Answered step by step

Verified Expert Solution

Question

1 Approved Answer

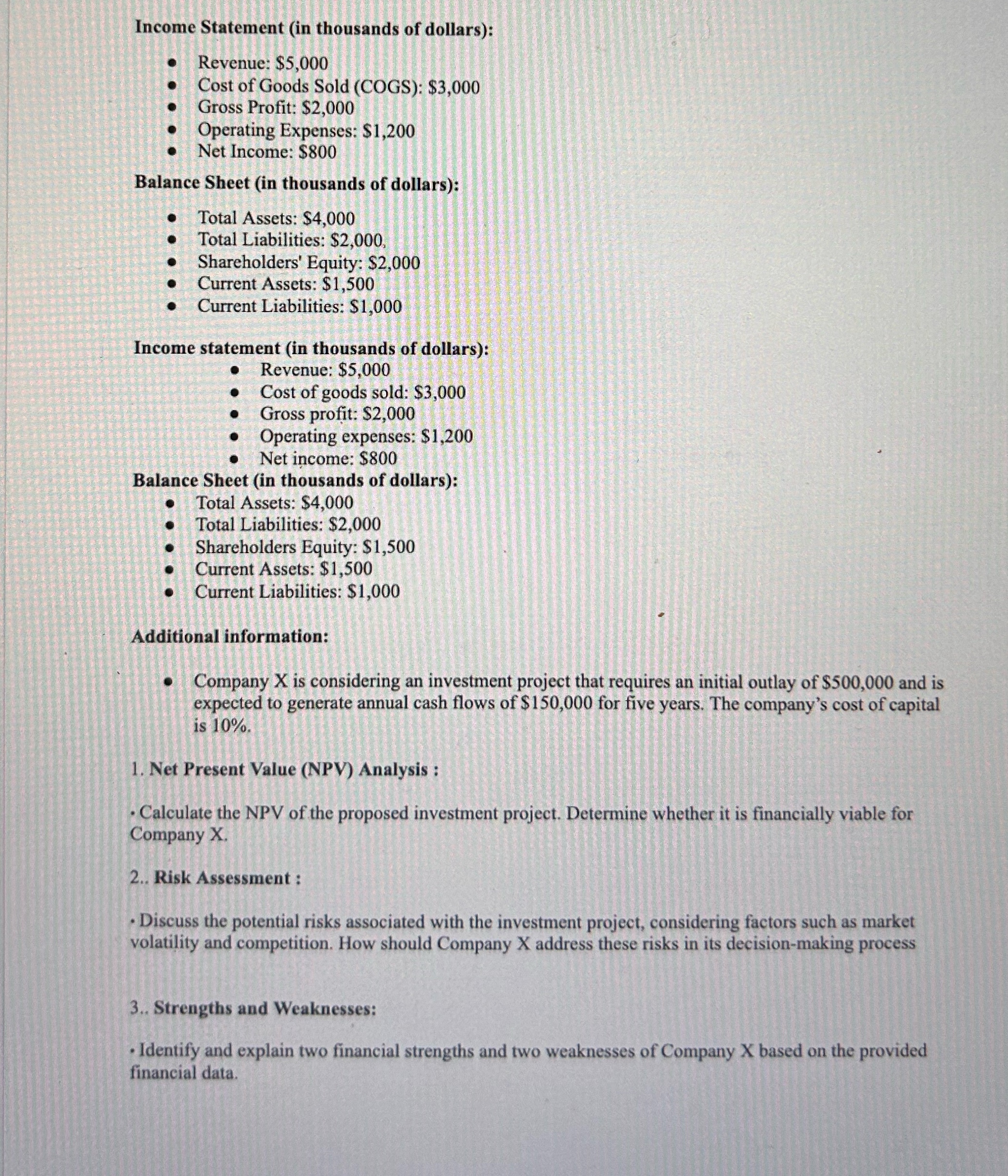

Income Statement ( in thousands of dollars ) : Revenue: $ 5 , 0 0 0 Cost of Goods Sold ( COGS ) : $

Income Statement in thousands of dollars: Revenue: $ Cost of Goods Sold COGS: $ Gross Profit: $ Operating Expenses: $ Net Income: $ Balance Sheet in thousands of dollars: Total Assets: $ Total Liabilities: $ Shareholders' Equity: $ Current Assets: $ Current Liabilities: $ Income statement in thousands of dollars: Revenue: $ Cost of goods sold: $ Gross profit: $ Operating expenses: $ Net income: $ Balance Sheet in thousands of dollars: Total Assets: $ Total Liabilities: $ Shareholders Equity: $ Current Assets: $ Current Liabilities: $ Additional information: Company is considering an investment project that requires an initial outlay of $ and is expected to generate annual cash flows of $ for five years. The company's cost of capital is Net Present Value NPV Analysis : Calculate the NPV of the proposed investment project. Determine whether it is financially viable for Company X Risk Assessment : Discuss the potential risks associated with the investment project, considering factors such as market volatility and competition. How should Company address these risks in its decisionmaking process Strengths and Weaknesses: Identify and explain two financial strengths and two weaknesses of Company X based on the provided financial data.

Income Statement in thousands of dollars:

Revenue: $

Cost of Goods Sold COGS: $

Gross Profit: $

Operating Expenses: $

Net Income: $

Balance Sheet in thousands of dollars:

Total Assets: $

Total Liabilities: $

Shareholders' Equity: $

Current Assets: $

Current Liabilities: $

Income statement in thousands of dollars:

Revenue: $

Cost of goods sold: $

Gross profit: $

Operating expenses: $

Net income: $

Balance Sheet in thousands of dollars:

Total Assets: $

Total Liabilities: $

Shareholders Equity: $

Current Assets: $

Current Liabilities: $

Additional information:

Company is considering an investment project that requires an initial outlay of $ and is expected to generate annual cash flows of $ for five years. The company's cost of capital is

Net Present Value NPV Analysis :

Calculate the NPV of the proposed investment project. Determine whether it is financially viable for Company X

Risk Assessment :

Discuss the potential risks associated with the investment project, considering factors such as market volatility and competition. How should Company address these risks in its decisionmaking process

Strengths and Weaknesses:

Identify and explain two financial strengths and two weaknesses of Company X based on the provided financial data.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started