Answered step by step

Verified Expert Solution

Question

1 Approved Answer

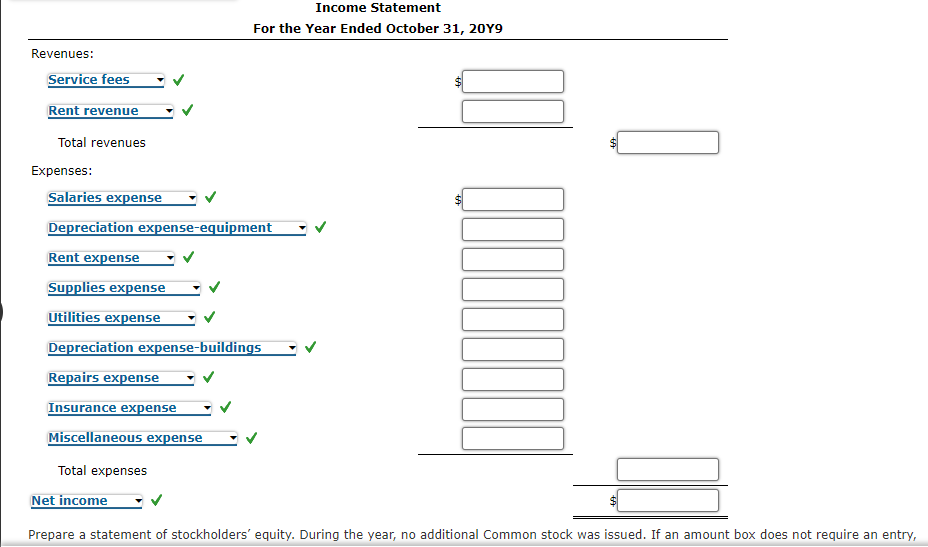

Income Statement For the Year Ended October 31, 20 Y9 Revenues: Expenses: Prepare a statement of stockholders' equity. During the year, no additional Common stock

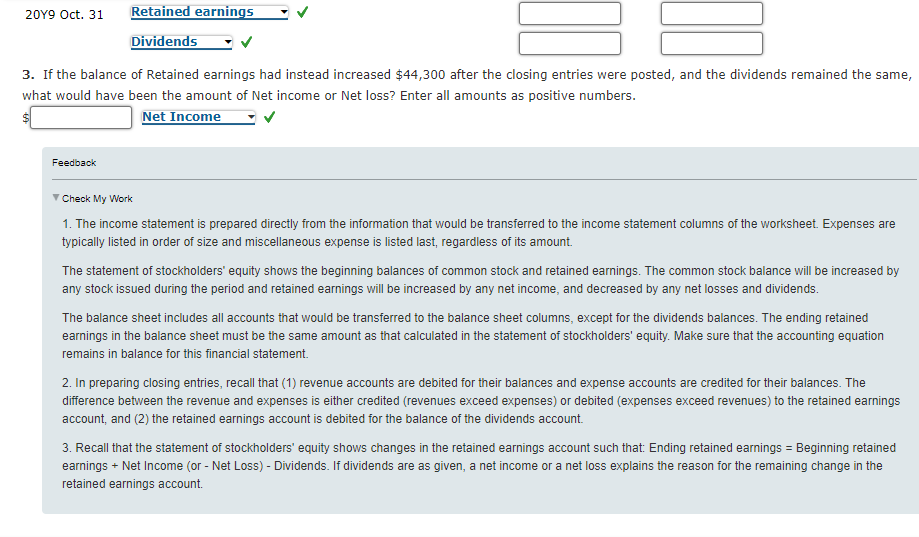

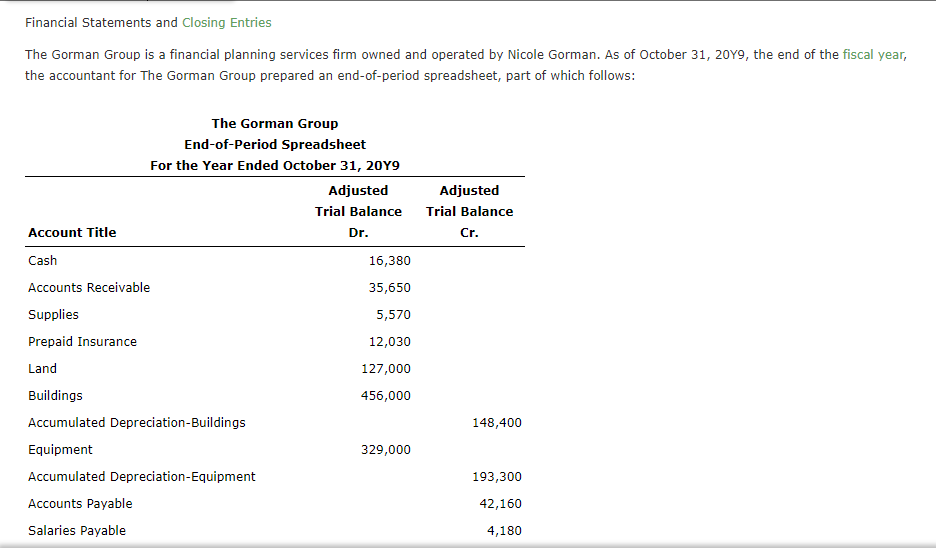

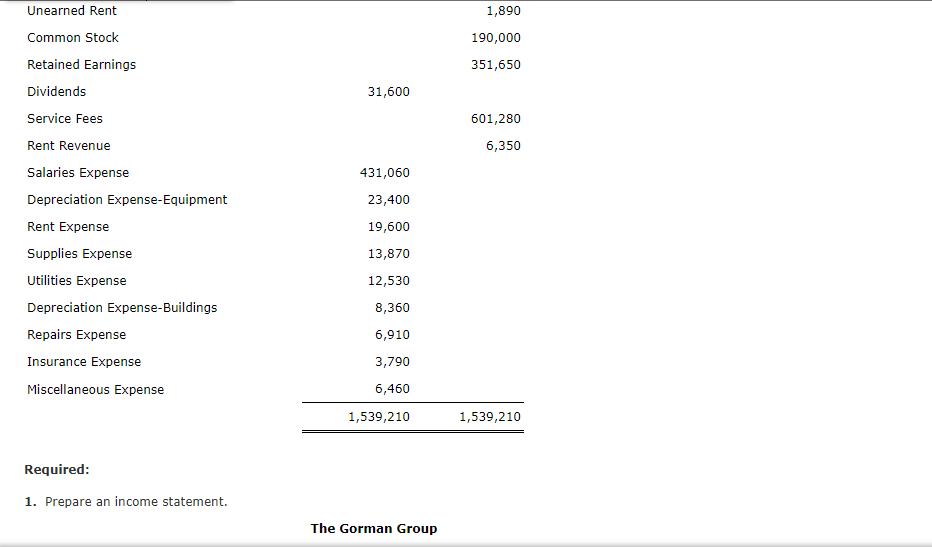

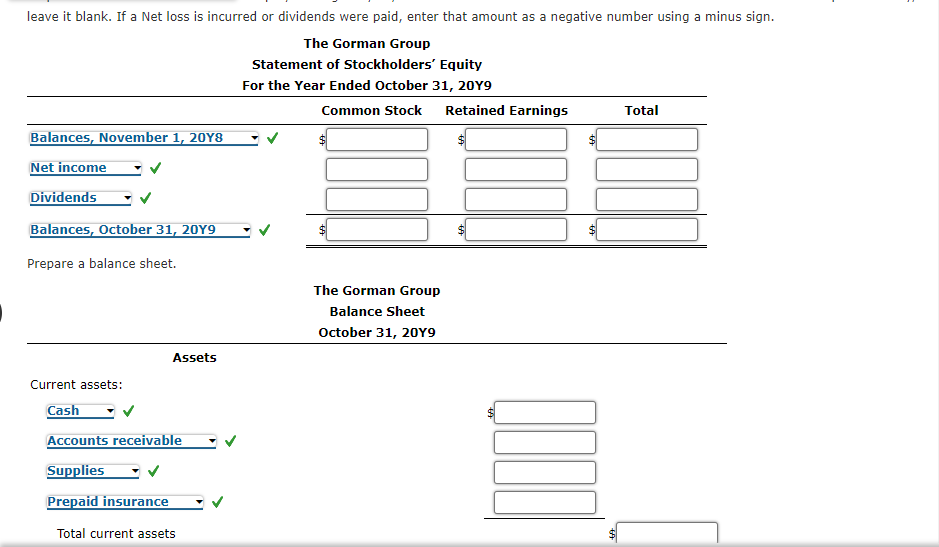

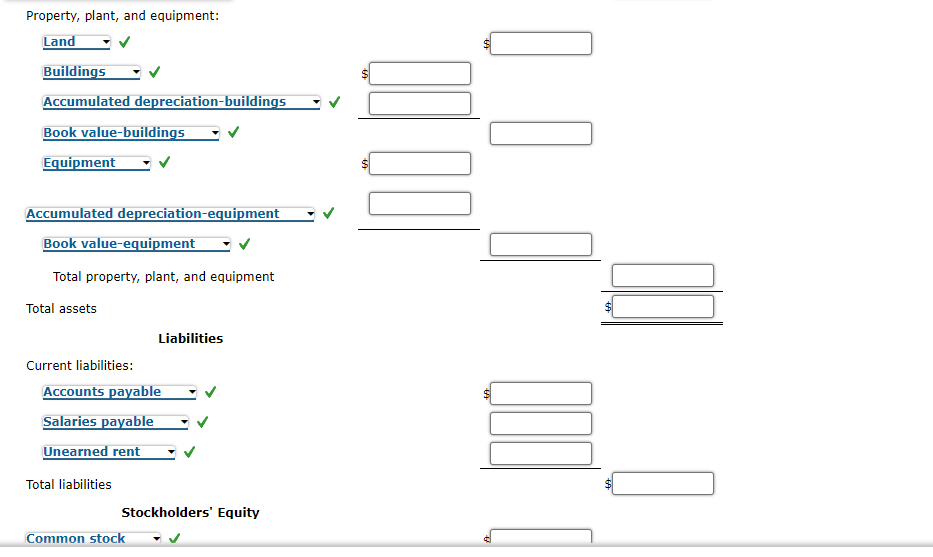

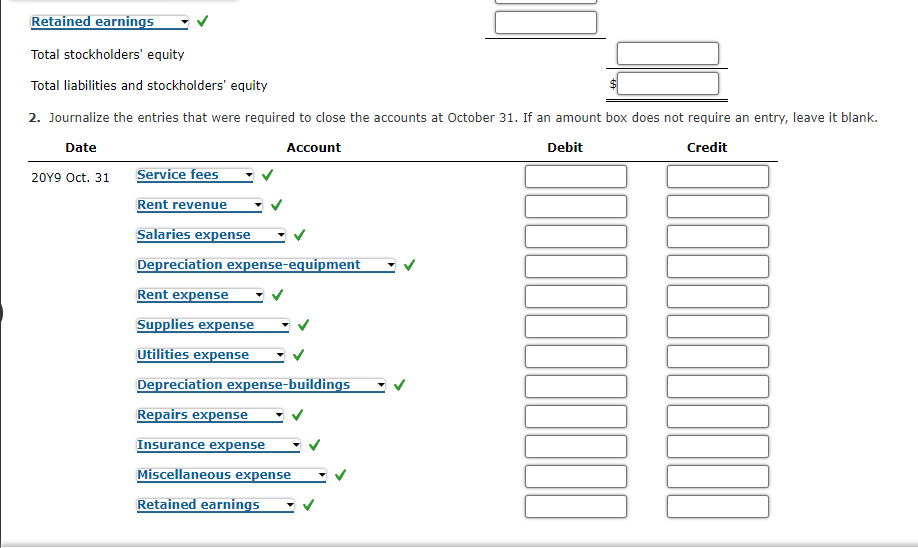

Income Statement For the Year Ended October 31, 20 Y9 Revenues: Expenses: Prepare a statement of stockholders' equity. During the year, no additional Common stock was issued. If an amount box does not require an entry, leave it blank. If a Net loss is incurred or dividends were paid, enter that amount as a negative number using a minus sign. The Gorman Group Statement of Stockholders' Equity For the Year Ended October 31, 20 Y9 Prepare a balance sheet. Unearned Rent Common Stock Retained Earnings Dividends Service Fees Rent Revenue Salaries Expense Depreciation Expense-Equipment Rent Expense Supplies Expense Utilities Expense Depreciation Expense-Buildings Repairs Expense Insurance Expense Miscellaneous Expense 1,890 190,000 351,650 31,600 601,2806,350 431,060 23,400 19,600 13,870 12,530 8,360 6,910 3,790 \begin{tabular}{rr} 6,460 \\ \hline 1,539,210 & 1,539,210 \\ \hline \hline \end{tabular} Required: 1. Prepare an income statement. The Gorman Group 3. If the balance of Retained earnings had instead increased $44,300 after the closing entries were posted, and the dividends remained the same, what would have been the amount of Net income or Net loss? Enter all amounts as positive numbers. Feedback Check My Work 1. The income statement is prepared directly from the information that would be transferred to the income statement columns of the worksheet. Expenses are typically listed in order of size and miscellaneous expense is listed last, regardless of its amount. The statement of stockholders' equity shows the beginning balances of common stock and retained earnings. The common stock balance will be increased by any stock issued during the period and retained earnings will be increased by any net income, and decreased by any net losses and dividends. The balance sheet includes all accounts that would be transferred to the balance sheet columns, except for the dividends balances. The ending retained earnings in the balance sheet must be the same amount as that calculated in the statement of stockholders' equity. Make sure that the accounting equation remains in balance for this financial statement. 2. In preparing closing entries, recall that (1) revenue accounts are debited for their balances and expense accounts are credited for their balances. The difference between the revenue and expenses is either credited (revenues exceed expenses) or debited (expenses exceed revenues) to the retained earnings account, and (2) the retained earnings account is debited for the balance of the dividends account. 3. Recall that the statement of stockholders' equity shows changes in the retained earnings account such that: Ending retained earnings = Beginning retained earnings + Net Income (or - Net Loss) - Dividends. If dividends are as given, a net income or a net loss explains the reason for the remaining change in the retained earnings account. Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 2. Journalize the entries that were required to close the accounts at October 31 . If an amount box does not require an entry, leave it blank. Property, plant, and equipment: Buildings Accumulated depreciation-buildings Book value-buildings Equipment Accumulated depreciation-equipment Book value-equipment Total property, plant, and equipment Total assets Liabilities Current liabilities: Accounts payable Salaries payable Unearned rent Total liabilities Stockholders' Equity Common stock \& Financial Statements and Closing Entries The Gorman Group is a financial planning services firm owned and operated by Nicole Gorman. As of October 31, 20Y9, the end of the fiscal year, the accountant for The Gorman Group prepared an end-of-period spreadsheet, part of which follows

Income Statement For the Year Ended October 31, 20 Y9 Revenues: Expenses: Prepare a statement of stockholders' equity. During the year, no additional Common stock was issued. If an amount box does not require an entry, leave it blank. If a Net loss is incurred or dividends were paid, enter that amount as a negative number using a minus sign. The Gorman Group Statement of Stockholders' Equity For the Year Ended October 31, 20 Y9 Prepare a balance sheet. Unearned Rent Common Stock Retained Earnings Dividends Service Fees Rent Revenue Salaries Expense Depreciation Expense-Equipment Rent Expense Supplies Expense Utilities Expense Depreciation Expense-Buildings Repairs Expense Insurance Expense Miscellaneous Expense 1,890 190,000 351,650 31,600 601,2806,350 431,060 23,400 19,600 13,870 12,530 8,360 6,910 3,790 \begin{tabular}{rr} 6,460 \\ \hline 1,539,210 & 1,539,210 \\ \hline \hline \end{tabular} Required: 1. Prepare an income statement. The Gorman Group 3. If the balance of Retained earnings had instead increased $44,300 after the closing entries were posted, and the dividends remained the same, what would have been the amount of Net income or Net loss? Enter all amounts as positive numbers. Feedback Check My Work 1. The income statement is prepared directly from the information that would be transferred to the income statement columns of the worksheet. Expenses are typically listed in order of size and miscellaneous expense is listed last, regardless of its amount. The statement of stockholders' equity shows the beginning balances of common stock and retained earnings. The common stock balance will be increased by any stock issued during the period and retained earnings will be increased by any net income, and decreased by any net losses and dividends. The balance sheet includes all accounts that would be transferred to the balance sheet columns, except for the dividends balances. The ending retained earnings in the balance sheet must be the same amount as that calculated in the statement of stockholders' equity. Make sure that the accounting equation remains in balance for this financial statement. 2. In preparing closing entries, recall that (1) revenue accounts are debited for their balances and expense accounts are credited for their balances. The difference between the revenue and expenses is either credited (revenues exceed expenses) or debited (expenses exceed revenues) to the retained earnings account, and (2) the retained earnings account is debited for the balance of the dividends account. 3. Recall that the statement of stockholders' equity shows changes in the retained earnings account such that: Ending retained earnings = Beginning retained earnings + Net Income (or - Net Loss) - Dividends. If dividends are as given, a net income or a net loss explains the reason for the remaining change in the retained earnings account. Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 2. Journalize the entries that were required to close the accounts at October 31 . If an amount box does not require an entry, leave it blank. Property, plant, and equipment: Buildings Accumulated depreciation-buildings Book value-buildings Equipment Accumulated depreciation-equipment Book value-equipment Total property, plant, and equipment Total assets Liabilities Current liabilities: Accounts payable Salaries payable Unearned rent Total liabilities Stockholders' Equity Common stock \& Financial Statements and Closing Entries The Gorman Group is a financial planning services firm owned and operated by Nicole Gorman. As of October 31, 20Y9, the end of the fiscal year, the accountant for The Gorman Group prepared an end-of-period spreadsheet, part of which follows Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started