Answered step by step

Verified Expert Solution

Question

1 Approved Answer

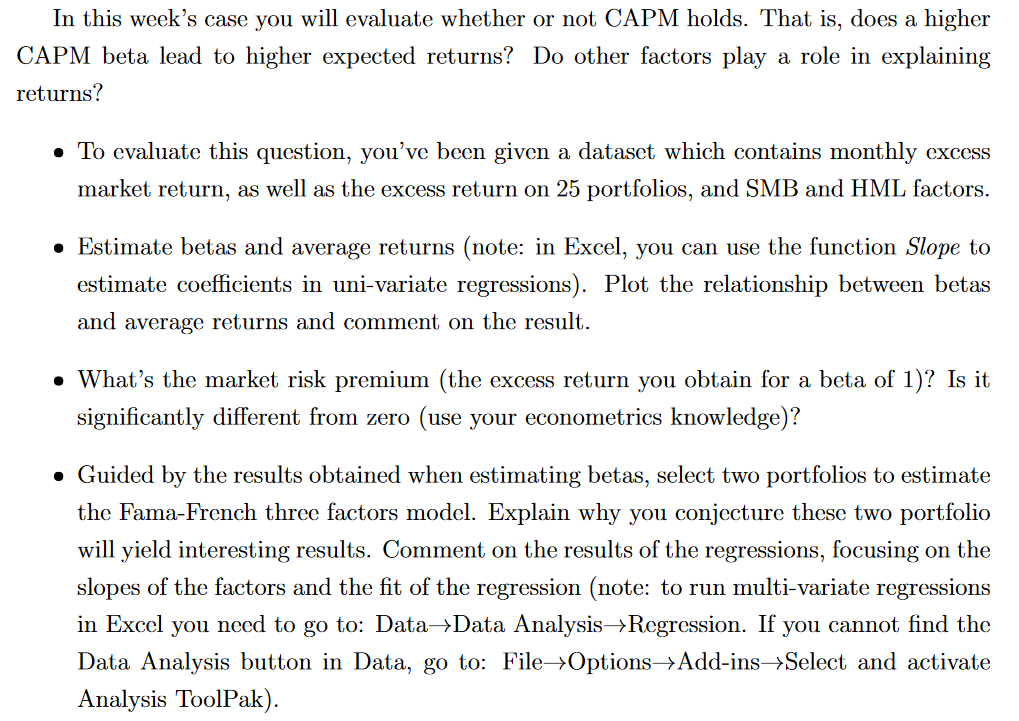

In this week's case you will eIn this week's case you will evaluate whether or not CAPM holds. That is , does a higher CAPM

In this week's case you will eIn this week's case you will evaluate whether or not CAPM holds. That is does a higher

CAPM beta lead to higher expected returns? Do other factors play a role in explaining

returns?

To evaluate this question, you've been given a dataset which contains monthly excess

market return, as well as the excess return on portfolios, and SMB and HML factors.

Estimate betas and average returns note: in Excel, you can use the function Slope to

estimate coefficients in univariate regressions Plot the relationship between betas

and average returns and comment on the result.

What's the market risk premium the excess return you obtain for a beta of Is it

significantly different from zero use your econometrics knowledge

Guided by the results obtained when estimating betas, select two portfolios to estimate

the FamaFrench three factors model. Explain why you conjecture these two portfolio

will yield interesting results. Comment on the results of the regressions, focusing on the

slopes of the factors and the fit of the regression note: to run multivariate regressions

in Excel you need to go to: Data Data Analysis Regression. If you cannot find the

Data Analysis button in Data, go to: File Options Addins Select and activate

Analysis ToolPakvaluate whether or not CAPM holds. That is does a higher

CAPM beta lead to higher expected returns? Do other factors play a role in explaining

returns?

To evaluate this question, you've been given a dataset which contains monthly excess

market return, as well as the excess return on portfolios, and SMB and HML factors.

Estimate betas and average returns note: in Excel, you can use the function Slope to

estimate coefficients in univariate regressions Plot the relationship between betas

and average returns and comment on the result.

What's the market risk premium the excess return you obtain for a beta of Is it

significantly different from zero use your econometrics knowledge

Guided by the results obtained when estimating betas, select two portfolios to estimate

the FamaFrench three factors model. Explain why you conjecture these two portfolio

will yield interesting results. Comment on the results of the regressions, focusing on the

slopes of the factors and the fit of the regression note: to run multivariate regressions

in Excel you need to go to: Data Data Analysis Regression. If you cannot find the

Data Analysis button in Data, go to: File Options Addins Select and activate

Analysis ToolPak

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started