Answered step by step

Verified Expert Solution

Question

1 Approved Answer

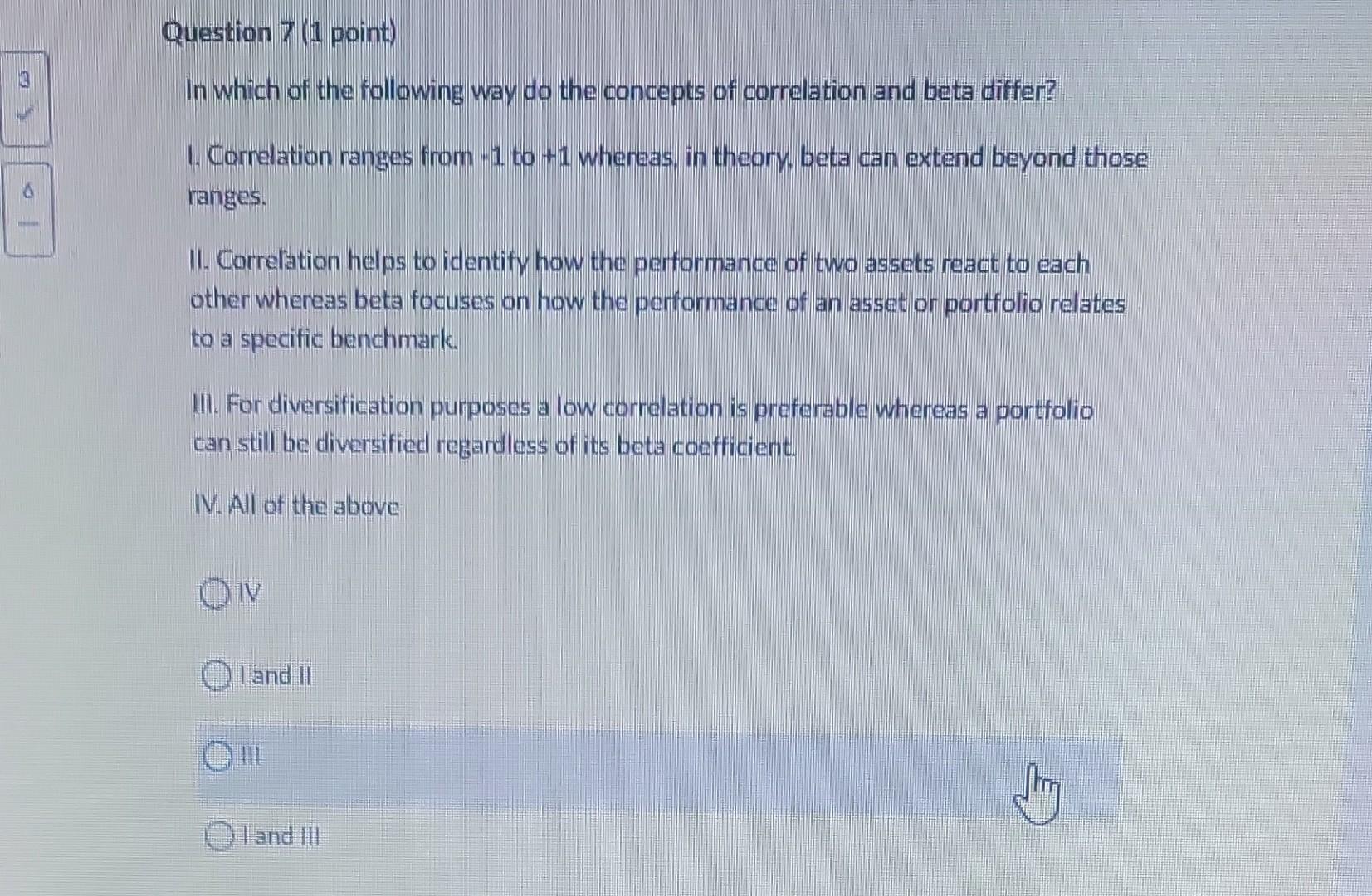

In which of the following way do the concepts of correlation and beta differ? 1. Correlation ranges from - 1 to +1 wheneas, in theory,

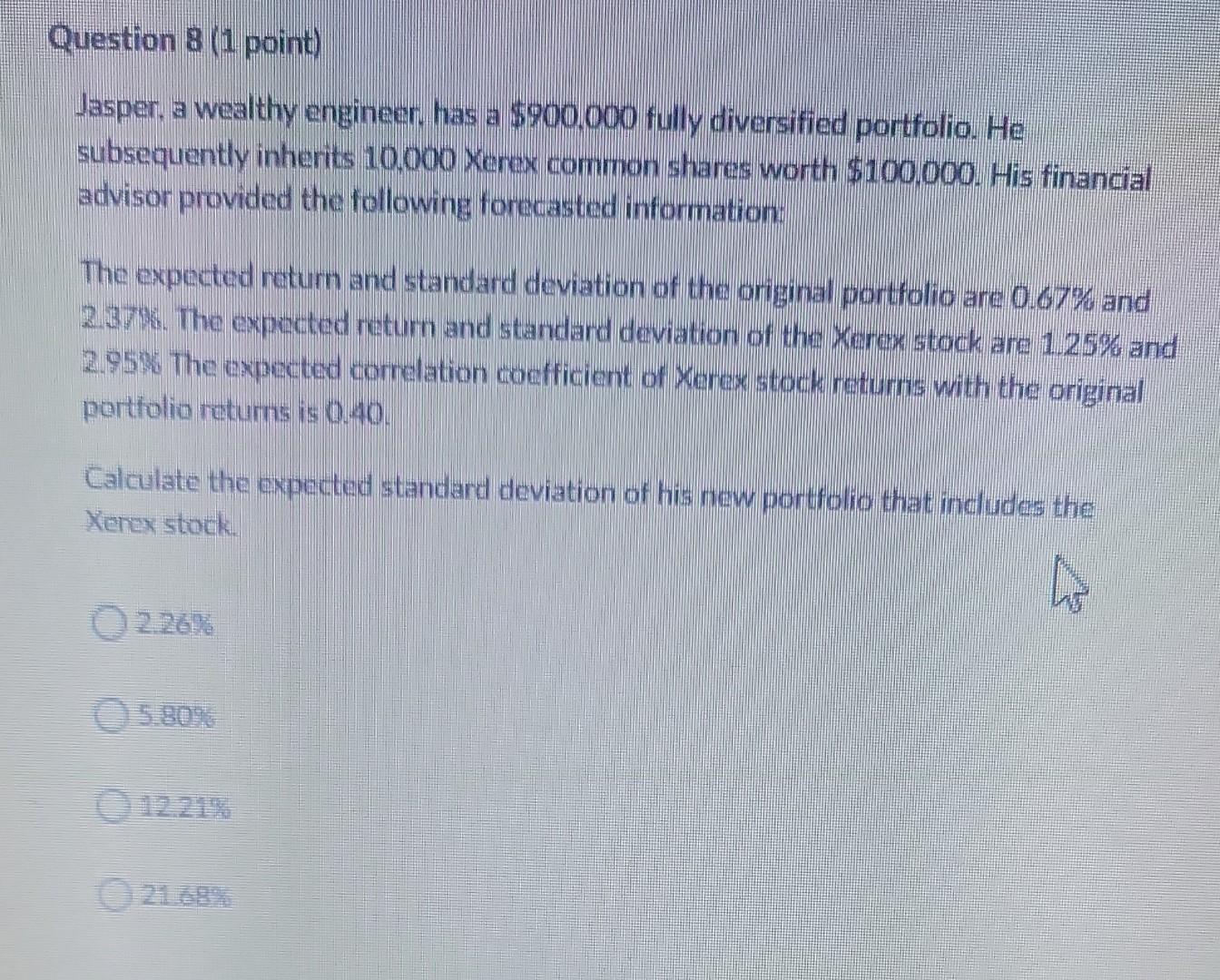

In which of the following way do the concepts of correlation and beta differ? 1. Correlation ranges from - 1 to +1 wheneas, in theory, beta can extend beyond those ranges. II. Correlation helps to identify how the performance of two assets react to each other whereas beta focuses on how the performance of an asset or portfolio relates to a specific benchmark. 11I. For diversification purposes a low correlation is preferable whereas a portfolio can still be diversified regardless of its beta coefficient. V. All of the above IV and II III land III inin Question 8 (1.point) Jasper, a wealthy engineer, has a $900.000 fully diversified portfolio. He subsequently inherits 10.000 Xerex common shares worth $100.000. His financial advisor provided the following forecasted information: The expected return and standard deviation of the original portiolio are 0.67% and 2.37\%. The expected return and standard deviation of the Xerex stock ane 125% and 2.95% The expected correlation cocfficient of Xerex stack returns with the original pertfolio returns is 0.40. Calculate the expected standard deviation of his new portfolio that includes the Xerex stock. 2.26% 5.80% 19 21.680

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started