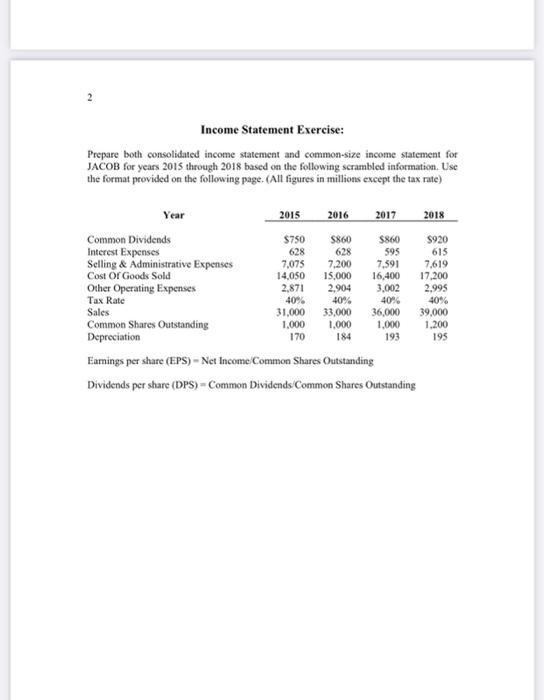

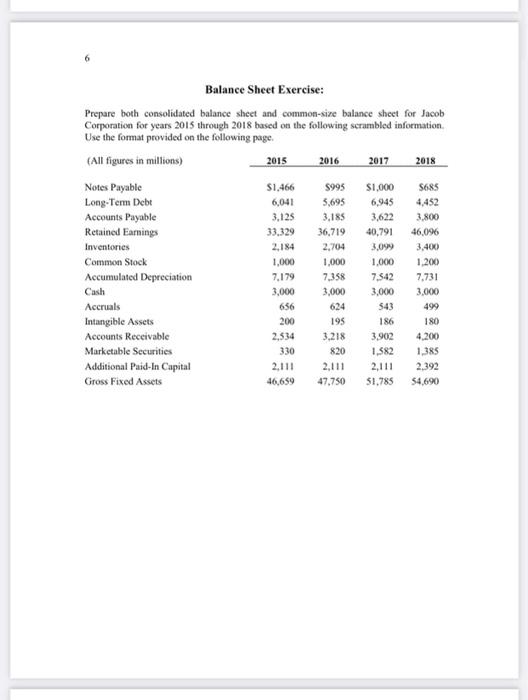

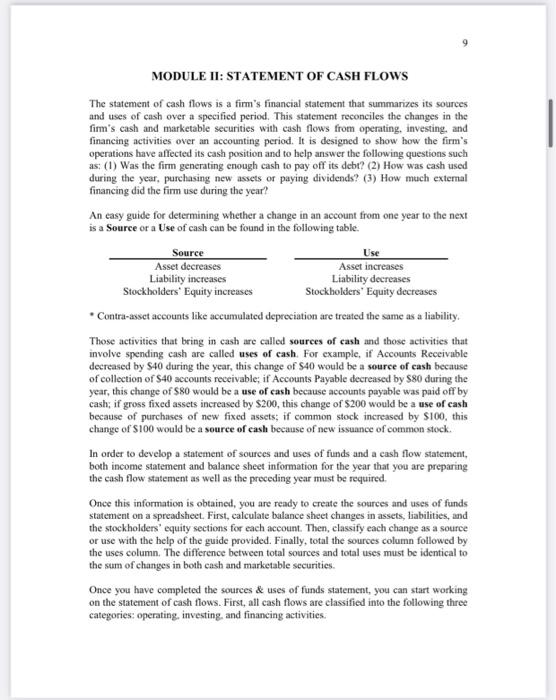

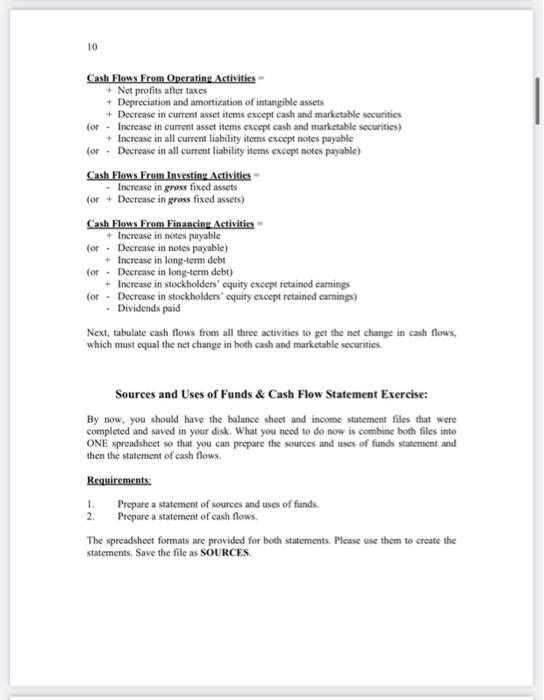

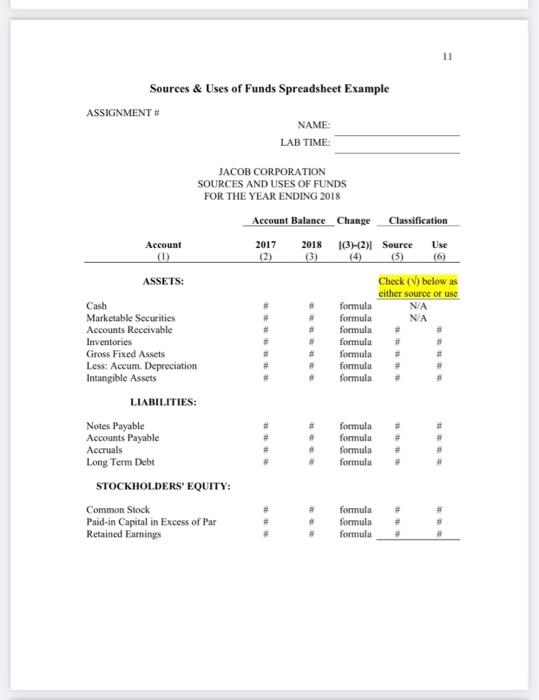

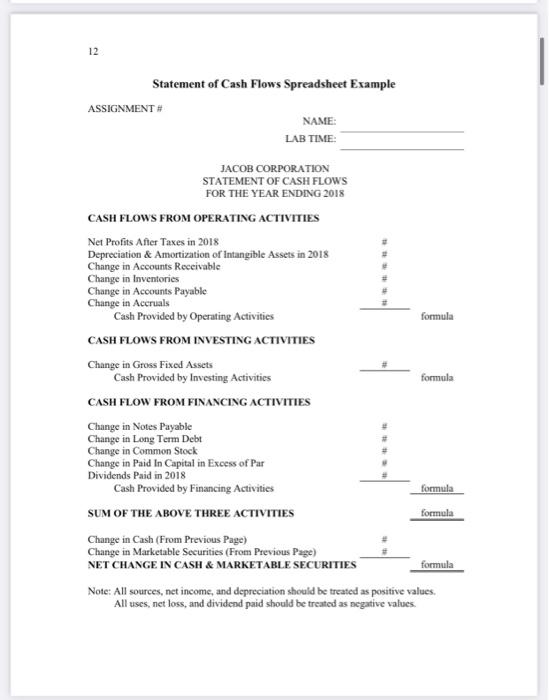

Income Statement Exercise: Prepare both consolidated income statement and common-size income statement for JACOB for years 2015 through 2018 based on the following scrambled information. Use the format provided on the following page. (All figures in millions except the tax rate) Year 2015 2016 2017 2018 40% Common Dividends $750 5860 $860 $920 Interest Expenses 628 628 595 615 Selling & Administrative Expenses 7,075 7.200 7.591 7.619 Cost or Goock Sold 14.050 15,000 16,400 17,200 Other Operating Expenses 2,871 2,904 3.002 2.995 Tax Rate 40% 40% 40% Sales 31,000 33,000 36,000 39.000 Common Shares Outstanding 1.000 1.000 1.000 1.200 Depreciation 170 184 193 Earnings per share (EPS) - Net Income Common Shares Outstanding Dividends per share (DPS) - Common Dividends Common Shares Outstanding 195 2015 2018 Balance Sheet Exercise: Prepare both consolidated balance sheet and common-size balance sheet for Jacob Corporation for years 2015 through 2018 based on the following scrambled information Use the format provided on the following page. (All figures in millions) 2016 2017 Notes Payable 51.466 5995 S1.000 5685 Long-Term Debt 6,041 5,695 6,945 4452 Accounts Payable 3,125 3,185 3.622 3.800 Retained Earnings 33.329 36,719 40,791 46,096 Inventories 2,184 2,704 3.099 3.400 Common Stock 1,000 1,000 1.000 1.200 Accumulated Depreciation 7.179 7.358 7.542 7.731 Cash 3.000 3,000 3,000 3.000 Accruals 656 543 Intangible Assets 200 195 186 180 Accounts Receivable 2,534 3.218 3,902 4.200 Marketable Securities 330 820 1.582 1,385 Additional Paid-In Capital 2.111 2,111 2,111 2.392 Gross Fixed Assets 46,659 47,750 51,785 54,690 MODULE II: STATEMENT OF CASH FLOWS The statement of cash flows is a firm's financial statement that summarizes its sources and uses of cash over a specified period. This statement reconciles the changes in the firm's cash and marketable securities with cash flows from operating, investing, and financing activities over an accounting period. It is designed to show how the firm's operations have affected its cash position and to help answer the following questions such as (1) Was the firm generating enough cash to pay off its debt? (2) How was cash used during the year, purchasing new assets or paying dividends? (3) How much external financing did the firm use during the year? An easy guide for determining whether a change in an account from one year to the next is a Source or a Use of cash can be found in the following table. Source Use Asset decreases Asset increases Liability increases Liability decreases Stockholders' Equity increases Stockholders' Equity decreases Contra-asset accounts like accumulated depreciation are treated the same as a liability. Those activities that bring in cash are called sources of cash and those activities that involve spending cash are called uses of cash. For example, if Accounts Receivable decreased by $40 during the year, this change of $40 would be a source of cash because of collection of S40 accounts receivable; if Accounts Payable decreased by $80 during the year, this change of $80 would be a use of cash because accounts payable was paid off by cash; if gross fixed assets increased by $200, this change of $200 would be a use of cash because of purchases of new fixed assets; if common stock increased by $100, this change of $100 would be a source of cash because of new issuance of common stock. In order to develop a statement of sources and uses of funds and a cash flow statement, both income statement and balance sheet information for the year that you are preparing the cash flow statement as well as the preceding year must be required. Once this information is obtained, you are ready to create the sources and uses of funds statement on a spreadsheet. First, calculate balance sheet changes in assets, liabilities, and the stockholders' equity sections for each account. Then, classify each change as a source or use with the help of the guide provided. Finally, total the sources column followed by the uses column. The difference between total sources and total uses must be identical to the sum of changes in both cash and marketable securities. Once you have completed the sources & uses of funds statement, you can start working on the statement of cash flows. First, all cash flows are classified into the following three categories: operating investing, and financing activities. 10 Cash Flows From Operating Activities + Net profits after taxes + Depreciation and amortization of intangible assets + Decrease in current asset items except cash and marketable securities (or. Increase in current asset items creept cash and marketable securities) + Increase in all current liability items except notes payable (or . Decrease in all current liability items except notes payable) Cash Flows From Investing Activities - Increase in gross fixed assets (or + Decrease in gross fixed assets) Cash Flows From Financing Activities Increase in netes payable (or - Decrease in notes payable) + Increase in long-term debt (or . Decrease in long-term debt) + Increase in stockholders equity except retained carings for Decrease in stockholders' equity except retained carnings) Dividends paid Next, tabulate cash flows from all three activities to get the net change in cash flows, which must equal the net change in both cash and marketable securities Sources and Uses of Funds & Cash Flow Statement Exercise: By now, you should have the balance sheet and income statement files that were completed and saved in your disk. What you need to do now is combine both files into ONE spreadsheet so that you can prepare the sources and uses of funds statement and then the statement of cash flows, Requirements 1. Prepare a statement of sources and uses of funds. Prepare a statement of cash flows. The spreadsheet formats are provided for both statements. Please use them to create the statements. Save the file as SOURCES 11 Sources & Uses of Funds Spreadsheet Example ASSIGNMENT NAME: LAB TIME: JACOB CORPORATION SOURCES AND USES OF FUNDS FOR THE YEAR ENDING 2018 Account Balance_Change Classification Account 2017 2018 (3-(2)| Source Use (1) (2) (3) (5) (6) ASSETS: Check (1) below as either source or use Cash formula NA Marketable Securities # formula NA Accounts Receivable # formula # Inventories # formula # Gross Fixed Assets # formula # Less: Accum. Depreciation # formula Intangible Assets # formula # LIABILITIES: Notes Payable formula Accounts Payable # formula Accruals # formula # Long Term Debt # formula STOCKHOLDERS' EQUITY: Common Stock formula Paid-in Capital in Excess of Par formula Retained Earnings formula , # 12 Statement of Cash Flows Spreadsheet Example ASSIGNMENT NAME: LAB TIME: formula JACOB CORPORATION STATEMENT OF CASH FLOWS FOR THE YEAR ENDING 2018 CASH FLOWS FROM OPERATING ACTIVITIES Net Profits After Taxes in 2018 Depreciation & Amortization of Intangible Assets in 2018 Change in Accounts Receivable Change in Inventories Change in Accounts Payable Change in Accruals Cash Provided by Operating Activities formula CASH FLOWS FROM INVESTING ACTIVITIES Change in Gross Fixed Assets Cash Provided by Investing Activities CASH FLOW FROM FINANCING ACTIVITIES Change in Notes Payable Change in Long Term Debt Change in Common Stock Change in Paid In Capital in Excess of Par Dividends Paid in 2018 Cash Provided by Financing Activities formula SUM OF THE ABOVE THREE ACTIVITIES formula Change in Cash (From Previous Page) Change in Marketable Securities (From Previous Page) NET CHANGE IN CASH & MARKETABLE SECURITIES formula Note: All sources, net income, and depreciation should be treated as positive values All uses, net loss, and dividend paid should be treated as negative values. Income Statement Exercise: Prepare both consolidated income statement and common-size income statement for JACOB for years 2015 through 2018 based on the following scrambled information. Use the format provided on the following page. (All figures in millions except the tax rate) Year 2015 2016 2017 2018 40% Common Dividends $750 5860 $860 $920 Interest Expenses 628 628 595 615 Selling & Administrative Expenses 7,075 7.200 7.591 7.619 Cost or Goock Sold 14.050 15,000 16,400 17,200 Other Operating Expenses 2,871 2,904 3.002 2.995 Tax Rate 40% 40% 40% Sales 31,000 33,000 36,000 39.000 Common Shares Outstanding 1.000 1.000 1.000 1.200 Depreciation 170 184 193 Earnings per share (EPS) - Net Income Common Shares Outstanding Dividends per share (DPS) - Common Dividends Common Shares Outstanding 195 2015 2018 Balance Sheet Exercise: Prepare both consolidated balance sheet and common-size balance sheet for Jacob Corporation for years 2015 through 2018 based on the following scrambled information Use the format provided on the following page. (All figures in millions) 2016 2017 Notes Payable 51.466 5995 S1.000 5685 Long-Term Debt 6,041 5,695 6,945 4452 Accounts Payable 3,125 3,185 3.622 3.800 Retained Earnings 33.329 36,719 40,791 46,096 Inventories 2,184 2,704 3.099 3.400 Common Stock 1,000 1,000 1.000 1.200 Accumulated Depreciation 7.179 7.358 7.542 7.731 Cash 3.000 3,000 3,000 3.000 Accruals 656 543 Intangible Assets 200 195 186 180 Accounts Receivable 2,534 3.218 3,902 4.200 Marketable Securities 330 820 1.582 1,385 Additional Paid-In Capital 2.111 2,111 2,111 2.392 Gross Fixed Assets 46,659 47,750 51,785 54,690 MODULE II: STATEMENT OF CASH FLOWS The statement of cash flows is a firm's financial statement that summarizes its sources and uses of cash over a specified period. This statement reconciles the changes in the firm's cash and marketable securities with cash flows from operating, investing, and financing activities over an accounting period. It is designed to show how the firm's operations have affected its cash position and to help answer the following questions such as (1) Was the firm generating enough cash to pay off its debt? (2) How was cash used during the year, purchasing new assets or paying dividends? (3) How much external financing did the firm use during the year? An easy guide for determining whether a change in an account from one year to the next is a Source or a Use of cash can be found in the following table. Source Use Asset decreases Asset increases Liability increases Liability decreases Stockholders' Equity increases Stockholders' Equity decreases Contra-asset accounts like accumulated depreciation are treated the same as a liability. Those activities that bring in cash are called sources of cash and those activities that involve spending cash are called uses of cash. For example, if Accounts Receivable decreased by $40 during the year, this change of $40 would be a source of cash because of collection of S40 accounts receivable; if Accounts Payable decreased by $80 during the year, this change of $80 would be a use of cash because accounts payable was paid off by cash; if gross fixed assets increased by $200, this change of $200 would be a use of cash because of purchases of new fixed assets; if common stock increased by $100, this change of $100 would be a source of cash because of new issuance of common stock. In order to develop a statement of sources and uses of funds and a cash flow statement, both income statement and balance sheet information for the year that you are preparing the cash flow statement as well as the preceding year must be required. Once this information is obtained, you are ready to create the sources and uses of funds statement on a spreadsheet. First, calculate balance sheet changes in assets, liabilities, and the stockholders' equity sections for each account. Then, classify each change as a source or use with the help of the guide provided. Finally, total the sources column followed by the uses column. The difference between total sources and total uses must be identical to the sum of changes in both cash and marketable securities. Once you have completed the sources & uses of funds statement, you can start working on the statement of cash flows. First, all cash flows are classified into the following three categories: operating investing, and financing activities. 10 Cash Flows From Operating Activities + Net profits after taxes + Depreciation and amortization of intangible assets + Decrease in current asset items except cash and marketable securities (or. Increase in current asset items creept cash and marketable securities) + Increase in all current liability items except notes payable (or . Decrease in all current liability items except notes payable) Cash Flows From Investing Activities - Increase in gross fixed assets (or + Decrease in gross fixed assets) Cash Flows From Financing Activities Increase in netes payable (or - Decrease in notes payable) + Increase in long-term debt (or . Decrease in long-term debt) + Increase in stockholders equity except retained carings for Decrease in stockholders' equity except retained carnings) Dividends paid Next, tabulate cash flows from all three activities to get the net change in cash flows, which must equal the net change in both cash and marketable securities Sources and Uses of Funds & Cash Flow Statement Exercise: By now, you should have the balance sheet and income statement files that were completed and saved in your disk. What you need to do now is combine both files into ONE spreadsheet so that you can prepare the sources and uses of funds statement and then the statement of cash flows, Requirements 1. Prepare a statement of sources and uses of funds. Prepare a statement of cash flows. The spreadsheet formats are provided for both statements. Please use them to create the statements. Save the file as SOURCES 11 Sources & Uses of Funds Spreadsheet Example ASSIGNMENT NAME: LAB TIME: JACOB CORPORATION SOURCES AND USES OF FUNDS FOR THE YEAR ENDING 2018 Account Balance_Change Classification Account 2017 2018 (3-(2)| Source Use (1) (2) (3) (5) (6) ASSETS: Check (1) below as either source or use Cash formula NA Marketable Securities # formula NA Accounts Receivable # formula # Inventories # formula # Gross Fixed Assets # formula # Less: Accum. Depreciation # formula Intangible Assets # formula # LIABILITIES: Notes Payable formula Accounts Payable # formula Accruals # formula # Long Term Debt # formula STOCKHOLDERS' EQUITY: Common Stock formula Paid-in Capital in Excess of Par formula Retained Earnings formula , # 12 Statement of Cash Flows Spreadsheet Example ASSIGNMENT NAME: LAB TIME: formula JACOB CORPORATION STATEMENT OF CASH FLOWS FOR THE YEAR ENDING 2018 CASH FLOWS FROM OPERATING ACTIVITIES Net Profits After Taxes in 2018 Depreciation & Amortization of Intangible Assets in 2018 Change in Accounts Receivable Change in Inventories Change in Accounts Payable Change in Accruals Cash Provided by Operating Activities formula CASH FLOWS FROM INVESTING ACTIVITIES Change in Gross Fixed Assets Cash Provided by Investing Activities CASH FLOW FROM FINANCING ACTIVITIES Change in Notes Payable Change in Long Term Debt Change in Common Stock Change in Paid In Capital in Excess of Par Dividends Paid in 2018 Cash Provided by Financing Activities formula SUM OF THE ABOVE THREE ACTIVITIES formula Change in Cash (From Previous Page) Change in Marketable Securities (From Previous Page) NET CHANGE IN CASH & MARKETABLE SECURITIES formula Note: All sources, net income, and depreciation should be treated as positive values All uses, net loss, and dividend paid should be treated as negative values