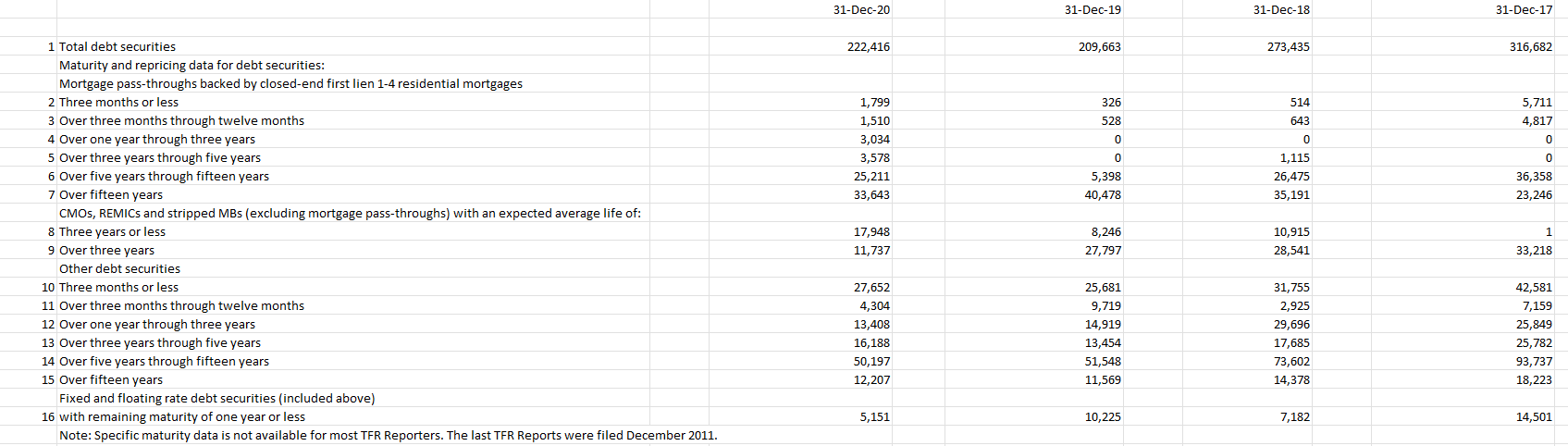

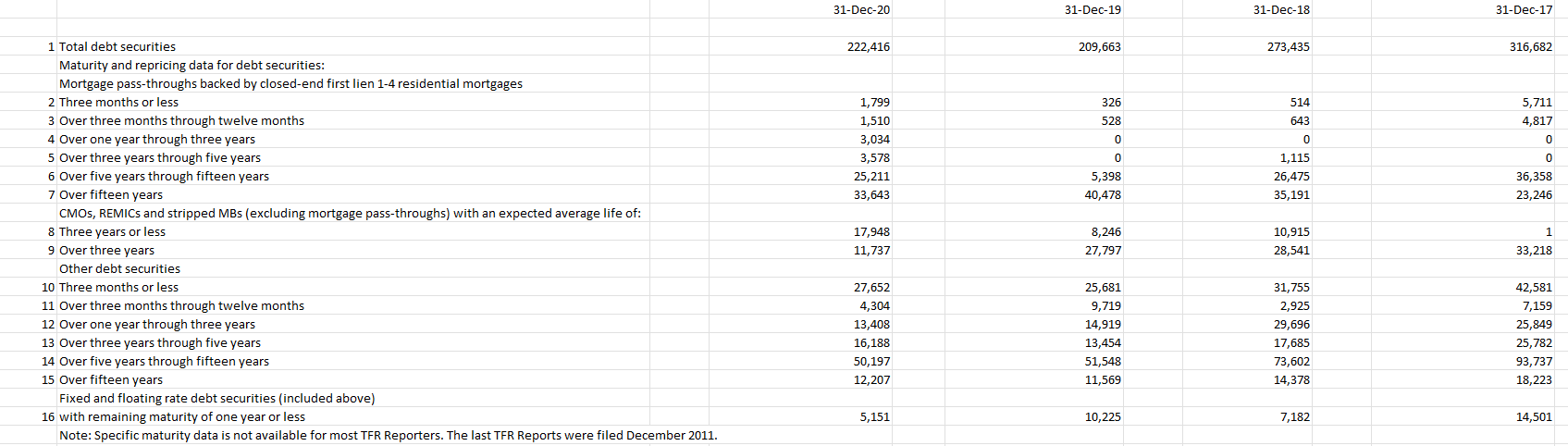

In your opinion, Looking at the maturities of securities this bank has, what might be the bank's investment strategy?

31-Dec-20 31-Dec-19 31-Dec-18 31-Dec-17 222,416 209,663 273,435 316,682 326 514 643 5,711 4,817 528 0 0 1,799 1,510 3,034 3,578 25,211 33,643 0 0 1,115 26,475 35,191 5,398 40,478 0 36,358 23,246 1 Total debt securities Maturity and repricing data for debt securities: Mortgage pass-throughs backed by closed-end first lien 1-4 residential mortgages 2 Three months or less 3 Over three months through twelve months 4 Over one year through three years 5 Over three years through five years 6 Over five years through fifteen years 7 Over fifteen years CMOS, REMICs and stripped MBs (excluding mortgage pass-throughs) with an expected average life of: 8 Three years or less 9 Over three years Other debt securities 10 Three months or less 11 Over three months through twelve months 12 Over one year through three years 13 Over three years through five years 14 Over five years through fifteen years 15 Over fifteen years Fixed and floating rate debt securities (included above) 16 with remaining maturity of one year or less Note: Specific maturity data is not available for most TFR Reporters. The last TFR Reports were filed December 2011. 17,948 11,737 8,246 27,797 10,915 28,541 1 33,218 27,652 4,304 13,408 16,188 50,197 12,207 25,681 9,719 14,919 13,454 51,548 11,569 31,755 2,925 29,696 17,685 73,602 14,378 42,581 7,159 25,849 25,782 93,737 18,223 5,151 10,225 7,182 14,501 31-Dec-20 31-Dec-19 31-Dec-18 31-Dec-17 222,416 209,663 273,435 316,682 326 514 643 5,711 4,817 528 0 0 1,799 1,510 3,034 3,578 25,211 33,643 0 0 1,115 26,475 35,191 5,398 40,478 0 36,358 23,246 1 Total debt securities Maturity and repricing data for debt securities: Mortgage pass-throughs backed by closed-end first lien 1-4 residential mortgages 2 Three months or less 3 Over three months through twelve months 4 Over one year through three years 5 Over three years through five years 6 Over five years through fifteen years 7 Over fifteen years CMOS, REMICs and stripped MBs (excluding mortgage pass-throughs) with an expected average life of: 8 Three years or less 9 Over three years Other debt securities 10 Three months or less 11 Over three months through twelve months 12 Over one year through three years 13 Over three years through five years 14 Over five years through fifteen years 15 Over fifteen years Fixed and floating rate debt securities (included above) 16 with remaining maturity of one year or less Note: Specific maturity data is not available for most TFR Reporters. The last TFR Reports were filed December 2011. 17,948 11,737 8,246 27,797 10,915 28,541 1 33,218 27,652 4,304 13,408 16,188 50,197 12,207 25,681 9,719 14,919 13,454 51,548 11,569 31,755 2,925 29,696 17,685 73,602 14,378 42,581 7,159 25,849 25,782 93,737 18,223 5,151 10,225 7,182 14,501