inclem statement

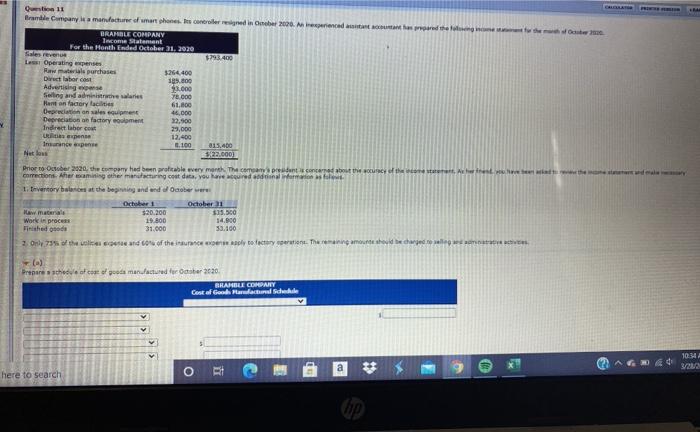

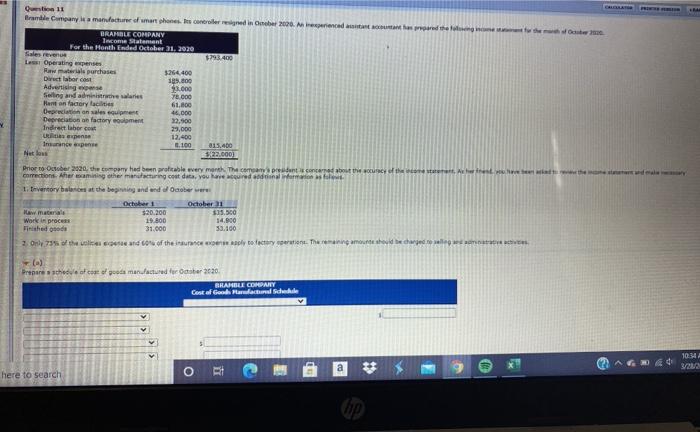

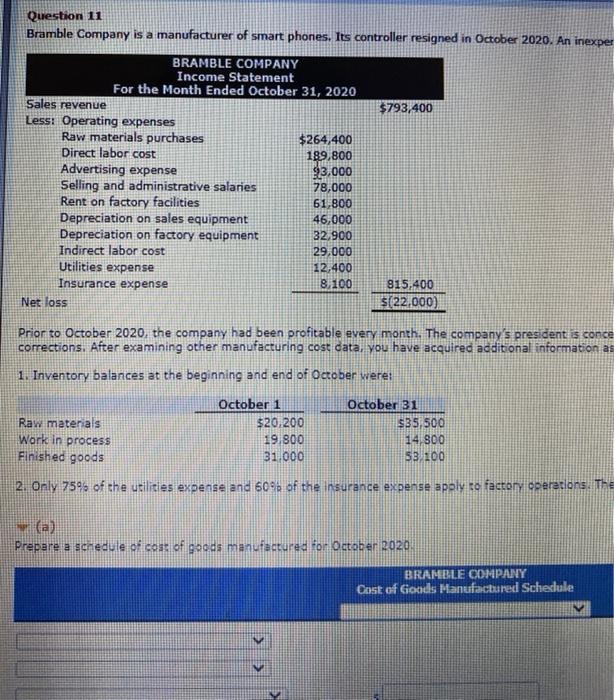

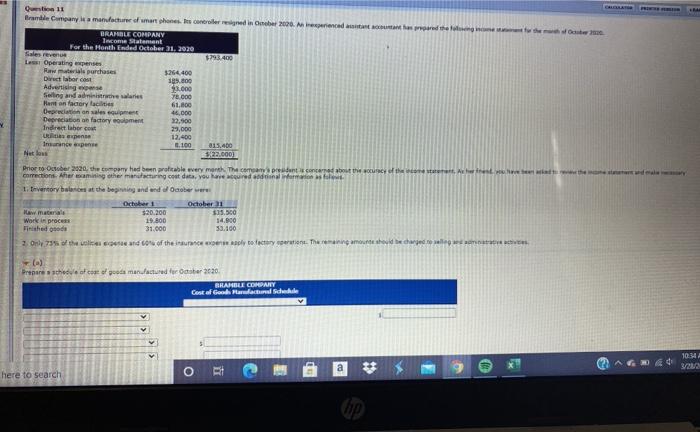

. Quo 11 Brame Companyia mandature of mart phones concerned in Ober 2006. An inexperienced and the need BRAMBLE COMPANY Income talentent For the Month Ended October 21, 2020 Sales revenue $791400 Les Operating penses Raw materiale purchase $264.400 Dirut labor Cost Advertising se 1.000 Selling and administhe wares 78.000 Mantan factory facilities 61,000 Depreciations en 46.000 Depreciation on factory moment 22,900 Indirect laber 29,000 Up 12.400 Insurance pense 6.100 035.400 5:22.000 Prior to October 2000, the company had been profitable every month. The comment concerned about the other corrections Aherming other mandating cost data, you have and informons for 1. Prventory boat the beginning and und aber were Ochot October w materials $20.300 $35.000 Work in process 14.00 The de 30.100 2. Only 73% of the end of their ply to factory on. The remaining and charged 11.800 31.000 Prepare the old man actured Oster 2020 BRAMBLE COMPANY Cost a Good Marwaddle a AG 10:31 3/2013 o a RI here to search * Question 11 Bramble Company is a manufacturer of smart phones. Its controller resigned in October 2020. An inexper BRAMBLE COMPANY Income Statement For the Month Ended October 31, 2020 Sales revenue $793,400 Less: Operating expenses Raw materials purchases $264,400 Direct labor cost 189,800 Advertising expense 93,000 Selling and administrative salaries 78,000 Rent on factory facilities 61,800 Depreciation on sales equipment 46,000 Depreciation on factory equipment 32.900 Indirect labor cost 29,000 Utilities expense 12,400 Insurance expense 8.100 915,400 Net loss $(22,000) Prior to October 2020, the company had been profitable every month. The company's president is conce corrections. After examining other manufacturing cost cata, you have acquired additional information as 1. Inventory balances at the beginning and end of October were: Raw materials Work in process Finished goods October 1 $20.200 19.800 31.000 October 31 $35,500 14.300 53.100 2. Only 759s of the utilities expense and 60% of the insurance expense apply to factory operations. The a) Prepare a schedule of cost of goods manufactured for October 2020. BRAMBLE COMPANY Cost of Goods Manufactured Schedule BRAMBLE COMPANY Cost of Goods Manufactured Schedule For the Month Ende October 11, 2070 39800 Work in Process Inventory, October 1 v Direct Materials 20200 Raw Materials Inventory, October 1 264400 Raw Materials Purchases 284600 D Total Raw Materials Available for Use Les Raw Materials Inventory, October 31 -35500 249100 Direct Materials Used 199000 Direct Labor Tanufacturing Overhead 29000 Indirect Labor 61800 Factor Facy Rent 32900 Depreciation on Factory Equipment 9300 Factory 4860 Factor Insurance 137860 Total Manufachting Overhead 576760 Total Mandarin Costa 596550 To Cost work proces -14800 Wo Process Tractory October 381750 Cost Boods Waactured Click if you would like to Show Work for this question: Open Show Work SHOW SOLUTION SHOW ANSWER o a treh URCES Prepare a correct income statement for October 2020, BRAMBLE COMPANY Income Statement V > > V V