of this plant asset in several formulas, assign range names to the cells. Name the cell containing the cost of the asset COST, name the cell containing the residual value RVALUE, and name the cell containing the useful life LIFE. 3. Add a new sheet and label the tab SL for straight line depreciation. Build the following schedule on this new sheet. Straight Line Depreciation Schedule 4. Use the function = SLN to compute straight line depreciation for year 1 . After inputting the formula for year 1, copy it down to years 2 through 4 . Fill in the formulas to compute the asset's accumulated depreciation and book value in the appropriate columns. 5 Add a new sheet and label the tab SYD. On this sheet, create a schedule to compute depreciation using sum-of -the-years digits depreciation (=SYD). Fill in the formulas to compute the asset's accumulated depreciation and book value in the appropriate columns. 6. Add a new sheet and label the tab DDB. On this sheet, create a schedule to compute depreciation using double-declining balance depreciation (=DDB). Fill in the formulas to compute the asset's accumulated depreciation and book value in the appropriate columns. 7. Add a new sheet and label the tab SUMMARY. On this sheet build a table which summarizes the annual depreciation expense for all three depreciation methods. The layout for this table is provided below. Be sure to use cell references as you fill in the chart. Comparison of Annual Depreciation Expense 9. Add a new sheet and label the tab CHART. On this sheet, create a line chart with markers that compares the annual depreciation expense under all three methods for the four years. Use the data from your summary table to build this chart. Your chart should look similar to the chart below. 10. Use Print Preview to verify that each sheet in your file would print on one page and make changes if necessary. Submit your file using the Lab 3 dropbox in your elearn course. In this project, you will create schedules to compute depreciation using the straight line, sumof-the-years-digits, and double-declining balance depreciation methods. Doing this project will familiarize you with Excel financial functions ( = SLN, = SYD, and =DDB). 1. Open a new file. Input the following information on sheet 1 . 2. Since you will be using the cost, residual value and useful life of this plant asset in several formulas, assign range names to the cells. Name the cell containing the cost of the asset COST, name the cell containing the residual value RVALUE, and name the cell containing the useful life LIFE. 3. Add a new sheet and label the tab SL for straight line depreciation. Build the following schedule on this new sheet. Straight Line Depreciation Schedule 4. Use the function = SLN to compute straight line depreciation for year 1 . After inputting the formula for year 1, copy it down to years 2 through 4 . Fill in the formulas to compute the asset's accumulated depreciation and book value in the appropriate columns. 5 Add a new sheet and label the tab SYD. On this sheet, create a schedule to compute depreciation using sum-of -the-years digits depreciation (=SYD). Fill in the formulas to compute the asset's accumulated depreciation and book value in the appropriate columns. 6. Add a new sheet and label the tab DDB. On this sheet, create a schedule to compute depreciation using double-declining balance depreciation (=DDB). Fill in the formulas to compute the asset's accumulated depreciation and book value in the appropriate columns. 7. Add a new sheet and label the tab SUMMARY. On this sheet build a table which summarizes the annual depreciation expense for all three depreciation methods. The layout for this table is provided below. Be sure to use cell references as you fill in the chart. Comparison of Annual Depreciation Expense 9. Add a new sheet and label the tab CHART. On this sheet, create a line chart with markers that compares the annual depreciation expense under all three methods for the four years. Use the data from your summary table to build this chart. Your chart should look similar to the chart below. 10. Use Print Preview to verify that each sheet in your file would print on one page and make changes if necessary. Submit your file using the Lab 3 dropbox in your elearn course