Question

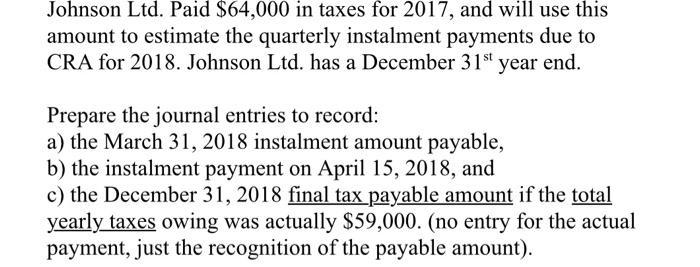

Johnson Ltd. Paid $64,000 in taxes for 2017, and will use this amount to estimate the quarterly instalment payments due to CRA for 2018.

Johnson Ltd. Paid $64,000 in taxes for 2017, and will use this amount to estimate the quarterly instalment payments due to CRA for 2018. Johnson Ltd. has a December 31st year end. Prepare the journal entries to record: a) the March 31, 2018 instalment amount payable, b) the instalment payment on April 15, 2018, and c) the December 31, 2018 final tax payable amount if the total yearly taxes owing was actually $59,000. (no entry for the actual payment, just the recognition of the payable amount).

Step by Step Solution

3.38 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

Page 1 Solution Journal Entries Date Particulars Debit 31 March Tax Expense instalment 16...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Management Concepts and Skills

Authors: Samuel C. Certo

13th edition

133059928, 978-0133059922

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App