in word please

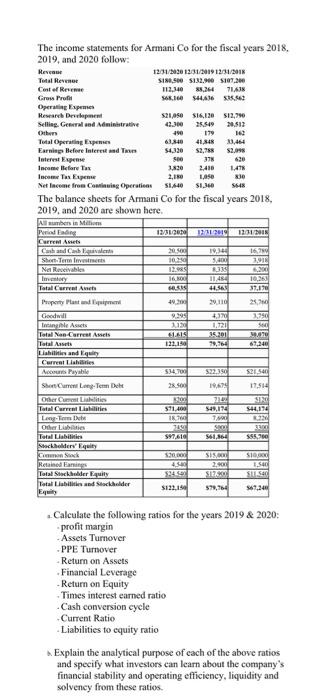

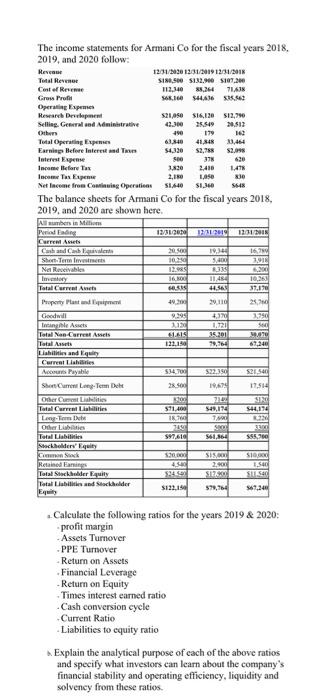

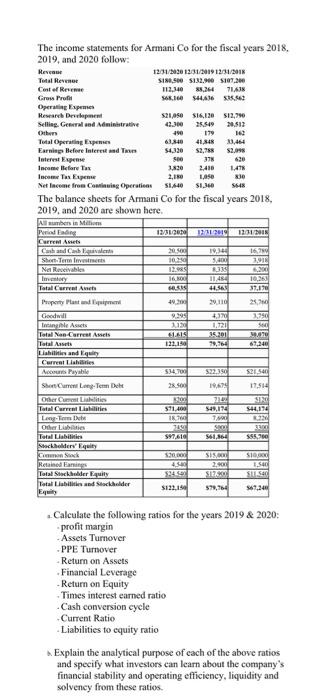

The income statements for Armani Co for the fiscal years 2018, 2019, and 2020 follow: Revea 1234/201231/301912/31/2018 Total Revenue S181.50 $132.90 $107.00 Costel Rese 112.340 88,264 71.43 Grow Profil 68.100 $44436 Operating pemes Reserde Descent $21,950 $16,130 512,70 Seling. General ad diministrative 25.549 Othe 179 100 Total Operating iemes . 61.340 41 MAN 23,464 Earnings Before Interesand Tum 54,30 $2,78 $2,098 Interest Experte SHO 37 Income fare te 2.410 14 Ice Tax 1,50 Net Income from Continuing Operations SI 30 The balance sheets for Armani Co for the fiscal years 2018, 2019 and 2020 are shown here. in M Pad 12/3EGEDO 2019 12012 LA Cusband Cabinets 2050 10, 16 Short Term Investments 5,401 19 Na Roccable 11.482 10,34 Tatal Care Ant HOUS 31.170 Property Plant und in 400 20110 Goodwill 295 4,37 1,350 Trongille Assets 11 1.721 64 Total Nan Current Assets 35.2011 Total Asset 121.190 79,764 67,340 30 4456 53470 $21.540 $22.350 19 28. 11,514 SIR S44,174 529,114 Current Ilahitles Acayah She Carrow Long Term Delt Oder Curt Lilles Total Care Lakilities Logo Oder Labs Total Liabiti Stockholders' Equity Cock Retained Basings Total Stockholder lily Total Liabilitand Stockholder 571,400 100 7 $97.610 SU 561,64 $55.70 520 45 SI 2.30 SIER 579,764 SIGN 1.540 STEST 567,244 $122.150 ..Calculate the following ratios for the years 2019 & 2020: -profit margin - Assets Turnover PPE Turnover Return on Assets Financial Leverage Return on Equity Times interest earned ratio Cash conversion cycle Current Ratio Liabilities to equity ratio Explain the analytical purpose of each of the above ratios and specify what investors can learn about the company's financial stability and operating efficiency, liquidity and solveney from these ratios. The income statements for Armani Co for the fiscal years 2018, 2019, and 2020 follow: Revea 1234/201231/301912/31/2018 Total Revenue S181.50 $132.90 $107.00 Costel Rese 112.340 88,264 71.43 Grow Profil 68.100 $44436 Operating pemes Reserde Descent $21,950 $16,130 512,70 Seling. General ad diministrative 25.549 Othe 179 100 Total Operating iemes . 61.340 41 MAN 23,464 Earnings Before Interesand Tum 54,30 $2,78 $2,098 Interest Experte SHO 37 Income fare te 2.410 14 Ice Tax 1,50 Net Income from Continuing Operations SI 30 The balance sheets for Armani Co for the fiscal years 2018, 2019 and 2020 are shown here. in M Pad 12/3EGEDO 2019 12012 LA Cusband Cabinets 2050 10, 16 Short Term Investments 5,401 19 Na Roccable 11.482 10,34 Tatal Care Ant HOUS 31.170 Property Plant und in 400 20110 Goodwill 295 4,37 1,350 Trongille Assets 11 1.721 64 Total Nan Current Assets 35.2011 Total Asset 121.190 79,764 67,340 30 4456 53470 $21.540 $22.350 19 28. 11,514 SIR S44,174 529,114 Current Ilahitles Acayah She Carrow Long Term Delt Oder Curt Lilles Total Care Lakilities Logo Oder Labs Total Liabiti Stockholders' Equity Cock Retained Basings Total Stockholder lily Total Liabilitand Stockholder 571,400 100 7 $97.610 SU 561,64 $55.70 520 45 SI 2.30 SIER 579,764 SIGN 1.540 STEST 567,244 $122.150 ..Calculate the following ratios for the years 2019 & 2020: -profit margin - Assets Turnover PPE Turnover Return on Assets Financial Leverage Return on Equity Times interest earned ratio Cash conversion cycle Current Ratio Liabilities to equity ratio Explain the analytical purpose of each of the above ratios and specify what investors can learn about the company's financial stability and operating efficiency, liquidity and solveney from these ratios